The Donald has done it again.

On Thursday, the presumptive GOP presidential nominee told CNBC that his solution to dealing with the $19 trillion-plus national debt — and the risk of a budget blowout should interest rates rise and balloon the interest expense owed by taxpayers — involves a form of default such as repurchasing existing bonds at a discount. "I am the king of debt," he said, alluding to his corporate bankruptcies and use of leverage to build his real estate empire. "I love debt. I love playing with it."

His many detractors, freshly outraged over his "taco bowl" tweet, let loose again, calling Trump’s idea “insane” and warning that it would tank the economy or set off an “unprecedented financial crisis.” The general consensus: Trump is an idiot who doesn't know much about the way the financial system works.

Related: Trump Would Risk 'Full Faith and Credit of the US’

The irony is: His critics are the ones who don't understand.

Trump's comments get at the heart of the one big problem in the global economy: The ongoing accumulation of government debt that's hamstringing growth and economic vitality. Just look at Japan's multi-decade debt-deflation malaise. It's time to at least consider how we could hit the reset button.

The solution of those on the left, to paraphrase: Borrow and spend even more, funding government largesse in the hopes we can grow out of our debt hole. The politically unlikely solution of moderates such as the Committee for a Responsible Federal Budget: Cut spending, including entitlement programs like Medicare and Social Security, while raising taxes.

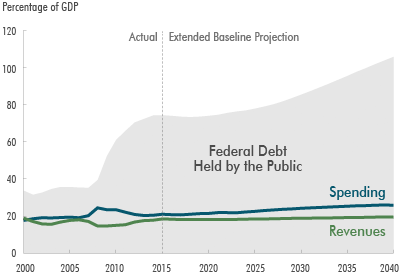

Debt-to-GDP ratios, overall debt levels and demographically driven budget deficit projections are all downright scary. The accumulation of debt like we're seeing now is without precedent outside of a global war. And the rise of the national debt threatens the government's ability to respond to unforeseen crises such as war, pandemic, recessions and disasters.

Related: As the Debt Hits $19 Trillion, Has the US Reached a Tipping Point?

A struggle against these trends has manifested in what is the greatest experiment with cheap money stimulus ever —including swelling the Federal Reserve’s balance sheet to more than $4 trillion (up from $800 billion before the financial crisis), negative interest rates in much of the developed world and fresh chatter of dropping money from helicopters (by both the European Central Bank and the Bank of Japan), alluding to a 2002 speech by former Federal Reserve Chair Ben Bernanke.

All of this is pretty unorthodox. Where is the outrage? Only some nontraditional voices on the right — the likes of Sen. Rand Paul (R-KY) and even Trump — seem to be proponents of more traditional monetary policy.

And Trump’s latest idea fits right in with historic tradition. Harvard economist Kenneth Rogoff, who specializes in the study of historical high-debt scenarios, notes in a forthcoming Journal of International Economics article that advanced countries have relied on unorthodox debt-management strategies far more often than many realize, including "restructuring debt contracts, generating unexpected inflation, taxing wealth, and repressing private finance."

America and many other developed economies have a long history with credit defaults. It's only in the modern post-war era that America's sovereign debt has become sanctified, along with the elevation of the dollar to the status of global reserve currency of choice (replacing the British pound).

Related: Why People Are Worried About Donald Trump Learning State Secrets

Rogoff, along with Harvard colleague Carmen Reinhart, has written that before World War II "the outright write-down of debt in advanced countries was common and consequential" and that “the message from dozens of episodes of significant debt reductions in advanced economies since the Napoleonic War is that everything is on the table.”

Back in 2013, I wrote of the desperate need for America to default on its debt — using the idea of a debt-for-equity swap — and why there is historical precedent for the kind of outside-the-box thinking Trump is bravely pushing:

Robert Wright, a market history professor as Augustana College, reminded me that many state governments endured "hard default” scenarios in the early 1840s in response to a plunge in real-estate values in the wake of President Jackson's closure of the Bank of the United States and the resultant Panic of 1837. Also contributing was a restive pre-war population that didn't like the idea of paying back losses via tax revenue.

So they defaulted, reset the books and added balanced-budget amendments to their constitution to stay out of trouble in the future. Perhaps it's time for Washington to follow an example of fiscal discipline and creative thinking set nearly 200 years ago. Hit reset, prevent another debt binge and move on with the reforms and investments we need to get this economy revved up.

After all, it seemed crazy and unorthodox when President Nixon ended the dollar's convertibility into gold in 1971, undermining the post-war Bretton Woods currency regime. It seemed crazy when private ownership of gold was outlawed during in the Great Depression. And it seemed crazy when the Treasury started issuing fiat currency — known as "greenbacks" for their distinctive coloration — to bolster the war effort against the rebels in the South.

Perhaps history books will mark President Trump's write-down of the national debt as another entry in the list of crazy economic ideas that got America back on track.