For investors, 2016 has been a bloodbath so far. And it's likely to get worse before it gets better.

The Dow has fallen below 16,000. The small-caps in the Russell 2000 are down 22.3 percent from their highs. The S&P 500 has dropped to critical support levels around the lows set in October 2014 and October 2015.

A violation here would put the entire post-2009 bull market at risk. Whether the losses deepen or a rebound materializes depends on whether Federal Reserve policymakers can restore hope.

Related: 3 Money Moves to Make When Stocks Are Sinking

They can do this by backing away from their four-in-2016 rate hike forecast. But if they stick to their guns, based on ongoing gains in the labor market, they'll leave financial markets adrift without the cheap money support investors have counted on for years — setting up a possible drop below the S&P 500's 666 bear market lows.

The catalysts for all this should be familiar to my readers: The ongoing waterfall collapse in crude oil (down to 2003 lows), volatility in China, weak economic data at home and overseas, tepid earnings, the threat of additional Federal Reserve rate hikes and bond market vulnerabilities. Rising fears of defaults by U.S. shale oil producers has pushed the Barclays High Yield Bond SPDR (JNK) to levels not seen since 2012.

The economic data certainly support a dovish turn by the Fed:

- Headline retail sales dropped 0.1 percent in December to post a mere 2.1 percent gain for the year, the weakest performance by consumers since 2009.

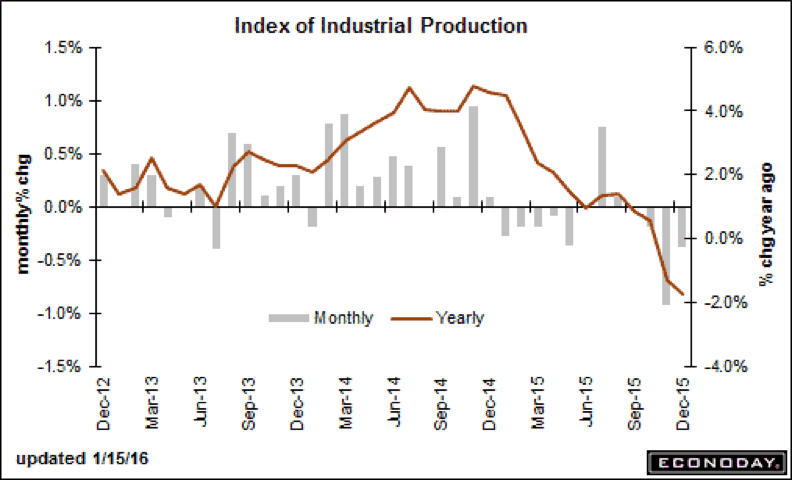

- Industrial production fell a larger-than-expected 0.4 percent in December over November, continuing a downward trend, shown above, started in the summer of 2014.

- U.S. freight volumes are falling for the first time in three years, with the decline in rail traffic flashing a recessionary signal according to J.P. Morgan economists.

- The inventory-to-sales ratio has risen to recessionary levels.

- The Atlanta Fed's GDPNow estimate for Q4 GDP growth dropped to just 0.6 percent.

Related: The Devil's Due — China Could Send S&P 500 Below 666

Long story short: A deflation dynamic — led by weak oil prices — is ripping through an overleveraged and overly optimistic financial system. It's fueled by a mix of Fed policy tightening (QE3 bond buying ended in December 2014 and interest rates were hiked 0.25 percent last month for the first time since 2006) as well as a U.S.-OPEC oil price war.

Other wrinkles include the situation in China (currency instability and capital outflows), weak corporate earnings growth (on track for a third straight quarterly decline in Q4) and the fact that, so far, cheaper oil prices have done more to hurt (by cutting capital investment) than help (by boosting consumer spending).

The kicker: If the Fed can engineer a reversal of the cheap oil/strong dollar dynamic by holding off on rate hikes or even considering new stimulus measures, the market could quickly rebound.

This would be at the risk of lost credibility for Fed Chair Janet Yellen and would reinforce the idea of the "Fed put." It would again encourage excessive risk-taking by complacent investors, and add a not-insignificant risk of runaway inflation down the road.

We may have already seen a hint of this: Early Friday, New York Fed President William Dudley said negative interest rates would be considered if the economy weakened. As recently as September, now-retired Minneapolis Fed President Narayana Kocherlakota was suggesting in the Summary of Economic Projections or "dot plot" that negative interest rates were appropriate in 2016.

Related: Are These the Death Throes of the Seven-Year Bull Market?

It's far from assured the Fed will ride to the rescue of investors this time.

On Friday, San Francisco Fed President John Williams said he doesn't see signs that asset values are depressed or below normal and cited the strong dollar as more of a concern than low commodity prices. He defended the December rate hike decision — and he added that the Fed has met its full employment mandate, believes the labor market will continue to strengthen this year and that inflation should return to policymakers’ 2 percent target over the next couple of years.

Dallas Fed President Robert Kaplan cautioned against overreacting to the "tough start" to the year and said Fed officials have the luxury to wait to see if market losses do, in fact, weigh on U.S. economic growth.

We'll know more when the Fed holds its next policy meeting on January 26 and 27. We’ll find out this week if the bloodbath continues.