Medicare Overpaid $251 Million in 18 Months for Drugs

By reimbursing certain drug providers based on outdated pricing, Medicare has squandered millions of dollars that could have been saved if the recommendations of a government watchdog had been followed.

As reported by The Washington Examiner, the Office of the Inspector General for the Health and Human Services Dept. found that Medicare has continued to pay providers of infusion drugs, which are delivered through IV pumps, at higher prices than necessary. HHS is paying providers based on 2003 prices when the drugs were more expensive--this despite warnings from the IG, most recently in February, 2013.

“Medicare payment amounts for infusion drugs…substantially exceeded the estimated acquisition costs,” according to findings reported on the IG’s website.

The IG said that had its recommendations been implemented, $251 million would have been saved over an 18-month period.

The Centers for Medicare & Medicaid Services (CMS) apparently ignored the IG when it proposed that the agency push legislation that would have brought the method of reimbursement for infusion drugs in line with the process for other pharmaceuticals. As an alternative, the IG recommended that the CMS employ competitive bidding to supply infusion drugs.

“CMS partially concurred with the first recommendation, but has not taken steps toward seeking legislation,” The IG’s report said. “CMS concurred with the second recommendation but said subsequently that…infusion drugs will not be included in competitive bidding until at least 2017.”

So presumably the overpaying won’t stop anytime soon.

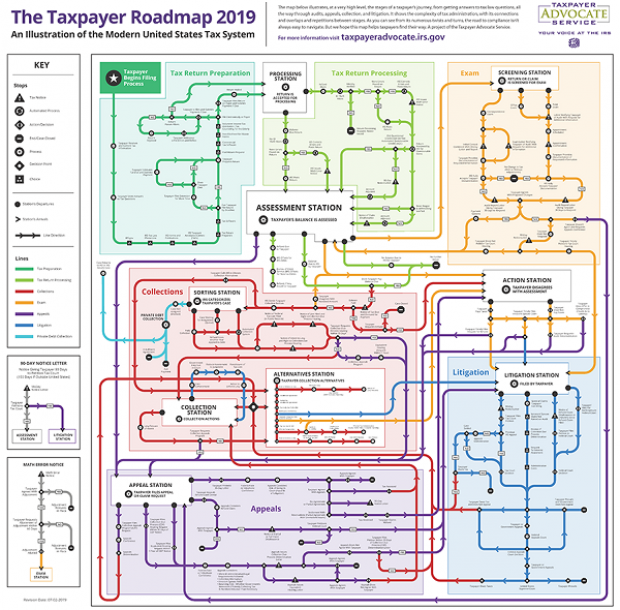

Map of the Day: Navigating the IRS

The Taxpayer Advocate Service – an independent organization within the IRS whose roughly 1,800 employees both assist taxpayers in resolving problems with the tax collection agency and recommend changes aimed at improving the system – released a “subway map” that shows the “the stages of a taxpayer’s journey.” The colorful diagram includes the steps a typical taxpayer takes to prepare and file their tax forms, as well as the many “stations” a tax return can pass through, including processing, audits, appeals and litigation. Not surprisingly, the map is quite complicated. Click here to review a larger version on the taxpayer advocate’s site.

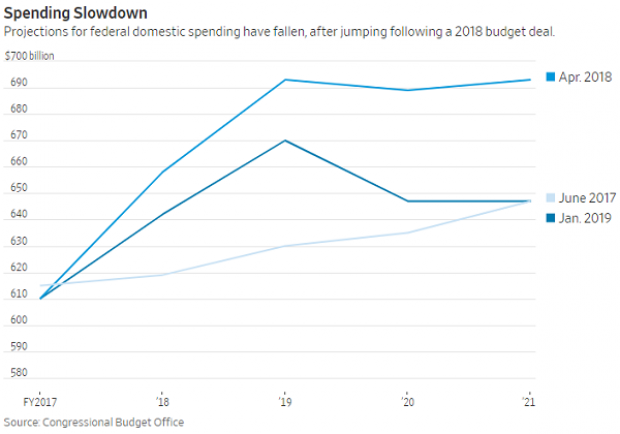

A Surprise Government Spending Slowdown

Economists expected federal spending to boost growth in 2019, but some of the fiscal stimulus provided by the 2018 budget deal has failed to show up this year, according to Kate Davidson of The Wall Street Journal.

Defense spending has come in as expected, but nondefense spending has lagged, and it’s unlikely to catch up to projections even if it accelerates in the coming months. Lower spending on disaster relief, the government shutdown earlier this year, and federal agencies spending less than they have been given by Congress all appear to be playing a role in the spending slowdown, Davidson said.

Number of the Day: $203,500

The Wall Street Journal’s Catherine Lucey reports that acting White House Chief of Staff Mick Mulvaney is making a bit more than his predecessors: “The latest annual report to Congress on White House personnel shows that President Trump’s third chief of staff is getting an annual salary of $203,500, compared with Reince Priebus and John Kelly, each of whom earned $179,700.” The difference is the result of Mulvaney still technically occupying the role of director of the White House Office of Management and Budget, where his salary level is set by law.

The White House told the Journal that if Mulvaney is made permanent chief of staff his salary would be adjusted to the current salary for an assistant to the president, $183,000.

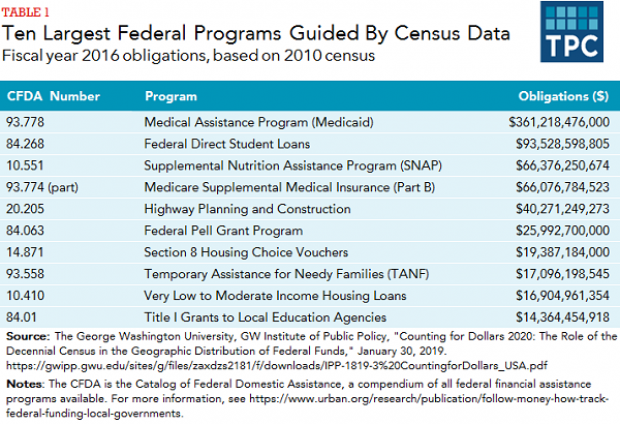

The Census Affects Nearly $1 Trillion in Spending

The 2020 census faces possible delay as the Supreme Court sorts out the legality of a controversial citizenship question added by the Trump administration. Tracy Gordon of the Tax Policy Center notes that in addition to the basic issue of political representation, the decennial population count affects roughly $900 billion in federal spending, ranging from Medicaid assistance funds to Section 8 housing vouchers. Here’s a look at the top 10 programs affected by the census:

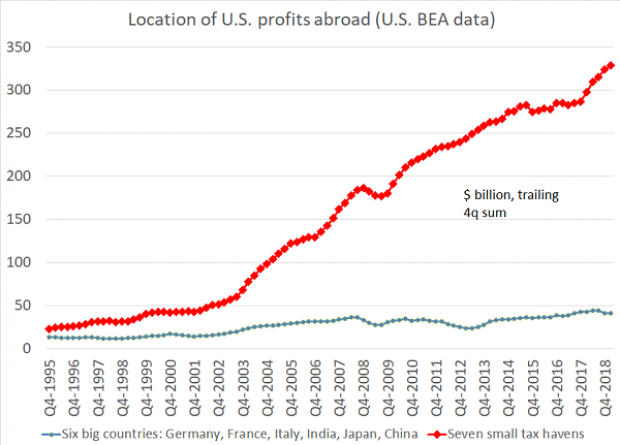

Chart of the Day: Offshore Profits Continue to Rise

Brad Setser, a former U.S. Treasury economist now with the Council on Foreign Relations, added another detail to his assessment of the foreign provisions of the Tax Cuts and Jobs Act: “A bit more evidence that Trump's tax reform didn't change incentives to offshore profits: the enormous profits that U.S. firms report in low tax jurisdictions continues to rise,” Setser wrote. “In fact, there was a bit of a jump up over the course of 2018.”