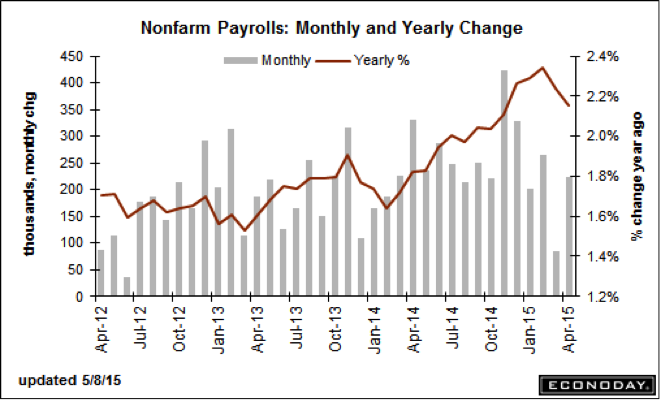

On the surface, Friday’s jobs report for April looked like a nice rebound from the soft report in March — suggesting the economy is finding its footing after a disappointing first quarter. Payrolls expanded by 223,000 and the unemployment rate fell to 5.4 percent, the lowest level since early 2008.

But a look at the details suggests otherwise. Overtime, hours worked and wage growth all disappointed, for example. And the prospects of a spring economic rebound are still unclear: The Atlanta Fed's GDPNow estimate of Q2 growth is at just 0.8 percent.

Related: The Pain the Job Numbers Don’t Show

All of this combined suggests that Fed officials will pull both a June and a September rate hike off the table, which is why the bulls got excited on Friday. The futures market now puts the probability of a December rate hike at 51 percent (with increasing odds of an early 2016 rate hike). But with rates near 0 percent since 2008, it's not going to be an easy call for Fed policymakers. June? September? December? 2016? Right now, the data is decidedly mixed.

Michelle Meyer at Bank of America Merrill Lynch said the combination of "weak GDP growth, sluggish inflation and slowing job growth suggests the risks are skewed toward a later rate hike."

Still, the Fed’s hawks can find plenty of reason to act: The job market is clearly making progress towards their goals. In a note to clients Friday afternoon, Deutsche Bank Chief U.S. Economist Joseph LaVorgna described the drop in the unemployment rate as a sign labor market slack is being absorbed, and he expects further declines in the months to come. LaVorgna is projecting a 4.7 percent unemployment rate at the end of the year, well below the Fed's estimate of 5.0 percent to 5.2 percent.

The Fed is clearly looking beyond the headline unemployment rate to other job market trends, but pressure may build there, too. Aneta Markowska at Societe Generale, for example, points to the specter of a rise in wage inflation later this year given the "significant uptick" in the wage and salary component of the Employment Cost Index during the first quarter. She adds that the labor market is now at an inflection point, based on the narrowing employment gap (unemployment rate vs. full employment rate). She's looking for wage growth to "accelerate non-linearly over the coming quarters" — meaning it should gallop higher.

For now, though, those trends are obscured by some contradictory data. Standard Chartered economist Thomas Costerg told clients the "soft" April payroll report sows doubt about whether the economy has fully moved past the headwinds that created a drag on growth and job gains over the winter. He's looking for the Fed to stay in "wait and see mode."

For investors, wait and see is good enough at the moment. These days, any hint of a delay in the timing of a hike is enough to set off a round of panic buying. (Fed Chair Janet Yellen's comments earlier in the week about lofty stock market valuations — which unnerved many investors — were quickly forgotten.) Still, it's worth remembering that stocks have been rattled recently by rising inflation expectations — based on the premise of a delayed Fed rate hike in the context of a bounce back in the economy — which has acted to push up long-term bond yields.

Related: Will ‘Goldilocks’ Jobs Report Have a Fairy Tale Ending?

If the Fed waits too long for confirmation that the job market merely suffered a short-term, weather-related setback earlier this year, it risks amplifying this tension between its own dovish behavior and higher and higher bond yields, which is something officials can't want.

One possible clue to the apparent disconnect in some of the data could be the fact that job gains have been outpacing measures of economic activity in recent years, a sign of a less productive workforce. If so, that means employers will need more workers — further increasing wage pressures — than is currently believed. Assuming, of course, that the economic expansion continues.

We'll get the Fed's own thoughts on all this on June 17 when the release of the latest policy statement is accompanied by the Fed’s latest Summary of Economic Projections (dubbed the "dot plot") as well as a press conference from Yellen.

Related: 7 Quirky Economic Indicators – from Dogs to Guns

Until then, stock bulls have a chance to make a run to fresh record highs as the Dow closes in on its early March peak of 18,300 — potentially moving clear of the long, oscillating trading range near 18,000 that it has been mired in since November.

Top Reads from The Fiscal Times: