Friday’s decline for the S&P 500 ruined what could've been the first "perfect week" for the market since early 1998 — that is, up every single day of the week, with each session notching a new record high.

It was only the third down day since the post-Brexit rebound began. And the Dow Jones Industrial Average managed to close at another record high, gaining 0.1 percent.

Not to ruin the mood, but I’m calling B.S. on this parabolic move.

The bulls will have a number of new catalysts to deal with when trading resumes on Monday morning. The attack in France and the coup attempt in Turkey add to the still-evolving Brexit situation in the United Kingdom. Europe is a hot mess right now as economic growth is uneven and debt and deflation remain acute problems.

Related: Can Stocks Stay at Highs? That Depends on Earnings

Yet recent fears surrounding a possible Italian bank bailout and the “gating” of some U.K. property funds, meaning investor redemptions were suspended, have been replaced by euphoria: Italian bank stocks were up 13 percent last week for the best run in five years. Really?

We have Federal Reserve and Bank of Japan policy decisions coming at the end of the month. Stocks have been surging on hopes that former Fed Chair Ben Bernanke's pilgrimage to Tokyo to talk up "helicopter money" stimulus with the Japanese will end that country's long malaise. Unfortunately, there could be legal hurdles to Bernanke’s dreams of monetized fiscal spending. Something better be delivered, though, with the Japanese yen enjoying its biggest weakening since 1998 (good from Tokyo's mercantilist, inflation importing/goods exporting perspective).

As for the Fed, after a super-strong June jobs report and a massive post-Brexit market rally, Chair Janet Yellen and her cohorts are quickly running out of excuses to not raise interest rates. Stocks won't like this, as the futures market now expects no action until late 2017 at the earliest.

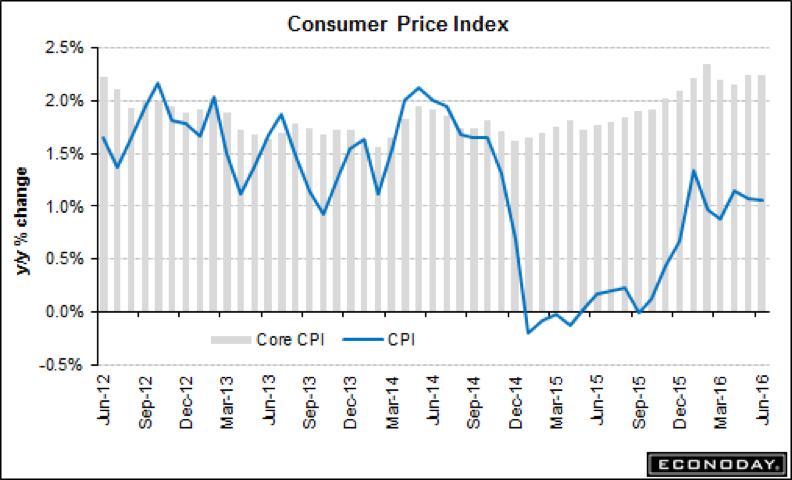

On Friday, we learned that consumer price inflation is running hotter than expected, as shelter costs rise and the labor market tightens. Industrial production and retail sales all beat estimates. Another Fed worry that is now fading is the economic situation in China, where second quarter GDP grew at a 6.7 percent annual rate, unchanged from the first quarter and ahead of the 6.6 percent estimate.

The second quarter earnings season will heat up as well, with 140 S&P 500 companies set to report (only 7 percent have reported so far). According to FactSet, S&P 500 earnings are set to decline 5.5 percent from last year, for the fifth consecutive quarterly decline. As earnings have stalled but share prices keep rising, the S&P 500's trailing 12-month price-to-earnings ratio has swelled to its highest level since 2010 (19.4x) and is well above its five-year (15.8x) and 15-year (17.6x) averages.

Finally, keep an eye on the recent rebound in long-term interest rates. The U.S. 10-year yield has gained about 20 basis points (or 0.20 percent) over the last two weeks on expectations of higher inflation and economic growth spurred by the whirring of Bernanke's helicopter. That's the third largest weekly spike in history.

The ironic catch in all this is that if central bankers are in fact successful in revitalizing growth and inflation, led by Japan, it could badly destabilize the bond market, where roughly a quarter of government bonds (and a growing share of the corporate bond market) is trading with negative interest rates — roughly $13 trillion worth in total.

Related: Japan Stocks Seen Posting First Annual Drop to End 'Abenomics' Rally

According to Goldman Sachs, a 1 percent rise in long-term interest rates would generate a mark-to-market loss of $2.4 trillion due to the impact of duration, which is like leverage. When bonds have a longer time to maturity, and a lower interest rate, the price sensitivity to interest rate changes is multiplied.

This could also jeopardize the largest source of buying demand for stocks lately: Corporate buybacks. The Wall Street Journal noted that S&P 500 companies bought about $161 billion worth of their own stock during the second quarter (often, using cheap debt or cash saved via foregone physical investments to fund the purchases). That's the second-highest quarterly amount on record.

Bond investors — and by extension, stock market investors — should be feeling very, very nervous. The global financial system is incredibly complex and increasingly threadbare. And a surge in central bank asset purchases to levels not seen since 2013, combined with hopes of even more purchases, has helped push stocks to fresh highs.

Related: Gundlach Says 'Big Money' to Be Made if Stocks Fail to Stay Near Current Highs

But stocks are incredibly vulnerable. Only 28 stocks in the S&P 500 (less than 6 percent of the index) are at new highs. Less than 72 percent of the stocks in the S&P 500 are even in uptrends.

Any hiccup, from a reversal in the yen; a backup in rates; indications that the Fed is sticking to its two-quarter-point rate hike forecast for 2016; disappointment in the BoJ; realization that valuations and earnings are a problem; a return of geopolitical fears; a continuation of recent energy price weakness (with U.S. oil rig counts growing at the fastest pace since 2011); or even a realization that anti-establishment/anti-globalization candidate Donald Trump has risen in some polls (especially in critical swing states) against global elitist/status quo candidate Hillary Clinton could quickly reverse the gains we've seen over the last three weeks.

You know the old adage: Stocks take the stairs up but the elevator down. With everything so expensive, the bull market among the oldest in history, and risks multiplying as fundamentals fade, caution is a virtue here.