Democratic Senators renewed their call for a public health insurance option late last week, a move met within hours by firm disapproval from across the insurance industry. At issue is dwindling competition among American health insurers, as providers struggle to remain profitable in the new regime created by the Affordable Care Act, also known as Obamacare. Rather than attempting to impose competition on an already strained market, policymakers should take the lead in easing regulations that have squeezed insurers, doctors and patients alike.

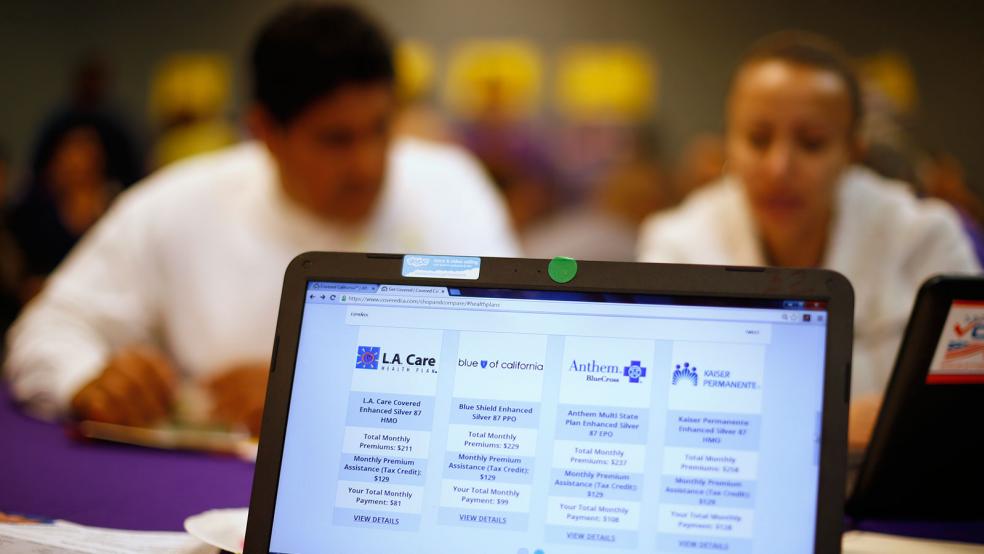

Two recent studies underscore the challenge: McKinsey projects that 17 percent of Americans eligible for ACA policies will have only one option next year, up from just 2 percent last year. Breaking down coverage by geography, Avalere Health projects that 36 percent of exchange rating regions – where regulators approve plan offerings and prices -- will have only one plan available next year.

Related: Obamacare Insurers Are Looking for a Taxpayer Bailout

Less competition means higher costs for consumers—and for taxpayers, who cover the lion’s share of insurance premiums.

Red states and blue states alike are feeling the pain. In Arizona, Blue Cross Blue Shield, the insurer of last resort, is considering withdrawing from the public exchange, on the heels of UnitedHealth pulling out after losing $185 million in 2015. In Minnesota, BCBS reported a $265 million loss from individual market plans in 2015, and projects a cumulative loss of more than $500 million over three years. They announced withdrawal in June.

Oregon lost two health care providers from the exchanges last year, including Health Republic, a failed co-op that went belly up after $20 million in losses. Oregon’s BCBS plan reported a loss of $12.7 million in just the first quarter of this year. In fact, there’s only one insurer in Oregon operating in the black.

Senate Democrats seem to suggest the ACA can be tweaked simply by following Hillary Clinton’s lead and launching a public option, a government financed plan that would compete with private insurers.

While Clinton has yet to release any specifics, her 2008 healthcare platform, the American Health Choices Plan, gives us a glimpse. The AHCP stipulated a public option “which could be modeled on the traditional Medicare program, but would cover the same benefits as guaranteed in private plan options…[to] compete on a level playing field with traditional private insurance plans…[and] provide a more affordable option.”

Related: With Aetna Pulling Out, Can Anything Save Obamacare?

That assumes insurers are price gouging by not offering affordable options. But the problem isn’t that there’s too much profit being made on the exchanges, it’s that there’s too little. Such a public option would undercut insurers, leading to even less competition. Low government rates would encourage even more doctors and hospitals to abandon exchange plans.

Democrats and Republicans should agree on a different strategy: driving down health care costs through choice and competition. The ACA’s heavy handed regulations have undermined this effort. Prices are kept artificially low for older applicants, but that drives up prices for the younger enrollees insurers desperately need to keep premiums from skyrocketing.

Government mandated benefits—for pregnancy coverage, addiction recovery, and rehabilitation services—drive up the cost of even bare bones plans, and limit the types of plans on offer. The result has been a proliferation of high deductibles and narrow networks (not bad in themselves) that offer very little in the way of coverage for average consumers, as opposed to the poorest and sickest (who receive generous federal subsidies).

The market’s going to get worse before it gets better. That’s because two big federal programs designed to offset insurers’ losses on the sickest patients phase out this year. Higher premiums will chase even more healthy people out of the exchanges.

Related: Obamacare’s Death Spiral of Consumer Choice

Simple reforms that could attract bipartisan support should include allowing insurers to charge younger applicants less relative to older ones, offer benefit designs that cover fewer services (like Copper plans) at a lower price point, offer multi-year plans with premium discounts for consumers who sign up. If consumers opt for less expensive plans, they should keep the savings in a Health Savings Account. Finally, as in Medicare Part D, you should have the option of declining insurance, but it should come with a financial penalty that grows over time.

As an olive branch to Democrats, and following the Medicare Part D model, Congress could accept the Clinton proposal through a fall back plan. A Medicare option could be available to those 50 to 64 in any region with fewer than two private insurers competing for business. Private Medicare Advantage plans should also be allowed to compete for this population, since they already have experience managing older patients effectively.

In all likelihood, we’ll be facing divided government again in 2017. Creating a functional individual insurance market in the years ahead – without exploding costs for taxpayers – will require embracing commonsense solutions. Partisans on both sides hoping for a total reboot – either repealing and replacing the ACA, or embracing single payer – will be disappointed, but that doesn’t mean we can’t deliver targeted reforms that deliver what the vast majority of Americans want most: access to affordable routine care when they need it, with protection against financial ruin in the event of a serious illness.

The next president can thread the needle by throttling back on ACA’s expensive regulations, and allowing companies to offer insurance protection Americans really want to buy at price they can afford. The alternative is years more of bitter partisan wrangling while health care costs spiral out of control.

Paul Howard is the director of health policy at the Manhattan Institute. Stephen T. Parente is Minnesota Insurance Industry Chair of Health Finance in Carlson School of Management and the Director of the Medical Industry Leadership Institute at the University of Minnesota.