|

Any economist will tell you that productivity—output per hour worked—is the key to higher living standards. Given more capital equipment, improved technology, and sharper skills, the same number of workers can produce more, generating more national income and a bigger economic pie for all to share. Much was the case during the technology-fueled surge in productivity during the 1990s. Right now, however, you’ll have a hard time selling the virtues of productivity growth to American workers. Although productivity over past decade has grown even faster than it did in the 1990s, workers are losing ground—and at a record pace.

It’s a stunning reversal of fortune that may

well be the key trend underlying

much of the anger expressed by

the Occupy Wall Street crowd.

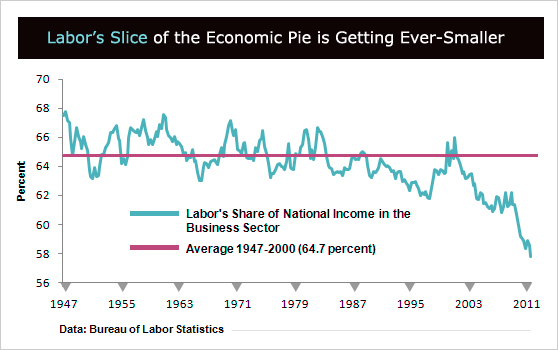

In short, Americans are working harder with less to show for it, based on the breakdown of national income, which is the total of all income generated by labor and capital in the production of goods and services, including salaries, employee benefits, profits, rents, interest, and dividends. Over the past decade, the share of national income going to workers—salaries and benefits—has fallen sharply to an all-time low of 57 percent in the third quarter. On the flipside, the share going to capital has surged to an all-time high, with the chief beneficiary being profits. It’s a stunning reversal of fortune that may well be the key trend underlying much of the anger expressed by the Occupy Wall Street crowd.

Throughout the postwar period, labor’s share of national income had been so stable that is was generally taken as a constant in economic analysis, says J. P. Morgan economist Michael Feroli. Labor’s share has tended to vary with the economy’s ups and downs, but the recent break from the long-term trend is unprecedented, and the share shows no sign of turning up. From 1947 to 2000 labor’s share of national income had averaged a relatively steady 64 percent. If the current share were at the pre-2000 average, worker income would be $780 billion higher right now, equal to nearly 10 percent of current pay and benefits. “That income would have provided a much-needed lift for a sector of the economy reeling from too much debt and too little employment.” says Feroli.

The pressure of globalization on businesses may well be the chief reason for the downshift, combined with structural changes in the labor market over the years that have reduced the costs of hiring and firing. Few economists will disparage the benefits of global trade, which in theory benefits all parties. But in the corporate sector’s push to boost productivity and competitiveness, there is little evidence, at least over the past decade, that American workers are showing any gains.

The rise of temporary workers allows

companies to match their payrolls with

the volume of business, often while

saving on the cost of benefits.

Feroli says studies have shown that greater openness to foreign trade is associated with a smaller labor share of income, most likely because increased exposure to global forces can alter labor’s power in the market. The declining influence of unions means companies have more freedom to adjust their labor costs in a downturn. The rise of temporary workers allows companies to quickly match their payrolls with the volume of business, often while saving on the cost of benefits, and on-line job listings have reduced search costs. “Greater openness to trade has reduced labor’s ability to obtain a bigger slice of the pie,” says Feroli.

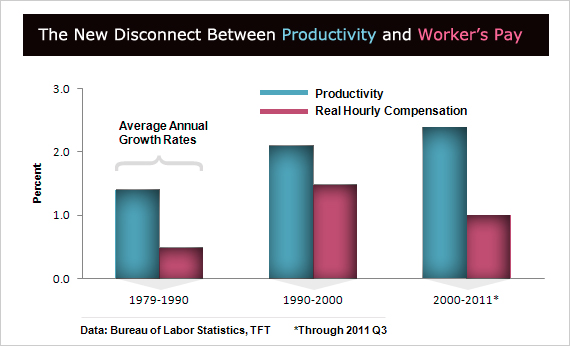

Reflecting these trends, the gap between productivity and workers’ pay began to open up gradually in the 1980s, held about steady in the 1990s, and then widened sharply in the 2000s. During the technology boom in the 1990s, productivity growth picked up, with a corresponding acceleration in real—or inflation adjusted—labor compensation. Journalists popularly called this era the New Economy, an exceptional period of strong growth, tame inflation, and low unemployment that benefited U.S. businesses and workers alike.

Over the past decade, however, productivity and pay show a striking disconnect, perhaps best illustrated in an article in the Labor Dept.’s Monthly Labor Review earlier this year. Since 2000, output per hour worked in the nonfarm business sector has grown 2.4 percent annually, up from 2.1 percent in the decade of the 1990s, but real compensation has slowed, to only 1 percent from 1.5 percent.

In the current recovery, business productivity has posted a striking 6 percent advance over the past two years, but the gains have gone straight to corporate profits. In the third quarter profits stood 19.4 percent above their pre-recession peak, while real labor compensation has posted no gain. Rather than indicating improved efficiency or technological progress, as in the 1990s, the productivity surge reflects companies’ aggressive job cutting during the recession and their ability to meet demand in the recovery by boosting output while adding fewer workers than in the past. Over the past two years, nonfarm businesses have lifted their output by 7.6 percent, while increasing the hours worked by their employees by only 1.5 percent.

The combination of modest pay and robust productivity means that unit labor costs, which are workers’ pay adjusted for productivity gains, have fallen by 2.1 percent since the recovery began. That decline has been the fuel for both rising profits and sharper U.S. competitiveness in foreign markets, even in a period of weak demand and pricing power. Since the fourth quarter of 2007, economists at Barclays Capital calculate that unit labor costs in the U.S. have risen 3.3 percent, compared to about 8 percent in Germany and France and more than 11 percent in Britain.

The U.S. is even becoming increasingly competitive with China. Earlier this year, a study by the Boston Consulting Group argued that China’s cost advantage over U.S. manufacturers was shrinking fast, and that within five years, a combination of rising Chinese wages, higher U.S. productivity, a weaker dollar, and other factors would “virtually close the cost gap between the U.S. and China for many goods.” The result could be a return of some 3 million jobs to U.S. shores.

The shrinking slice of the economic pie going to American workers raises some crucial questions: Are U.S. businesses becoming more competitive on the backs of their employees, and what does that say about future living standards? Also, if jobs begin to return from overseas, will they be the types of jobs with the skill levels needed in an increasingly knowledge-based economy that depends on innovation and high-value-added production for economic growth? Against the current backdrop, it’s easy to see why U.S. workers are doubtful and disgruntled.