House Republicans are pushing for spending cuts to reduce the deficit in exchange for raising the debt ceiling, but they also hope to extend the package of GOP tax cuts passed under then-President Donald Trump in 2017 – a move that would increase the deficit significantly. House Speaker Kevin McCarthy told Fox News last fall that he wanted “to lock in those tax cuts that we got,” and Rep. Vern Buchanan of Florida introduced a bill in February backed by 72 fellow Republicans that would “make permanent tax cuts for individuals and small businesses originally enacted as part of the Tax Cuts and Jobs Act (TCJA) of 2017.”

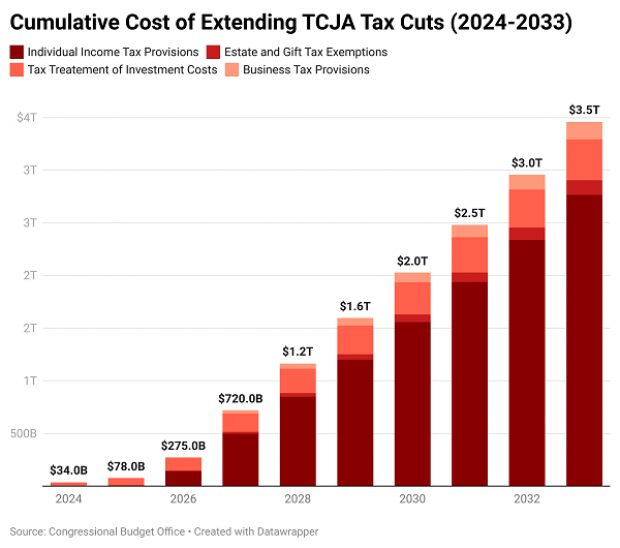

In a new analysis published Tuesday that was prepared at the request of Democratic Sens. Sheldon Whitehouse and Ron Wyden, the Congressional Budget Office looked at how much it would cost to extend the 2017 tax cuts, many of which are scheduled to expire at the end of 2025, although some expire sooner. The total cost: nearly $3.5 trillion over 10 years.

The biggest expense is associated with extending the individual tax cuts, which end in 2025. “The expiring provisions affect major elements of the individual income tax code, including statutory tax rates and brackets, allowable deductions, the size and refundability of the child tax credit, the 20 percent deduction for certain business income, and the income levels at which the alternative minimum tax takes effect,” CBO said. The cost of extending those provisions is about $2.5 trillion from 2024 to 2033. Higher interest costs on the resulting debt would add another $278 billion.

Extending the higher exemptions for gift and estate taxes, which were doubled in the 2017 legislation, would cost $126 billion over a decade, plus another $13 billion for debt service. Extending the bonus depreciation provision for businesses would cost $325 billion, plus another $59 billion in added interest. And extending a set of tax changes that apply to overseas business income would cost $150 billion, plus another $16 billion for debt service.

In a statement, Wyden pointed out the apparent contradiction between the GOP policy choices. “Republicans who say they’re worried about the deficit have brought our economy on the brink of default, and yet they want to run up the debt by locking in the Trump tax law that remains horribly skewed toward corporations and the wealthy,” he said.

Former Treasury official Steven Rattner, who provided the chart below, put it more succinctly. “So much for fiscal responsibility,” he tweeted.