Few governors in the nation greeted the Affordable Care Act (ACA) with more enthusiasm than Mark Dayton. The Minnesota Democrat hailed the new program as the apex of progressive governance and made sure the DFL-controlled legislature approved the Mnsure state insurance exchange.

Not even a series of disasters in Mnsure implementation shook Dayton’s confidence in Obamacare, refusing to accept a recommendation in January 2014 from an independent consultant to shut down Mnsure and rely on the HHS federal exchange. Instead, Dayton poured tens of millions more into the state exchange, insisting that the rocky beginning belied Obamacare’s glorious and successful future.

Related: Get Ready for Huge Obamacare Premium Hikes in 2017

That was then; this is now. On Wednesday, Dayton declared the status of the individual insurance market an “emergency” and that the Affordable Care Act was an oxymoron. “Ultimately, the reality is that the Affordable Care Act is no longer affordable for an increasing number of people,” Dayton told the media. Dayton’s remarks came a week after Bill Clinton admitted that Obamacare was “the craziest thing in the world,” and that consumers “wind up with their premiums doubled and their coverage cut in half.”

Perhaps Dayton felt that Clinton gave him enough political cover to admit the obvious, but Minnesotans might need to use their coverage to remedy the whiplash from following Dayton’s lead. Three years ago, the governor bragged that the state exchange would have the lowest rates in the nation, thanks in large part to the number of insurers that sold policies without federal control of the marketplace. Those advantages got wiped out a year later when insurers demanded double-digit increases to stick with Mnsure.

The state’s largest insurer in Mnsure did not bother to ask for a rate hike for 2015 – Preferred One shut down its exchange operations instead. At that time, Preferred One had sold 59 percent of the plans purchased through Mnsure but discovered that the business model made it impossible to succeed. Mnsure, they announced, was “not administratively and financially sustainable,” despite all of the happy talk from Dayton and the Obama administration.

Related: It’s Time to Blame Obamacare for Losing So Many Full-Time Jobs

Two years later, Preferred One’s point has been validated. State commerce commissioner Mike Rothman approved rate hikes for 2017 that pushed prices 50 to 67 percent higher than 2016’s premiums. That follows price hikes for 2016 of 14 to 49 percent, making it three straight years of beatings for Minnesota consumers on the individual insurance market.

Rothman had little choice in the matter. As the Star Tribune notes, all seven of the remaining insurers in the state had threatened to follow Preferred One out the door without the massive rate hikes. Even with Rothman surrendering to the realities of centrally controlled economies, Blue Cross Blue Shield will still exit Mnsure at the end of 2016. The massive price hikes, Rothman said in September, were “a stopgap for 2017.” Foreshadowing Dayton’s announcement on Wednesday, Rothman added, “It’s an emergency situation – we worked hard and avoided a collapse.”

Avoided? As Dayton made clear yesterday, all Minnesota has done is postpone a collapse – and probably for only another year. The biggest problem for insurers in these markets is the unstable utilization rates, which prevent them from accurately calculating risk to set a tenable premium price.

The reason for that instability is that higher prices are disincentivizing healthier consumers from buying expensive comprehensive insurance policies as they opt instead to pay out of pocket for their minimal utilization and pay the tax penalty for non-coverage instead. Thanks to skyrocketing premiums and deductible thresholds, the likelihood of many consumers to have benefits applied to anything but a basic wellness check is remote at best, which makes the risk worthwhile.

Related: Obamacare: Costs Go Up, Insurers Drop Out and Consumers Get Screwed

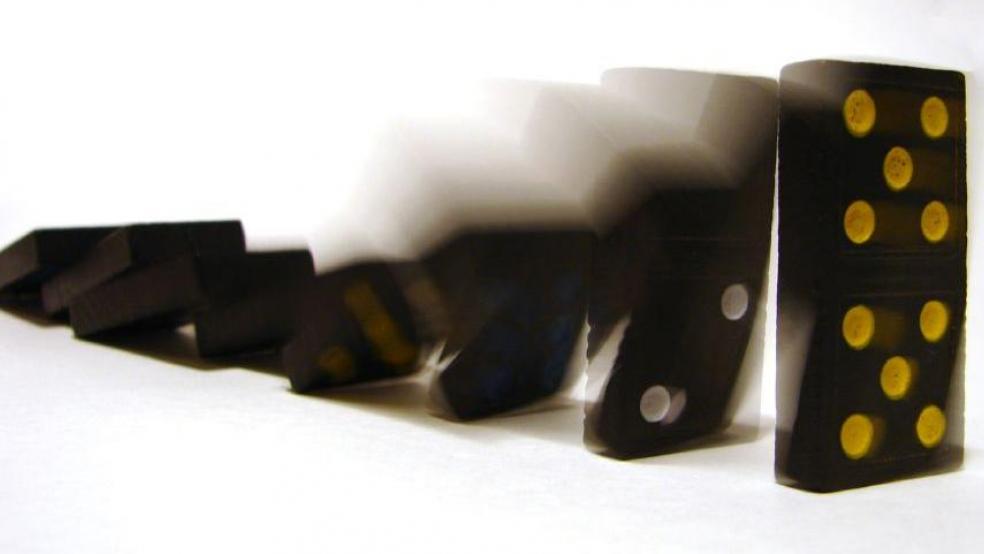

As prices go up, the risk for healthier consumers gets lower and lower, which means more of them will opt out rather than pay thousands of dollars every year for benefits they never use. As that continues, utilization rates for the sicker and older consumers who have incentives to stay in the system continue to escalate, necessitating even higher premiums. Eventually, the system exhausts itself and collapses. That “death spiral,” long predicted by Obamacare critics, would have arrived in Minnesota now except for the approval of astoundingly high premium hikes – an event that political realities will almost certainly keep from being repeated.

Dayton called for the Minnesota state legislature to take action to prop up Mnsure, but even he recognized that the problem starts with the ACA itself. “It’s got some serious blemishes right now and serious deficiencies,” Dayton admitted of the law that he once championed.

Unfortunately, President Barack Obama will not make the same admission. The Associated Press reported that Obama still argues that massive premium hikes in Minnesota and several other states are a “one-year market correction,” despite repeated and increasing jumps in premiums over the last three years.

Related: White House Is Spending Millions to Battle Obamacare Rate Hikes

The White House solution consists of larger subsidies, tax credits, and restoring access to the general fund for risk-corridor repayment programs to insurers – a government bailout of the sector’s Obamacare losses. None of that addresses the perverse incentives and fatal structural flaws of the ACA; in fact, bailouts and increased subsidies will only perpetuate them and do more damage.

It’s time for the Obama administration to admit what a former Democratic president and a current progressive governor have openly declared. Obamacare truly is “the craziest system,” and it will only get crazier every year until it’s finally discarded.