A two-day selloff has cut U.S. crude oil prices below $50 a barrel for the first time in three months. The catalyst for the weakness — which comes despite an OPEC agreement to reduce production — is a combination of record high inventories and growing evidence of a rebound in U.S. shale oil activity.

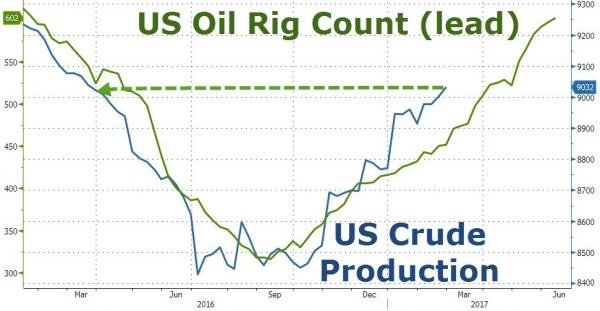

In short: The market is growing increasingly oversupplied. Bloomberg reports that U.S. oil inventories are 39 percent above their five-year average at a time when U.S. rig counts are 51 percent higher than last year. Bullish hopes for an end to the oil supply glut have dimmed.

Related: The US Economy Is Humming Along, but a Big Jump in Growth Is Unlikely

The oil price decline will be accelerated by the fact that, according to futures market data, net long commitment is "well over-extended" according to Scotia's energy commodity strategist Michael Loewen. Panicked selling of positions by hedge fund types threatens to dramatically deepen the pullback and end the relative calm energy markets have enjoyed for the past year.

The decline really shouldn't come as a surprise, despite all the hype over the OPEC supply freeze agreement first teased in February 2016, hammered out late last year and triumphantly touted more recently thanks to strong enforcement levels. Why? Because as the old adage goes: The best cure for high commodity prices is high commodity prices.

Many U.S. shale oil companies capped wells and offshore drillers idled rigs when Saudi Arabia launched its price war in 2014. As prices have recovered above the marginal cost of production, it's now easy for U.S. producers to restart production. While exploration activity may still be dampened, as energy companies trim costs aggressively in an effort to restore profitability in this environment, putting idled resources back to work is a no brainer.

Related: How the New Trump Travel Ban Could Hurt the US Economy

Credit analysts at Fitch sounded a warning earlier this week: "The recovery in U.S. drilling activity will drive up shale production in the second half of 2017, offsetting a portion of recent oil price gains." Fitch notes that a stressed, oversupplied market could see crude oil prices at $40 a barrel in 2019.

Saudi Arabia appears to have made a tactical mistake, surrendering the hard fought market share gains earned since 2014 back to U.S. producers and non-OPEC countries. Fiscal pressures on Riyadh's budget, and months of "verbal intervention" in the market by promising a supply cap deal, forced the oil sheiks to tighten their spigots. Since January, a 1.8-million-barrel production cut has enjoyed a 94 percent compliance rate within OPEC.

But non-OPEC compliance — including by countries like Russia — stands at just 60 percent to 66 percent. And U.S. oil companies are revving up.

Now that prices are sliding again, it's only worsening the fiscal squeeze on Saudi Arabia since both oil price and oil output are now on a lower base for OPEC countries. In terms of net revenue and market share position, Riyadh may well have been better off to let oil prices hold near $30 and push high-cost U.S. shale producers into bankruptcy.

A fresh downtrend in energy prices will be bad news for overall corporate earnings and GDP growth. Weak oil prices were responsible for the recently ended corporate earnings recession. And according to the Brookings Institution, the 2014 oil price decline had no simulative effect on the economy, as a decline in investment offset the benefit to consumers.

Related: Americans’ Household Wealth Hits a New High

Falling crude prices could also keep the Federal Reserve from hiking interest rates as aggressively this year. In 2015, Fed Chair Janet Yellen noted that a prolonged decline in oil prices — along with other factors including an appreciation of the U.S. dollar, which is also in play again right now — had adverse implications for the economic outlook.

Anthony Mirhaydari is founder of the Edge and Edge Pro investment advisory newsletters. A two-week and four-week free trial offer has been extended to readers of The Fiscal Times.