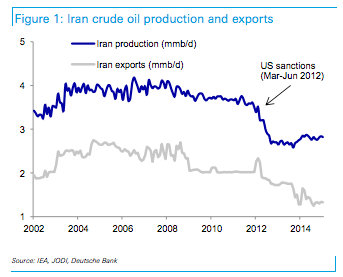

Oil prices have slipped under the $30-a-barrel level for the first time since 2003 after the announcement over the weekend that Iranian economic sanctions will be lifted — further saturating an already badly oversupplied global oil market.

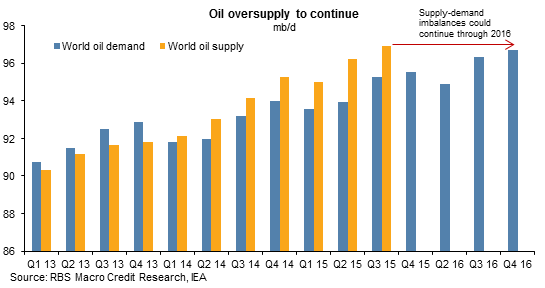

As shown below, the global oil oversupply is expected to continue at least through the end of the year, with the International Energy Agency saying Tuesday that it expects the supply to exceed demand by 1 million barrels per day for a third straight year.

"Unless something changes, the oil market could drown in over-supply,” the groups’ monthly report said, giving an “emphatic yes” to the question of whether oil prices could sink lower.

Related: 3 Money Moves to Make When Stocks Are Sinking

While demand has been improving, thanks in large part to a surge of vehicle miles traveled here in the United States, vehicle efficiency efforts in recent years have lessened the impact on gasoline consumption. Thus, the glut that started in 2014 has yet to end.

Estimates of the exact number of additional Iranian barrels to be added vary, and what gets to market will depend on the state of Persian oil infrastructure, pricing, etc. Figure somewhere around 300,000 barrels per day, initially, rising to around 500,000 barrels.

The implications of a further energy price deflation are becoming quite clear. And they're not good. Here are four ways Iran’s oil could threaten the global economy.

1. The budgets of oil exporters in the Middle East will continue to suffer and will likely contribute to worsening geopolitical and social stability in the region. According to analysts at the Royal Bank of Scotland, the most vulnerable countries in the region include U.S. allies Saudi Arabia and Qatar since they have the largest government share of GDP and are the most reliant on oil exports.

Related: The Devil's Due — China Could Send S&P 500 Below 666

Saudi Arabia's Tadawul Stock Index is already down more than 50 percent from its 2014 high as questions over the stability of the Kingdom's fixed currency exchange rate grow. Foreign exchange reserves are falling and foreign investors are rapidly pulling capital out. In an effort to control a rising fiscal deficit amid increased military expenditures, the country's new leadership was forced to cut social spending and raise domestic fuel prices.

2. U.S. shale will come under increased pressure as well, increasing the risk of bankruptcies and defaults by indebted, high-cost producers. RBS notes the overall U.S. high-yield bond market is pricing in an increase in the default rate to 6.1 percent from 3.2 percent now, which explains why the Barclays High Yield Bond ETF (JNK) tested down to mid-2012 levels on Friday.

But this may not adequately reflect the exposure retail and manufacturing firms have to the energy sector, which means the default rate could very well end up being higher.

3. Investors are coming to the realization that U.S. banks are exposed to energy firms not only via loans but through consumers in oil-dependent states as well. Major U.S. banks are holding between 2 percent and 10 percent of their overall credit exposure in the energy sector. In response to vulnerability to smaller energy firms, JPMorgan Chase (JPM) increased its loan loss reserve in the fourth quarter for the first time since the financial crisis.

Related: Are These the Death Throes of the Seven-Year Bull Market?

4. Energy-dependent states like Texas, Wyoming, Pennsylvania and West Virginia are likely to see deteriorating growth, which will weigh on overall U.S. economic data, job creation and retail spending. Already, West Virginia has fallen into contraction for 2015 after growing 5.1 percent in 2014. North Dakota's year-over-year growth rate fell below 1 percent in the middle of 2015 from 6.3 percent in 2014.

Taken together, the risks from added oil supply are considerable — and a divided economic recovery along with the deflationary drag from lower oil prices increase the chance that the Federal Reserve will have to respond by slowing its rate hike tempo this year. We’ll find out after Fed officials meet Jan. 26 and 27 just how concerned they are that the U.S. economy could go skidding on the global oil slick.