TOKYO (Reuters) - Most economists oppose Prime Minister Shinzo Abe's plan to redirect some revenue from a planned sales-tax increase to child care and education because it would add to Japan's massive debt burden, a Reuters poll showed.

The economists said the government elected in an Oct. 22 general election should prioritize reform of Japan's restrictive labor market and its social security system.Campaigning began on Tuesday in a race that pits Abe's Liberal Democratic Party (LDP) against the fledgling Party of Hope led by Tokyo Governor Yuriko Koike and other smaller parties contesting seats in Japan's more powerful lower house of parliament.Abe promises to press ahead with the 2019 hike in sales tax to 10 percent from 8 percent but wishes to use some of the extra revenue for child care and education, instead of the original plan to repay government debt.Koike's Party of Hope, by contrast, says it would freeze the tax hike to ensure economic recovery."Considering huge public debt, which is at more than twice the size of the economy, balancing fiscal revenue and spending is a pressing issue," said Atsushi Takeda, chief economist at Itochu Economic Research Institute."Financial resources for new policies should be financed by cutting other government spending." Twenty-three of 34 economists said they do not support Abe's plan to reallocate the sales tax revenue, the poll taken between Oct. 3 and 12 showed.And 27 of 35 economists expect the government will increase the tax as planned in 2019. Abe has already postponed planned increases twice. Asked about which economic areas the new government should focus on after the election, 22 economists in the poll selected labor market reform and 21 picked medical and social security reform. Seventeen economists said the government needs to focus on measures to improve productivity, while nine advocated policies to encourage wage growth and a recovery in consumer spending.Fourteen respondents favored child care and education.The question allowed respondents to select three economic themes. "It is important for the government to proceed with structural reforms and encourage companies to allocate their accumulated cash holdings to investment and to improve productivity, which would lead to wage increases," said Harumi Taguchi, principal economist at index compiler IHS Markit.The poll also found economists were unimpressed by Yuriko Koike, who is Tokyo's first female governor and is shaking things up as her new party challenges Abe's ruling bloc in the election.Twenty-nine of 35 economists thought there was a low possibility that Koike could change Japan's politics while six believed she could, the poll found."It is not clear what Ms Koike would do differently from the current government, apart from not pressing ahead with the sales tax hike," said Marcel Thieliant, senior Japan economist at Capital Economics.Analysts kept their view that the Bank of Japan would scale back its ultra-easy stance when it next decides to change monetary policy, but that was only seen likely sometime in the latter half of 2018 or later, the poll showed.BOJ Governor Haruhiko Kuroda this week reiterated the central bank's resolve to continue its massive stimulus program to achieve its 2 percent price target.The poll found that analysts see the core consumer price index (CPI), which includes oil products but excludes volatile fresh food prices, up by only 0.6 percent in the fiscal year to March 2018 and up by 0.8 percent for the next, far below the Bank of Japan's 2 percent target.The economy will grow 1.6 percent in this fiscal year but growth will then slow to 1.1 percent over the next fiscal year, the poll predicted.(This story has been refiled to correct typo in paragraph 19) (Reporting by Kaori Kaneko; Polling by Shaloo Shrivastava and Khushboo Mittal; Editing by William Mallard and Eric Meijer)Economists oppose Japan PM's plan to use sales tax revenue for education: Reuters poll

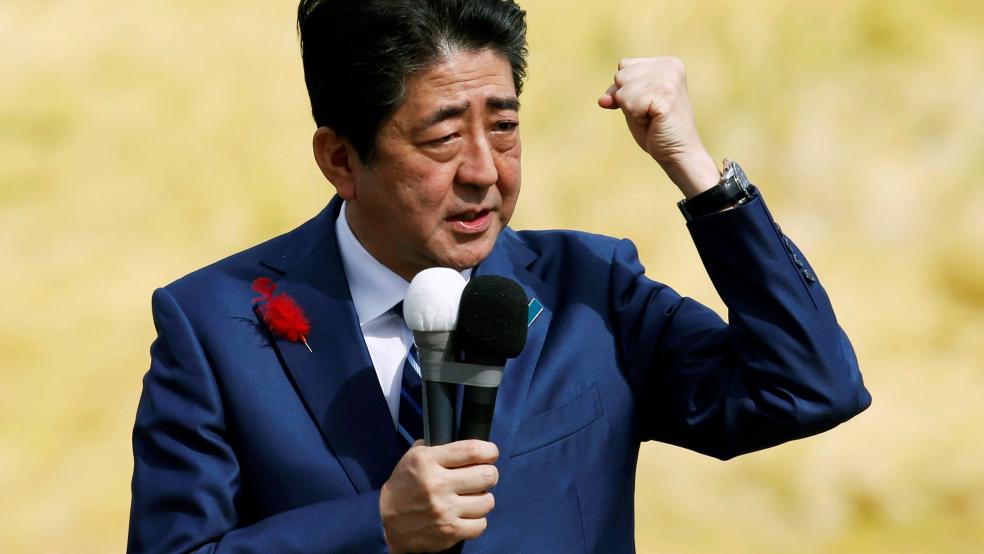

TORU HANAI