Direct payments for the child tax credit began flowing Thursday, with millions of American families receiving their first monthly payments worth as much as $300 per child. The Treasury Department said that about $15 billion was paid out to roughly 35 million families with nearly 60 million children.

The program marks a significant shift in the federal government’s approach to helping poor and middle-class families. “This is the biggest anti-poverty effort since Lyndon B. Johnson’s War on Poverty,” Joshua McCabe, a historian of U.S. welfare policy, told The Washington Post. “This is a once-in-a-longtime chance to significantly reduce child poverty.”

Secretary Janet Yellen hailed the program Thursday. “For the first time in our nation's history, American working families are receiving monthly tax relief payments to help pay for essentials like doctor’s visits, school supplies, and groceries,” she said in a statement. “This major middle-class tax relief and step in reducing child poverty is a remarkable economic victory for America – and also a moral one.”

Key details: The payments are a result of the American Rescue Plan, the $1.9 trillion economic package that became law in March through the budget reconciliation process with only Democratic support. The legislation expanded the current child tax credit, providing $3,600 per child under age the age of 6 and $3,000 for children between the ages of 6 and 17. It also required the Treasury Department to send direct payments to beneficiaries, with half of the money delivered on a monthly basis between July and December.

The program will cost about $120 billion on an annual basis. It is scheduled to expire at the end of the year, though Democrats hope to extend the program as part of the $3.5 trillion spending package currently being written in Congress.

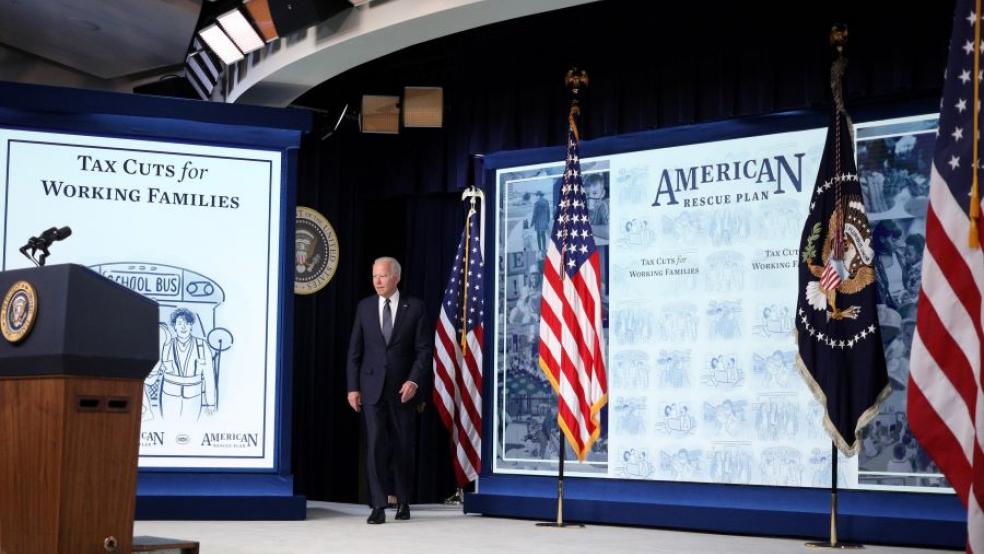

Biden celebrates: Speaking at the White House, President Biden praised the temporary program, saying it would deliver the largest one-year reduction in child poverty in U.S. history.

“It’s a reflection of our belief that the people of this country who need a tax cut aren’t the folks at the top — they’ve gotten plenty of tax cuts, they’re doing fine — but it’s the people in the middle, the folks who are struggling or who are just looking for a little bit of, as my dad would say, a little breathing room,” Biden said.

Some experts say the program could cut child poverty by 50%, though questions have emerged about the federal government’s ability to reach the poorest households, some of which do not file income tax forms. “This is a hard population to reach; in the worst of times, you’ve offered thousands of dollars, and they have not signed up,” Gene Sperling, the White House official in charge of implementing the program, said. “That is why we must stay at it and work smarter and harder to get more people signed up.”