While stocks have been inching to new highs in recent weeks, the action has been subdued. Volumes have been light. Sentiment has been mixed. And cautious investors have sold into the rally, resulting in net fund outflows.

This uncertainty is being driven by a number of fundamental headwinds. Energy prices still look shaky. Economic growth is tepid. Stock valuations are high. And, above all, we're in the midst of a corporate earnings recession that has, through the second quarter of 2016, lasted for five consecutive quarters.

The optimists are justifying the recent hitting of new highs on buoyant expectations for a bounce back in the second half of the year. The economy, based on the Atlanta Fed's GDPNow estimate of third-quarter growth, looks solid. But what about profits?

Related: Why It’s Time for the Fed to Green Light a Strong Stimulus

For the second quarter, with 91 percent of S&P 500 companies reporting results, earnings are on track for a 3.5 percent decline from last year and are down about 10 percent from their peak. Revenues are even worse, with sales on track for their sixth consecutive quarterly decline.

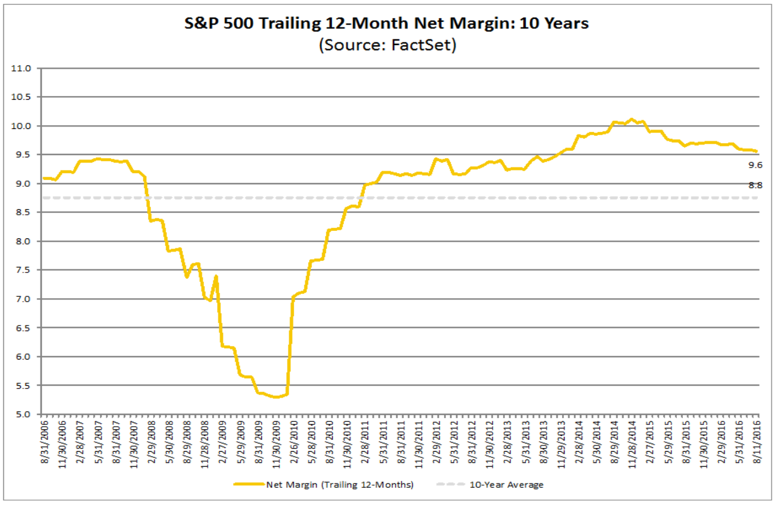

According to FactSet, earnings growth isn't expected to return until the fourth quarter of 2016, with another 2 percent decline penciled in for the third quarter. Profit margins remain a concern, dragged down by the strength of the U.S. dollar, weak energy prices, labor market tightening and a drop in labor productivity.

Related: Home Prices Hit an All-Time High — Is This Another Bubble?

Ed Yardeni of Yardeni Research is much more optimistic, declaring triumphantly to clients earlier this week "that the earnings recession is over based on final S&P 500 earnings and revenue data for Q2." Why the optimism? Because while earnings are still declining on a year-over-year basis, they improved sequentially on a month-over-month basis in Q2.

Put simply: Profits are slowly starting to pull out of their nose dive.

Yardeni admits that industry analysts disagree and have been lowering their estimates for the second half of the year based on negative guidance from management. But he remains confident in his call for a few reasons:

1. He is counting on the typical earnings "hook" where management and analysts tend to be overly pessimistic heading into earnings reporting season as actual results tend to surprise to the upside. Better to beat a lowered hurdle than disappoint a higher one. Actual results have exceeded expected results in every single quarter since the beginning of 2009.

2. Most of the recent markdown to earnings in the third and fourth quarters has been driven by ongoing pessimism about the energy sector. But chatter about a possible OPEC supply freeze deal at a meeting in Algiers next month, recycling headlines from back in February, has resulted in a short squeeze and higher oil prices. As a result, West Texas Intermediate is actually in positive territory on a year-over-year basis, and annual comparisons are set to get easier heading into the winter.

Related: The US Now Has More Oil Reserves Than Saudi Arabia or Russia

3. Analysts are penciling in a serious bounce back in 2017, with S&P 500 earnings expected to grow nearly 14 percent. Translation: There is no recession risk. This is corroborated by the fact the index of Leading Economic Indicators — of which S&P 500 forward earnings estimates are a component — was within 1.3 percent of its March 2006 record in July.

Of course, this forecast assumes things go relatively smoothly into the end of the year despite worries of a possible Fed rate hike in September and/or December, a contentious U.S. presidential election in November and the end of the summer driving season at a time when oil inventories are bloated.

All else equal, at least in terms of earnings, it looks like a turnaround is coming.