Having parents with financial means is generally assumed to give students a leg up in academia – but a new study finds that might not always be the case.

While the study, “More Is More or More Is Less? Parent Financial Investments During College,” found that parents who fund their child’s education increases the child’s chances of attending college as well as their odds of graduating, parents’ financial support actually decreases a student’s GPA.

RELATED: Parents: How Much College Do You Owe Your Kids?

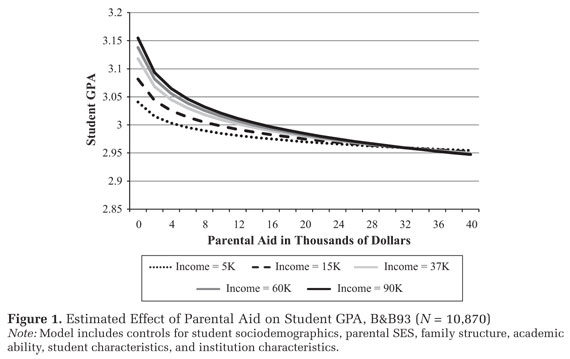

The study draws on data from the National Center for Education Statistics on parent financial contributions and student grades across all types of colleges and universities. After controlling for parents’ socioeconomic status, the author of the study, Laura Hamilton, a sociology professor at the University of California, Merced, found that as parental aid increased, every income group saw a reduction in GPA – with the curve steepest among the most privileged students. The chart below shows the striking results:

Hamilton concluded that the effects of parental financial support on GPA was modest overall and not enough to decrease a student’s odds of graduating, but “any reduction in student GPA due to parental aid – which is typically offered with the best of intentions – is both surprising and important,” she writes in the study. “Even small disparities in GPA are magnified in an increasingly competitive labor market and disadvantage graduates when their records are considered next to those without such deductions.”

Hamilton suspects the reason behind the drop is that students who receive endless checks from mom and dad may not take their education as seriously as those students who have to weigh the financial investment and return of college. She also found after interviewing parents that students had lower grades if their parents paid for their schooling but did not discuss the students’ own responsibility for their education.

The study comes at a time when colleges and students are growing more dependent on parents’ financial support. According to a recent study from the University of Michigan-Ann Arbor, nearly two thirds of young adults between the ages of 19 and 22 receive financial assistance from their parents. And an April 2012 Merrill Edge report by Bank of America found that 56 percent of parents have paid or expect to pay more for college than they expected when their first child was born.

“As public schools begin to operate more like private schools and rely heavily on tuition dollars, the role of parents becomes even more central,” writes Hamilton in the study. “Parents often become the primary financiers of higher education.”