President-elect Donald Trump.

The realization of that moniker threw financial markets and most of the world into confused chaos on Tuesday night as American voters delivered a heavy blow to the socio-economic establishment. The initial response was cold terror, sending U.S. equity futures plunging overnight. Then, a concession by Hillary Clinton and a tempered victory speech by Trump removed the threat of a contested outcome, started the healing process and focused attention on the consequences to come — namely, the prospect of a huge fiscal stimulus of tax cuts and infrastructure spending.

The result has been a historic reversal, pushing the Dow Jones Industrial Average to a new high on Thursday.

But the evidence suggests the post-election volatility isn't over yet.

Related: Stocks Rally as Investors Jump on the Trump Trade

For one, while Wednesday’s rally was flashy in its intensity it was disappointing in its underlying strength. Incredibly, there were only 310 net advancing issues on the New York Stock Exchange. That's down nearly 30 percent from Tuesday's modest advance and well below the nearly 2,000 net advancing issues seen on Monday. Popular tech stocks like Apple (AAPL), Alphabet (GOOGL) and Amazon (AMZN) have fallen.

More importantly, the stock rally was accompanied by a disorderly selloff in Treasury bonds that caused long-term yields to surge. The iShares 20+ Year Treasury Bond Fund (TLT) fell more than 4.2 percent to plunge to levels not seen since early February — capping a total decline of near 13 percent from its July high.

In fact, the ferocity of the rise in interest rates was a primary driver of the stock rally. Financial stocks as a group have surged on hopes of wider net interest margins and higher profitability. Investors, in their enthusiasm, are ignoring possible downside risks to the economy from higher mortgage and car loan rates.

Related: Trump Proposes $1 Trillion for Infrastructure Without Raising Taxes

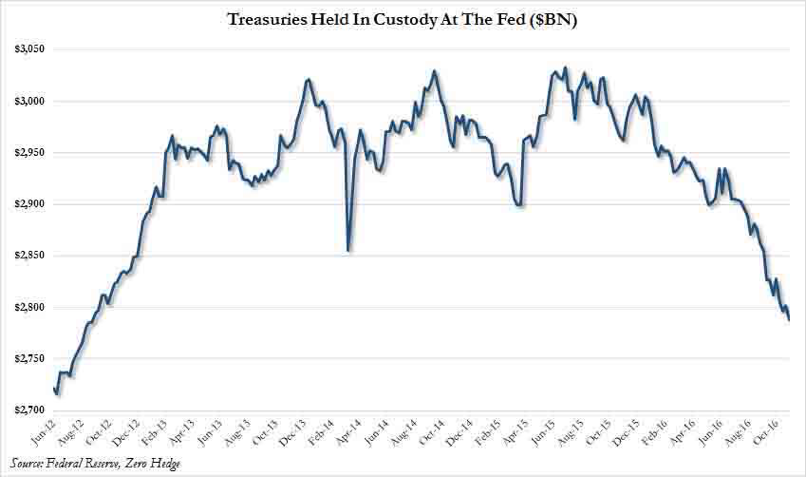

Why are interest rates on the rise? It’s a combination of expectations of higher inflation and stronger economic growth and chatter about the official selling of Treasury reserves by the Chinese, who no doubt must be worried about Trump's loose talk during the campaign about a possible debt restructuring. And let's not forget the rising odds of a December interest rate hike from the Federal Reserve.

The risk here is that the narrow stock market rally will soon be undone by the rise in Treasury yields. Why would those yields keep rising? Because folks are realizing that Trump's plans, as structured now, are set to massively increase the national debt, per an analysis by the Committee for a Responsible Federal Budget.

Trump's first major policy hurdle will be the need to raise the debt ceiling in March, which will put the budget hawks in Congress in an awkward position. Chinese (and other state entity) nervousness will surely continue as well, at least until there is more clarity around Trump's fiscal, debt management and trade policies. The chart above shows the intense selling pressure that's already been seen as Treasury bonds held in custody by the Fed dwindle away.

Much also depends on the Fed's policy decision next month and how the market tolerates another expected increase in the policy rate.

Related: 7 Big Risks That Could Derail the Stock Market’s Rally

To get a sense of the seriousness of all this, consider that Wednesday's move in the 10-year Treasury yield was the largest on record going back to 1962. If this is, indeed, the start of a protracted rise in interest rates, it could very well threaten the 30-year bull market in bonds.

President-elect Trump's first months in office, like President Obama's in early 2009, could very well be marked by financial and economic turmoil as long-simmering problems held down by the outgoing administration boil over. Let's see what the self-proclaimed "King of Debt" can do.