An interesting thing happened on the way to fiscal sanity. Someone actually calculated the difference between Clinton’s 1993 tax increases on the so-called “rich” in today’s dollars. As you recall, Democrats have been touting the 1993 tax hikes as a roadmap to prosperity. Clinton raised the top two brackets to 36 percent and 39 percent, with the top rate hitting incomes above $250,000.

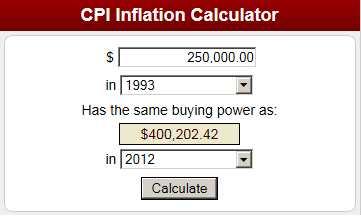

A quick calculation on the Bureau of Labor Statistics’ CPI widget shows that $250,000 in 1993 is $400,202.42 in 2012.

This brings us to Warren Buffett, who wrote a provocative op-ed today in The New York Times. Buffett, now self-proclaimed tax policy expert, takes his usual cheap shots at the club of which he is a member—super wealthy billionaires. “The group’s average income in 2009 was $202 million — which works out to a ‘wage’ of $97,000 per hour, based on a 40-hour workweek. (I’m assuming they’re paid during lunch hours.)”

Buffett does, however, make his case. “More than a quarter of these ultra-wealthy paid less than 15 percent of their take in combined federal income and payroll taxes. Half of this crew paid less than 20 percent. And — brace yourself — a few actually paid nothing.” Buffett goes on to call for a new alternative minimum tax of 30 percent of taxable income between $1 million and $10 billion and 35 percent on amounts above that. If that proposal ever passes, chances are Warren would be voted out of the billionaires’ boys’ club.

Billionaires aside, Buffett takes a stand — finally — on what and who is really rich, and it isn’t a two-income couple making $250,000 a year and trying to raise children while working full time. Buffett actually doubles the threshold. “I prefer a cutoff point somewhat above $250,000,” he said, “maybe $500,000 or so.”

WHERE’S BIG DATA WHEN YOU NEED IT?

By now, most know that President Obama’s high tech campaign team was able to target voters by data mining and learning as much if not more about them as their closest relatives. Armed with this personalized information, the messaging was far more efficient and effective. Why then is the government so completely blind to real data about its citizens? Take the upper middle class, as an example.

Most are college educated; they carry hefty student loans; they get jobs in big cities where the cost of living is much higher than, say, Peoria; they pay high state and city taxes; and they hope to be able to afford children before they age out of their breeding years. How does the government look at this group? They’re as rich as Warren Buffett if each is earning $125,000 a year.

Politicians take national averages or medians from the Bureau of Labor Statistics or the Census Bureau to determine how to frame a successful election campaign. And sometimes broad top-level data can drive policy initiatives — but that’s risky business. For example, income stagnation among middle wage earners is clearly the result of unemployment on the one hand and changing demographics on the other.

There are two huge groups squeezing the middle: Young people (millennials) who come in and out of the workforce with temporary jobs (the BLS measures workers starting at age 15) and bring down average incomes; and retired baby boomers living off pensions and Social Security in contrast to jobs that paid significantly more. Those in the middle, between the ages of 25 and 55, are in their high earning years, but they represent the baby dearth or GenX, as it has been called.

HOW WELL DID CLINTON REALLY DO?

The aftermath of Clinton’s tax increases and the overreach of Hillary Clinton’s health care plan hurt the Democrats, and the party suffered dramatic losses the following year The GOP gained 54 House seats and eight Senate seats and won control of Congress. Toward the end of his second term, Clinton came up with major policy reforms that worked, including tax cuts. He lowered the capital gains tax rate to 20 percent from 28 percent, and increased the death tax exemption to $1 million ($2.8 million today) from $600,000.

More importantly, he cut spending, starting with a welfare system that kept people locked in poverty instead of moving up and out of it. Clinton had his eye on economic growth and knew what it took to have a shared prosperity. We can get there again if Congress and the President do the right thing.