'Star Wars' Digital Downloads: Aren't You a Little Expensive for a 40-Year-Old Movie?

The Star Wars movies are available today for digital purchase on services like iTunes, Google Play and Amazon Instant Video for the first time. For $89.99 you can own two and a half good movies, and then hours of other stuff George Lucas also made, now featuring nine additional hours of bonus features.

That purchase price might be palatable to some fans, but seems a lot to charge as a promotional tool ahead of this December's new J.J. Abrams-directed installment in the franchise, now owned by The Walt Disney Company. Especially considering the franchise has already earned something on the order of $27 billion across its various outlets.

But most of that went directly to Lucasfilm, before Disney completed its purchase. Along with its Marvel revenues, Disney should see quite the revenue bump from the sci-fi/fantasy world this year, with The Avengers: Age of Ultron, the sequel to the third-highest grossing movie ever, opening next month, followed by Star Wars: Episode VII in November.

While there are probably some people out there who have no idea what it means to ask "who shot first?", those people are not likely to pay $90 to find out. And for those fans who do know, it seems the new digital versions still have the wrong answer.

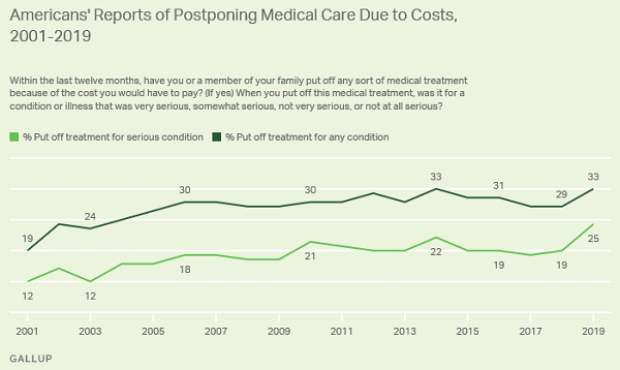

Increasing Number of Americans Delay Medical Care Due to Cost: Gallup

From Gallup: “A record 25% of Americans say they or a family member put off treatment for a serious medical condition in the past year because of the cost, up from 19% a year ago and the highest in Gallup's trend. Another 8% said they or a family member put off treatment for a less serious condition, bringing the total percentage of households delaying care due to costs to 33%, tying the high from 2014.”

Number of the Day: $213 Million

That’s how much the private debt collection program at the IRS collected in the 2019 fiscal year. In the black for the second year in a row, the program cleared nearly $148 million after commissions and administrative costs.

The controversial program, which empowers private firms to go after delinquent taxpayers, began in 2004 and ran for five years before the IRS ended it following a review. It was restarted in 2015 and ran at a loss for the next two years.

Senate Finance Chairman Chuck Grassley (R-IA), who played a central role in establishing the program, said Monday that the net proceeds are currently being used to hire 200 special compliance personnel at the IRS.

US Deficit Up 12% to $342 Billion for First Two Months of Fiscal 2020: CBO

The federal budget deficit for October and November was $342 billion, up $36 billion or 12% from the same period last year, the Congressional Budget Office estimated on Monday. Revenues were up 3% while outlays rose by 6%, CBO said.

Hospitals Sue to Protect Secret Prices

As expected, groups representing hospitals sued the Trump administration Wednesday to stop a new regulation would require them to make public the prices for services they negotiate with insurers. Claiming the rule “is unlawful, several times over,” the industry groups, which include the American Hospital Association, say the rule violates their First Amendment rights, among other issues.

"The burden of compliance with the rule is enormous, and way out of line with any projected benefits associated with the rule," the suit says. In response, a spokesperson for the Department of Health and Human Services said that hospitals “should be ashamed that they aren’t willing to provide American patients the cost of a service before they purchase it.”

See the lawsuit here, or read more at The New York Times.

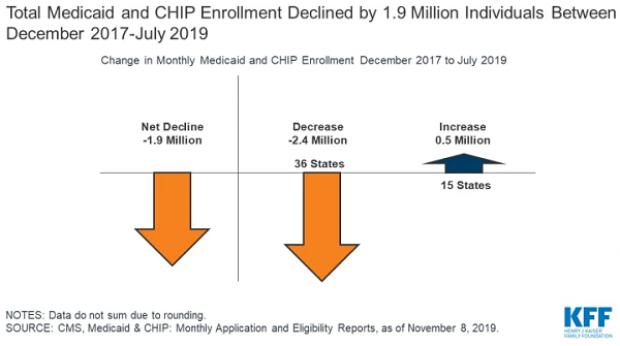

A Decline in Medicaid and CHIP Enrollment

Between December 2017 and July 2019, enrollment in Medicaid and the Children's Health Insurance Program (CHIP) fell by 1.9 million, or 2.6%. The Kaiser Family Foundation provided an analysis of that drop Monday, saying that while some of it was likely caused by enrollees finding jobs that offer private insurance, a significant portion is related to enrollees losing health insurance of any kind. “Experiences in some states suggest that some eligible people may be losing coverage due to barriers maintaining coverage associated with renewal processes and periodic eligibility checks,” Kaiser said.