If you are in shock about what you owe the government this spring, consider this—for thousands of high-income Americans, that amount is $0. A report from the IRS last May shows that more people who earn above $200,000 a year are paying no federal taxes.

That group of the well-off who don’t write checks aren’t gaming the system—they’re operating well within the law’s letter and spirit. They owe nothing because of the federal government’s tax deduction system.

RELATED: Two Taxes Could Decide the Fate of Obamacare

The number of affluent tax-free people is growing steadily. About 19,500 filers who made more than $200,000 in “expanded income” (a measure by the IRS that includes items like tax-exempt interest and nontaxable Social Security benefits) paid no income tax in 2009, the latest year available, up from about 17,000 in 2008, a 15-percent increase. Over the longer term, the number has exploded—there were only 64 people in this category in 1977, when the IRS first started tracking the data. Another IRS report from 2011 found that 1,400 millionaires paid no U.S. federal tax in 2009, though this number includes those paying taxes to foreign governments.

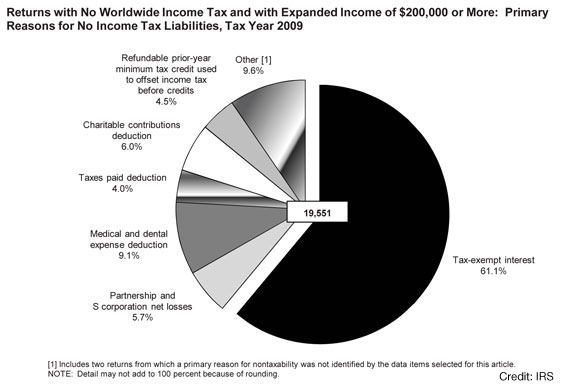

The most common item that zeroes out these people’s taxes is tax-free interest earned from state and local government bonds (known as muni-bonds). On 61 percent of the returns, exempt muni-bond interest was the primary reason, according to the report. The other top reasons were high medical and dental expenses (9 percent of the returns), large charitable contributions (6 percent), losses from partnerships, LLC, and S corporations (6 percent), and deductions for state sales or income taxes paid (4 percent). A “miscellaneous” category also was the primary reason in 10 percent of cases—deductions for items like casualty and theft losses and mortgage interest paid.

Jeanette Dugas, partner at tax accounting firm Dugas & Dugas, gives an example of how a high-income taxpayer could owe nothing. She might earn $200,000 in muni-bond interest and a $100,000 salary but deduct $30,000 in charitable contributions, $40,000 in medical expenses, $10,000 in state sales taxes, $20,000 in mortgage interest, and $10,000 in real estate taxes. All other factors aside, that person would owe no taxes—the interest is exempt, and the deductions offset her salary. For purposes of this report, the IRS would have counted the muni-bond interest as that person’s primary reason for not owing any tax.

In addition, S corporations, LLC, and partnership losses can drop a business owner’s taxable income to zero because their businesses are not taxed as stand-alone entities that are separate from the taxpayer, unlike C corporations and some other business structures. Although owners have to file separate tax forms for those companies, dividends and losses from the business show up on the owner’s tax return, says former IRS lawyer Charles Ruchelman, now a tax attorney at Washington DC-based law firm Caplin & Drysdale. Therefore, a business owner set up as a partnership, LLC ,or S corporation theoretically could pay herself a $200,000 salary from the business while declaring a $200,000 loss for the year and report her salary as zero.

The tax system is set up to reward certain behaviors and support people who presumably need federal help, and the wealthy take advantage of that, says Roberton Williams, a fellow at the Urban-Brookings Tax Policy Center. He says it shouldn’t be a surprise that some people pay no taxes. “People give away money [for charitable causes], which we like. They don’t have to pay tax on money spent on medical care, which as a society we think is a good thing. Somebody decided we like to subsidize state and local bonds. Don’t get upset about the fact that people aren’t paying taxes. Get upset about the way the policy is working,” he says.

RELATED: 10 Taxes That Could Be Hidden In Your Next Purchase

These high-income Americans aren’t the only ones not paying income tax, Williams notes. It’s also why 46.4 percent of citizens paid no taxes in 2011, as the center reported (a figure famously rounded up to 47 percent during last year’s presidential race), which includes low-income families who qualify for the Child Tax Credit and the Earned Income Tax Credit, and seniors living off Social Security.

Frank Clemente of the advocacy group Americans for Tax Fairness doesn’t think high-income earners belong in this group. “There are so many loopholes both on the individual side and the corporate side that only wealthy people can take advantage of…”, he says. “This is what you end up with, people who are paying a fraction of what the marginal tax rate is for their income level.”

Some advocates are calling for more scrutiny of the muni-bond exemption. Tax-free interest on muni-bonds is intended to help states and local governments borrow more cheaply than if the bonds were taxable. In 2009, for example, the average interest they paid on muni-bonds was 4.6 percent, while the rate on equivalent taxable bonds was 5.3 percent, according to the nonpartisan Congressional Budget Office.

The muni-bond tax break often ends up helping the well-off individual taxpayer as well. At an April 2012 congressional hearing, a CBO representative cited analysis suggesting that about 20 percent of the revenue that the federal government gives up through that deduction goes to wealthy taxpayers who buy these bonds, with the other 80 percent helping state and local governments. The wealthy benefit disproportionately because they’re in a higher tax bracket--someone making $400,000 gets a 35-percent break on their muni-bond interest income, while someone making $30,000 gets only a 15-percent deduction. Plus, the taxpayer making $30,000 is less likely to be investing in muni-bonds in the first place.

Beyond that debate is a larger one over the proliferation of deductions in the tax code. Data from Congress’ Joint Committee on Taxation show that the number of federal tax breaks almost tripled between 1972 and 2007. New breaks passed in that period included deductions for investment income from life insurance and annuity policies, the exclusion from taxes of capital gains on sales of principal residences, and tuition tax credits for post-secondary education.

Ruchelman says it’s that growth that has caused the dramatic gain since 1977 in the number of affluent people who can zero out their taxes. “We’ve seen an increase in congressional social engineering through the code,” he says. Many targeted breaks, like those for energy-efficient home improvements or college tuition tax incentives, benefit middle- and upper-income taxpayers, he says.

Reports of tax-free high-income filers have spurred the Obama administration over the last few years to propose capping deductions to 28 cents on each dollar for higher-income households earning more than $250,000. If that were to become law, a taxpayer in the 39.6 percent bracket who makes a $10,000 charitable deduction or earns $10,000 in muni-bond interest, for example, would be able to deduct only $2,800 instead of $3,960. “It would leave in place tax incentives but just reduce them,” says Steve Wamhoff, legislative director at Citizens for Tax Justice, which supports the plan.

Some Republicans also support a hard dollar cap on itemized deductions. A proposal initiated by former Reagan administration official Martin Feldstein would limit those breaks to 2 percent of adjusted gross income, according toThe New York Times. During the 2012 campaign, Mitt Romney proposed a fixed dollar cap on itemized deductions.

But if those proposals go nowhere, policymakers could reconsider the very idea of using the tax code to incentivize behavior. If so, the Tax Policy Center’s Williams thinks they should ask three questions about each deduction. “Should the government be doing it? Is this the best means—the tax system versus some other means? And is the way we’re doing it the best way within the tax system?”

Failing that, the IRS will be churning out many more reports showing an ever-growing number of tax-free high-income people.