Employers added 390,000 new jobs in May and the unemployment rate held steady at 3.6%, the Labor Department announced Friday, boosting hopes that the Federal Reserve can achieve a soft landing as it seeks to control a sustained burst of inflation that threatens to scar the U.S. economy.

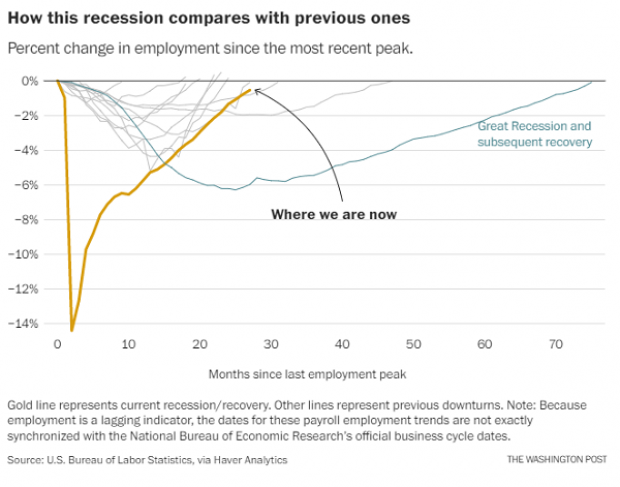

The stronger-than-expected report shows that hiring remains robust, even as the Fed intensifies its effort to tamp down inflation through higher interest rates and quantitative tightening. The labor force participation rate inched a tenth of a point higher, to 62.3%, and with more than 151 million people employed, payrolls are now less than 1 million below the pre-pandemic peak. (The employment chart below from The Washington Post highlights just how strong the recovery has been.)

Although the report beat expectations, the May total did break a 12-month streak of job creation exceeding 400,000 per month. Many analysts see that as good news, suggesting the pandemic recovery is slowing slightly but still far from stall speed. Nominal wage growth also moderated in May, falling from an annual rate of 5.5% to a still-robust 5.2%, helping ease fears about a potential wage-price spiral. Real wage growth, however, was negative, as inflation continued to take a big bite out of worker pay.

“Despite the slight cooldown, the tight labor market is clearly sticking around and is shrugging off fears of a downturn,” economist Daniel Zhao of Glassdoor said in a note. “We continue to see signs of a healthy and competitive job market, with no signs of stepping on the brakes yet.”

Fed still on track: The report offered little support for those hoping the Fed would reconsider its aggressive stance on inflation — a hope that has pushed stocks higher and rates lower over the last week or two.

“We do not expect the Federal Reserve to back off what we expect to be 50 basis-point hikes in the federal funds policy rate in June and July, with the possibility of another in September,” Joseph Brusuelas, chief economist at the consulting firm RSM, said in a note. “In addition, we expect the policy rate to move into restrictive terrain, above 2.5%, before the end of the year, which will create the conditions for further cooling in the labor market that will almost certainly slow down to gains of 200,000 per month in the near term.”

Not surprisingly, interest rates rose Friday, with the 10-year Treasury rate pushing back up close to 3%, and stocks fell as traders considered the increased likelihood of a sustained anti-inflationary campaign by the Fed.

Biden celebrates: President Joe Biden trumpeted the strong report Friday, noting that a record 8.7 million jobs have been created since he took office. And he argued that the economy is now at an inflection point, when inflation will ease and the economy can grow more slowly without tipping into recession.

“We’ve laid an economic foundation that’s historically strong,” he said in Rehoboth Beach, Delaware. “And now we’re moving forward to a new moment, where we can build on that foundation, build a future of stable, steady growth, so we can bring down inflation without sacrificing all the historic gains we’ve made.”

Biden also discussed his plans to combat inflation by lowering the cost of food, fuel and other consumer items, and to reduce the federal budget deficit. (See Biden’s full remarks at CSPAN, with the text available on the White House website.)

What comes next: No one knows, of course, and estimates are all over the map. But the jobs report had some analysts suggesting that the economic trendline is moving toward the Goldilocks scenario: not too hot, not too cold.

RSM’s Brusuelas said he’s confident the economy is slowing, and that the Fed’s anti-inflation campaign is already having its intended effect. “In our estimation, this is likely going to be the last robust employment report in this business cycle,” he wrote. “The delayed impact of past rate hikes is beginning to arrive with an observable slowing of hiring in the rate-sensitive areas of manufacturing, trade and transport, and goods-producing industries, as well as in finance. … Given what was clearly an overheating economy during the final quarter of last year, this jobs report represents a step in the right direction toward restoring price stability, which right now is the paramount policy objective out of Washington.”

Moody’s economist Mark Zandi said the economy is still running too hot but is moving in a healthy direction. “[J]ob growth needs to slow more this summer – get down closer to 150k,” he wrote. “This will ensure the economy doesn’t blow past full-employment, fan wage growth, and exacerbate the high inflation. But today’s job report suggests that’s precisely where the economy is headed.”

But J.P. Morgan Chief U.S. Economist Michael Feroli said that the Fed won’t be satisfied by the slowdown suggested by Friday’s numbers. “It’s moderating, but it’s not moderating to a level, I think, where it’s consistent with the Fed’s inflation goals,” he said of the wage growth data, adding that policymakers would probably want wages to cool toward an annualized 3.5 percent pace, a rate that officials view as aligned with their goal of 2% inflation.