Wall Street has soared since President Trump's surprise election win. The major indexes have all notched new record highs. And while the rally has narrowed in recent weeks (with small caps in a multi-month holding pattern while big tech stocks continue to climb), investor sentiment remains red hot.

The bulls are fending off some daunting challenges: The economy is underperforming on a scale not seen in years, Trump's promised pro-growth agenda is stalled and the Federal Reserve is preparing two more quarter-point interest rate hikes this year and is actively talking about drawing down its balance sheet. Maybe above all, the bulls are fighting history itself.

Related: Here's How Broken Washington Is — Even Without Trump

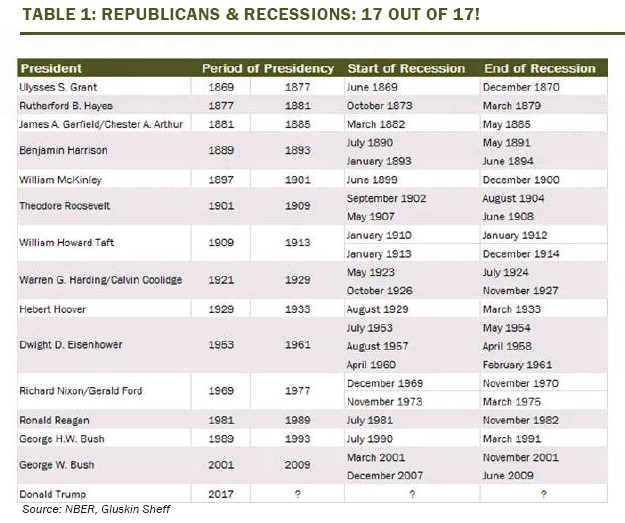

For whatever reason, new Republican presidents have a horrible record when it comes to the market. Over the last 150 years, going back to President Ulysses S. Grant, every single one has seen the economy suffer a recession in their first term. The stock market suffered in sympathy.

Grant's misfortune, which started in 1869 with another downturn in 1873, kicked off what would become known as the "Long Depression."

President Benjamin Harrison dealt with the aftermath of a bubble in railroad stocks in the 1890s. President William McKinley, before he was shot, dealt with a downturn related to tighter monetary conditions in 1890. And President Herbert Hoover presided over the start of the Great Depression.

More recent misfortunes are better known. President Reagan suffered a double-dip recession in the early 1980s as the Federal Reserve fought against out-of-control inflation by raising interest rates. President George W. Bush was left with the aftermath of the dot-com bubble.

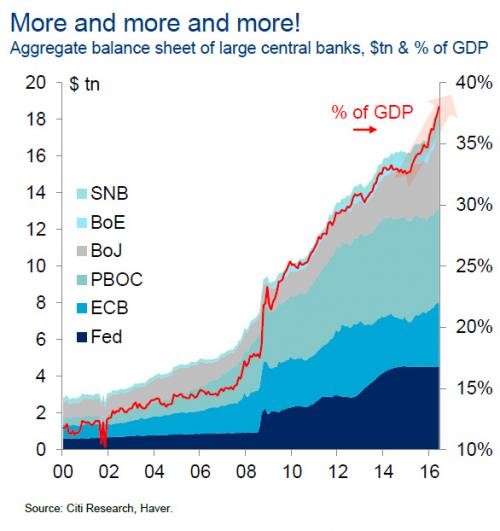

President Trump will no doubt be forced to deal with the aftermath of an epic experiment in cheap-money monetary policy. The chart above shows the full scale of the runaway money printing we've witnessed over the past 10 years, helping inflate the value of pretty much every asset class (save precious metals). Even art and classic car prices have benefited.

Related: Unemployment Hits a 17-Year Low, but Some Economists See a Worrying Sign

The catalyst for Trump's recession — like every recession of the modern era — will be the result of interest rate hikes from the Federal Reserve. After hiking only twice during President Obama's eight years, Fed Chair Janet Yellen and her cohorts have embarked on a tightening cycle that has so far seen three quarter-point hikes since December 2015, with more coming. A June hike is all but certain based on futures market pricing in odds of more than 91 percent.

Based on the most recent Federal Reserve meeting minutes as well as fresh commentary from Fed officials, a case is being made for two more quarter-point rate hikes this year as well as the start of the balance sheet tapering process. Dallas Fed President Robert Kaplan said recently that he continues to see two further rate hikes as the probable path forward and is eager to shrink the Fed's balance sheet. San Francisco Fed President John Williams echoed this, saying the Fed is closer than ever to meeting its inflation and employment mandates.

At this pace, a recession should arrive sometime in 2018. That's because one of the strongest warning indicators of a downturn is what's known as an inversion of the yield curve. In plain English, it's when short-term interest rates rise above long-term rates, a reversal of the normal order.

Gluskin Sheff economist David Rosenberg estimates it'll only take another four quarter-point rate hikes to accomplish this — which, in his words, will result in "either a sharp slowing in growth, some sort of negative credit or deflationary shock, or a combination of all three."

Related: The More Trump Fails, the Better Off We’ll Be

It seems the deck is stacked against Trump, suggesting the GOP's history of first-term downturns is likely to continue unless he can convince the Fed to pause its rate hikes, push through the tax reform and infrastructure legislation Wall Street's been waiting for and shrug off the myriad political scandals that have been creating constant distractions.

For investors buying stocks here, you're making a bet he accomplishes all this and breaks the curse.