Another "Black Swan" selloff has reversed itself in another neck-snapping V-shaped rebound.

We saw it with the Greek protests in 2010, the U.S. debt-ceiling crisis in 2011, Euro bailouts in 2012, the fiscal cliff in 2012, the Ebola scare in 2014, Chinese currency fears in 2015 or Brexit now, the pattern is remarkably similar.

This market, pumped up on central bank stimulus, refuses to stay down.

But as time goes on and debt, leverage and overconfidence builds even as the normal business cycle matures, these rebounds are becoming increasingly hollow, vulnerable and hard to justify. Don't take my word for it: Aggressive rallies in government bonds and precious metals belie the confidence in equities.

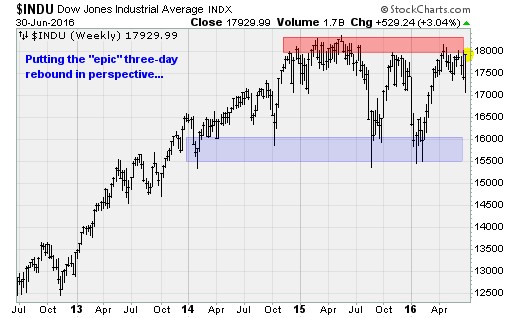

Caution is still warranted as stocks have merely returned to the upper end of an epic three-year consolidation range.

Related: The Upside of Brexit — 9 Ways You Can Save Money

U.S. equities charged higher for the third consecutive day on Thursday thanks to hopes of more central bank stimulus (from the Bank of England and European Central Bank), fading Brexit fears and end-of-quarter window dressing by investment professionals and fund managers. The over-the-weekend freak out over the United Kingdom's surprise vote to leave the European Union — which has resulted in credit downgrades for the U.K. and currency volatility for Europe — seems but a distant memory now.

On the year, the Dow Jones Industrial Average is now up 2.9 percent, while the S&P 500 has advanced 2.7 percent. The Nasdaq Composite Index is still off 3.3 percent.

I guess this shouldn't be surprising. Market makers were always going to do what they could to boost stocks, one the few areas of positivity left for the global economy, just before quarterly brokerage statements are mailed.

The rebound of the last three days is made all the more incredible because it lacks any grounding in fundamentals. It's been all technical, computer trading algorithms feeding on each other, short squeezes and the panicked selling of volatility hedges.

Still, the latest rally just means we've been sliding sideways for months. Wake me when there is a breakout and performance numbers that beat the "money under the mattress" option.

Related: Brexit’s Gift to US Homebuyers: Mortgage Rates Tumble to 3-Year Lows

Moreover, the "more stimulus!" headlines that propelled stocks on Thursday were hardly groundbreaking. Bank of England Governor Mark Carney said more stimulus would likely be needed over the summer. And the ECB is reportedly considering a change in how it allocates its bond purchase stimulus given a meltup in government bonds that has limited the pool of assets available to buy.

The headwinds facing stocks are familiar as well: an ongoing corporate earnings recession, the looming start of the Q2 reporting season, the specter of Federal Reserve interest rate hikes and an uneven global economy. Crude oil looks vulnerable to fresh weakness as short-term supply disruptions ease. And an ongoing tightening in the U.S. labor market — spiked by evidence of falling labor productivity — threatens to trap the Fed in a "stagflation" scenario.

Economist David Rosenberg of Gluskin Sheff — the famous bear that turned bullish between 2012 and 2015 — notes that the situation has become fragile. He recently warned clients of a "sub-par global economy, burdened by excessive debt and supply gluts in practically every market, and an equity market challenged by what is still a very murky earnings outlook." He has recommended using the current relief rally to lighten up on cyclical positions and focus on defensive assets like bonds and income-yielding stocks.

Related: Why the Public Has Stopped Paying Attention to Economists

Other concerns he highlights include U.S. election uncertainties; the rising tide of nationalism, isolationism and trade protectionism; relentless cuts to U.S. capital goods orders; and weak regional manufacturing activity surveys.

I couldn't agree more. The bulls have a tendency to push stocks higher into three-day holiday weekends like the one we’re about to enter. But once trading resumes on Tuesday and traders look ahead to catalysts like the forthcoming earnings season and the Fed’s next policy meeting, watch for the bears to reemerge.

If you think my skepticism is unwarranted, ask yourself: Why are Treasury bonds (and global government bonds in general) surging? Same for precious metals. Both are safe haven assets. And both are saying loud and clear that something is seriously amiss in the global financial system.

Also consider that consumer staples and utilities, both defensive sectors, led the way higher Thursday. Hardly a ringing endorsement of confidence in stronger growth.