For middle-class Americans, things are looking up. Gasoline is cheap. Credit is cheap. And now, based on the October payroll report released on Friday, job growth is soaring and wage inflation is picking up at long last.

But a looming Federal Reserve interest rate cut in December — which would be the first monetary policy tightening in nearly a decade — has rattled Wall Street. The Dow Jones Industrial Average has hit resistance just below the 18,000 level. Buyers are losing interest, pushing down measures of breadth. And the "rate hike on" trade is red hot, with the dollar soaring, Treasury bonds under pressure and commodities being hit hard.

Related: Hillary Clinton May Be the Biggest Winner from the Blowout October Jobs Report

What's worse, a December rate hike would worsen the dynamics that have weighed on corporate earnings growth, further worsening Wall Street's outlook. After an impressive rally out of the September lows, perhaps now's the time for investors to think cautiously again as hopes of a Santa Claus rally have suddenly dimmed.

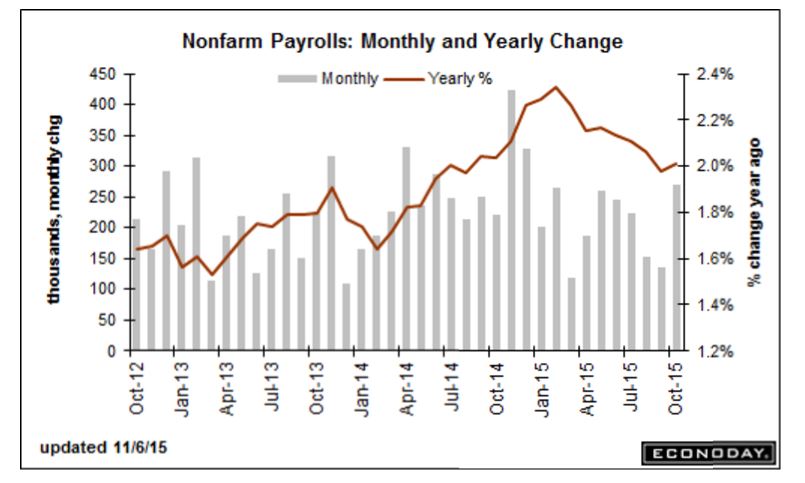

October payrolls added 271,000 workers (vs. the 190,000 expected and the 137,000 reported for September) while the unemployment rate fell a tick to 5.0 percent. Wages also grew at a 2.5 percent annual rate, a six-year high, suggesting that inflation is actually awakening after a long slumber.

Thus, Wall Street's mixed performance on Friday.

Treasury bonds got smashed, gapping the iShares Barclays 20+ Year Treasury Bond Fund (TLT) back to mid-September levels. The dollar surged, taking the PowerShares DB U.S. Dollar Index Bullish Fund (UUP) to levels not seen since April. Gold and gold stocks broke down, continuing a wipeout that is "now at historic proportions in terms of persistence and severity," according to Jason Goepfert at SentimenTrader. Crude oil lost 1.5 percent to close at $44.52 a barrel.

There’s reason for the stock market to be jittery. Many of the recent trends that have weighed on corporate earnings would worsen under a rate hike scenario. The dollar would strengthen further. Commodity prices would weaken, weighing not only on materials and energy stocks but industrials like Caterpillar (CAT) as well. And the value of overseas profits would diminish as emerging market currencies slide and commodity-dependent nations like Brazil are hit anew.

Already, the headwinds are strong. According to FactSet data, of the 444 companies in the S&P 500 that have reported third-quarter results, 74 percent have exceeded earnings estimates. But only 46 percent have exceeded revenue estimates. And overall, earnings are set to slip 2.2 percent over last year in what's set to be the first back-to-back earnings decline since 2009.

Related: Why the Stock Market Is Partying Like It’s 1999

To be sure, the Fed has the justification for rate liftoff it was seeking.

In an interview with Reuters last week, St. Louis Fed President James Bullard said that monthly payroll growth between 100,000 and 125,000 would be considered normal for this stage of the recovery. Then in an interview on CNBC, Chicago Fed President Charles Evans called the October gain a "good number" and added that macroeconomic conditions "look like they could be ripe for an increase" in rates.

Market-based odds now put a December rate hike at around 70 percent, up from below 60 percent Thursday and around 25 percent back in October.

At this point, it would take a big miss in the November payroll report — the last before the Fed's December policy decision — to keep a rate hike at bay.

A rate hike would finally reveal just how vulnerable the stock and bond markets are to a higher cost of credit — the great lingering unknown after the largest experiment in cheap money stimulus in human history.

Related: How Rising Rents Are About to Crush American Spending Power

Make no mistake: The tightening of the labor market, and budding wage inflation pressure, is fantastic news for middle Americans. But the risk is that the Fed falls behind on inflation and is forced to hike rates more aggressively than the market assumes, rattling financial markets accustomed to an ultra-low cost of capital. In fact, Paul Ashworth at Capital Economics expects the Fed funds policy rate to be close to two percent by the end of 2016. Compare that to current futures market expectations of rates to be around 0.85 percent.

Should job gains keep stacking up, and inflation move toward the Fed's 2 percent target thanks to wage increases, Fed Chair Janet Yellen could soon face a terrible task: Raising rates based on economic data showing Main Street hitting its stride as cries of pain emanate from a Wall Street that's had things its own way for the past seven years.