Many well-meaning people mistakenly believe that the ultra-wealthy are the source of American prosperity. They do the saving and investment that creates jobs; they are the entrepreneurs who start new businesses and implement economic innovations; and the well-being of everyone in the working and middle classes is ultimately dependent on the health and prosperity of the ultra-rich, it is widely thought.

This belief is largely bipartisan, although obviously more widely shared among Republicans. Since at least the Clinton administration, Democrats have also worked to implement wealth-friendly policies, often called the “neoliberal consensus,” such as free trade, low taxes on capital income, low inflation and deficit reduction.

The fact that Republicans want these things even more should not obscure the fact that both parties generally share the same economic philosophy, differing only in degree. Thus, despite high unemployment, the federal government has done virtually nothing to create jobs; despite the obvious failure of “austerity” programs in Europe, both parties believe that deficit reduction is the principal fiscal priority; and the obsession with minuscule levels of inflation continues to constrain Federal Reserve policy.

There are, however, a few creative thinkers out there saying that our national priorities are all wrong and that the basic premise of where growth comes from is upside down. One of these is Nick Hanauer, an entrepreneur from Seattle, Washington, who argues that strengthening the middle class is the key to wealth creation. And the key to middle class prosperity is good-paying jobs.

In testimony before the Senate Banking Committee on June 6, Mr. Hanauer argued that consumption is what drives investment, not the other way around.

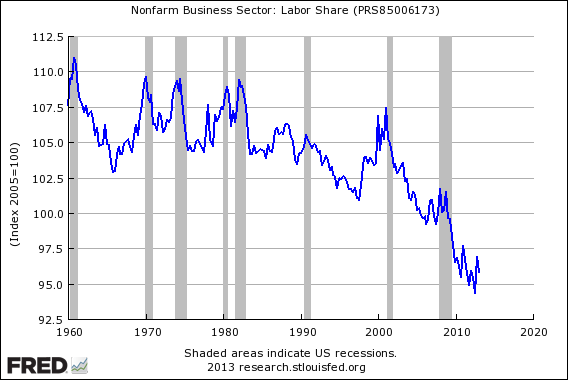

But consumption is constrained by the continuing impoverishment of the middle class due to wage stagnation and high unemployment, which has reduced labor’s share of the income pie drastically over the last 13 years, as illustrated in the chart.

Hanauer makes a simple and obvious point, but one with profound implications for policy. If growth is essentially demand-driven, the wealthy cannot be the drivers of growth because they simply don’t consume enough and raise their spending very little in response to increases in income. How could they? The number of rich people is small and they can already afford whatever they want.

It’s not only the income of the middle class that is ultimately essential for growth. It’s the wealth of that class, which has been decimated by the fall in home prices and increasing indebtedness, as middle class families struggle to maintain living standards, put their children through college and cope with downward income mobility.

A recent report from the Federal Reserve Bank of St. Louis says that the median household has only regained about half the wealth it lost during the recession from recently-rising stock market and home prices. (New data just released yesterday shows further improvement in rebuilding wealth from the recession.)

It’s easy to say that middle class families shouldn’t have locked so much of their wealth into a single asset, housing, that is a highly fickle investment, regularly rising spectacularly and then crashing just as spectacularly. One can also fault the middle class for investing insufficiently in stocks and continuing to stand by the sidelines as stock prices have risen.

The real question is what can be done now, given the straights that middle class families have fallen into. Simply cutting taxes, the Republican one-size-fits-all solution to every problem, isn’t viable as long as both parties insist that deficit reduction is the first priority of fiscal policy. Also, there is zero evidence that the tax cuts of the George W. Bush administration did anything to stimulate growth.

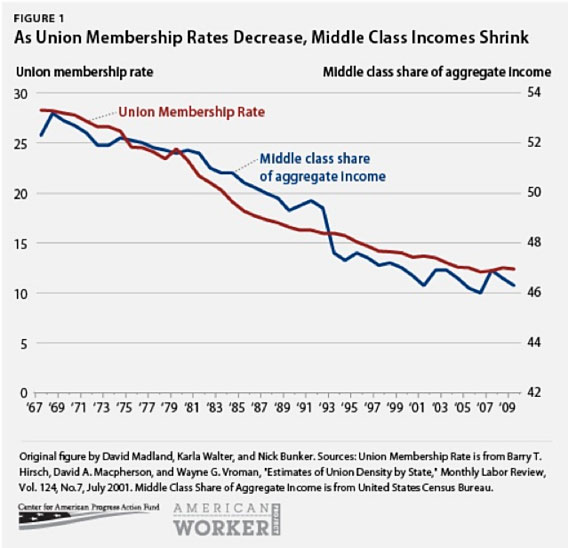

Progressives believe that the decline of labor unions is a key. Unions now represent just 6.6 percent of private sector workers, down from more than 20 percent in the 1970s. Unions used to be able to raise wages and improve benefits in the continuing competition between capital and labor.

But unions declined because of deep economic forces, such as globalization and the shift from manufacturing to services. That will not be reversed by making it easier for workers to organize. The proof is that unions have declined just as much in countries with much stronger protection for unions than the U.S. has.

Mr. Hanauer believes that the rich should pay more taxes. He believes that if all rich people had to pay more it would have little if any economic effect because rich people are motivated more by status and their relative positions in society vis-à-vis other rich people than by the absolute level of their wealth or income. If they all took the same tax hit, their relative position would be unchanged and there would be no economic harm, Hanauer believes.

But unless the higher revenues from taxing the wealthy are somehow channeled into spending programs that benefit the middle class, it is hard to see this move as more than a half step toward middle class-driven, consumption-driven growth.

Mr. Hanauer favors a big increase in the minimum wage to improve the income of the middle class. He thinks the higher incomes of those who get higher wages will raise spending and, ultimately, economic growth and profits for businesses. But unless businesses can raise their prices to pay for a higher minimum wage, I don’t see how this can possibly work. And unless the Federal Reserve permits inflation to rise, it simply won’t happen. The result will be higher unemployment, not faster growth.

The important thing, at this point, is to have at least a dialogue on creative solutions to the nation’s core problem – the continuing impoverishment of the middle class due to high unemployment, wage stagnation, rising health costs, and the collapse of housing prices.

It should be obvious by now that further governmental austerity measures will only make matters worse, but there appears to be no support for an expansionary fiscal policy, a federal jobs program, or a more stimulative monetary policy. Sadly, this means there is no end in sight to middle class malaise, which means that economic growth likely will be stuck where it is for the foreseeable future.