Inflation, the economy-crushing ogre that still haunts the forecasts of many economists and policymakers, has been kept on a short leash for decades. Yes, rents and the prices of some food items have risen in recent months, but inflation overall remains below the Federal Reserve’s targeted 2 percent annual rate.

Still, many economists and Fed watchers have been warning for years that the monster could soon be stirring, and their cries have become more urgent as inflation has edged higher. The time has come, they insist, for Janet Yellen and her colleagues on the Federal Open Market Committee to yank the chain by moving interest rates higher in order to ensure that the beast doesn’t get out of control.

The Fed on Wednesday rejected that idea, at least for now. Despite some reports and speculation that it might back away from its pledge to keep interest rates low for a “considerable time” after the end of its bond-buying stimulus program next month, the FOMC kept that language intact in its policy statement and again warned that “there remains significant underutilization of labor resources.”

Related: The Threat That Could Scar the Economy for Decades

In other words, even though the unemployment rate has fallen to 6.1 percent, the job market still needs help in its recovery and the Fed is more concerned about getting the millions of unemployed and underemployed Americans back to work than it is about the threat of spiking inflation. The updated economic projections of Fed board members and bank presidents released Wednesday showed that the central bankers still expect inflation to remain below their target rate of 2 percent, or at that level, through 2017.

The newest data on inflation, released Wednesday, support the decision to hold off. The Consumer Price Index calculated by the Bureau of Labor Statistics unexpectedly fell 0.2 percent in August — the first decline since April 2013 — leaving overall inflation at 1.7 percent over the last 12 months, down from 1.9 percent as of July. Excluding food and falling energy prices, inflation was flat last month.

At the same time, the new Fed forecasts included lowered estimates of economic growth for this year and next — the 2015 outlook for GDP growth fell to a range of 2.6 percent to 3 percent from a previous 3 percent to 3.2 percent — even as they also forecast that the unemployment rate would be a tick lower than in previous projections. That also could reinforce the notion that the Fed has room to keep rates low without risk that the economy will overheat.

Related: What Happens When the Fed Stops Propping Up Stocks?

“There are still too many people who want jobs but cannot find them, too many who are working part-time but would prefer full-time work and too many who are not searching for a job but would be if the labor market were stronger,” Yellen said at her Wednesday afternoon press conference.

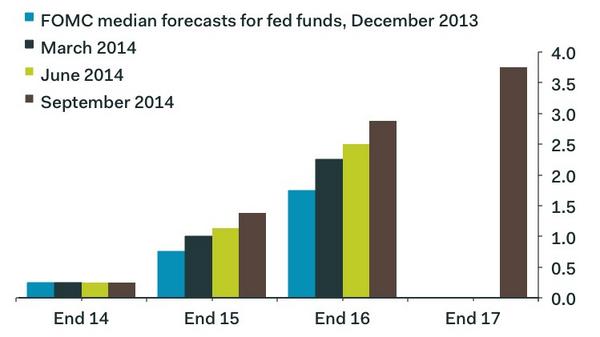

The Fed chair again emphasized that she and her colleagues are looking to be flexible and to respond to the economic data — and other Fed board members and regional Fed presidents signaled through their “dot plot” projections of the path for the federal funds rate that they felt a somewhat more aggressive tightening may well be in order. As BNP Paribas economists put it in a note to clients: “the statement and press conference were more dovish than expected, while participant’s expectations for the fed funds rate (aka ‘dot plot’) drifted higher and suggested a faster pace of rate hikes.

While the projections only drifted slightly this time, they have moved considerably over a longer period, Ian Shepherdson of Pantheon Macroeconomics pointed out in a note to clients, with the chart below.

Related: Steve Forbes’s Golden Plan to Save the Economy

Still, those dot plots may not carry as much significance as Fed watchers think, and Yellen herself has downplayed their importance. The Fed's "considerable time" promise may have been kept in the statement, but it remains as vague as ever, and Yellen suggested the definition was "highly conditional and linked to the committee's assessment of the economy." So Fed watchers are still left trying to guess precisely when the Fed will start its tightening cycle.

“It is a bit like splitting hairs trying to pinpoint the exact month the Fed will raise rates,” Diane Swonk, chief economist at Mesirow Financial, wrote in a blog post. “It is more important to know that the Yellen Fed would rather overstimulate the economy and wait too long to raise rates than move too soon and precipitate a recession; historically, central banks have raised rates too soon rather than too late after a financial market crisis. Indeed, we should all hope for a rate hike to happen sooner, as it would suggest that the economy is much stronger than it is today.”

Top Reads From The Fiscal Times: