Craigslist Car Scams Are on the Rise, Especially in Midwest

An insurance group is warning consumers of a widespread scam in which fraudsters are buying cars on Craigslist with bogus checks.

The National Insurance Crime Bureau has identified nearly 100 instances throughout the Midwest of Craigslist car sales in which the buyers used fake bank checks.

“These scams are well organized and have all the appearances of being legitimate,” NCIB President and CEO Joe Wehrle said in a statement. “But in the end, the criminal gets the car and the sellers or their financial institutions are left on the hook for thousands of dollars still owed on the car.”

Related: A New Vicious Scam Targets Desperate Homeowners

The scam appears to be especially prevalent in states where vehicle owners retain the title despite an outstanding lien. NCIB, a nonprofit supported by the insurance industry, advises car sellers never to sign over the title until they have the money for the sale in hand, even if that means waiting a week or more for a check to clear.

Craigslist offers its own list of tips to avoid scams. Remember, the online marketplace offers no guarantees regarding items bought or sold via its site and little recourse if you are the victim of a scam.

The site’s No. 1 tip is to do all transactions in person. A growing number of police stations now offer dedicated space for people meeting in person for transactions they’ve agreed to online.

Those with information about insurance fraud or vehicle theft can anonymously report it by calling 800-835-6422 or texting keyword “fraud” to TIP411.

Deficit Hits $738.6 Billion in First 8 Months of Fiscal Year

The U.S. budget deficit grew to $738.6 billion in the first eight months of the current fiscal year – an increase of $206 billion, or 38.8%, over the deficit recorded during the same period a year earlier. Bloomberg’s Sarah McGregor notes that the big increase occurred despite a jump in tariff revenues, which have nearly doubled to $44.9 billion so far this fiscal year. But that increase, which contributed to an overall increase in revenues of 2.3%, was not enough to make up for the reduced revenues from the Republican tax cuts and a 9.3% increase in government spending.

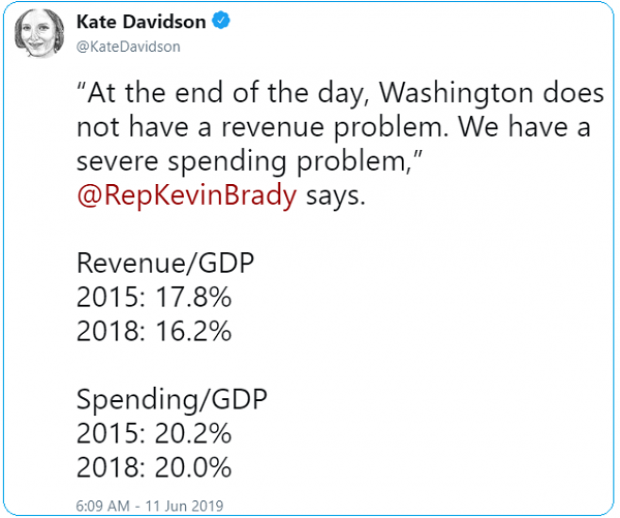

Tweet of the Day: Revenues or Spending?

Rep. Kevin Brady (R-TX), ranking member of the House Ways and Means Committee and one of the authors of the 2017 Republican tax overhaul, told The Washington Post’s Heather Long Tuesday that the budget deficit is driven by excess spending, not a shortfall in revenues in the wake of the tax cuts. The Wall Street Journal’s Kate Davidson provided some inconvenient facts for Brady’s claim in a tweet, pointing out that government revenues as a share of GDP have fallen significantly since 2015, while spending has remained more or less constant.

Chart of the Day: The Decline in IRS Audits

Reviewing the recent annual report on tax statistics from the IRS, Robert Weinberger of the Tax Policy Center says it “tells a story of shrinking staff, fewer audits, and less customer service.” The agency had 22% fewer personnel in 2018 than it did in 2010, and its enforcement budget has fallen by nearly $1 billion, Weinberger writes. One obvious effect of the budget cuts has been a sharp reduction in the number of audits the agency has performed annually, which you can see in the chart below.

Number of the Day: $102 Million

President Trump’s golf playing has cost taxpayers $102 million in extra travel and security expenses, according to an analysis by the left-leaning HuffPost news site.

“The $102 million total to date spent on Trump’s presidential golfing represents 255 times the annual presidential salary he volunteered not to take. It is more than three times the cost of special counsel Robert Mueller’s investigation that Trump continually complains about. It would fund for six years the Special Olympics program that Trump’s proposed budget had originally cut to save money,” HuffPost’s S.V. Date writes.

Date says the White House did not respond to HuffPost’s requests for comment.

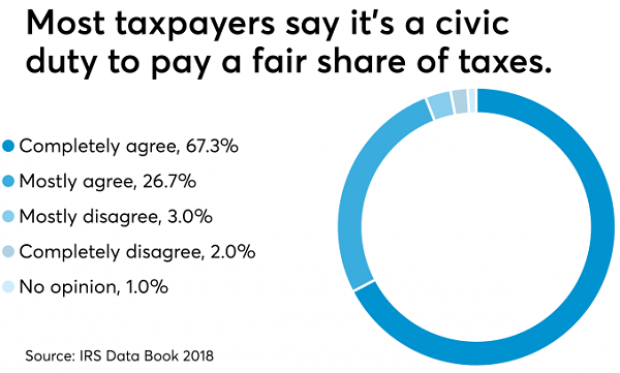

Americans See Tax-Paying as a Duty

The IRS may not be conducting audits like it used to, but according to the agency’s Data Book for 2018, most Americans still believe it’s not acceptable to cheat on your taxes. About 67% of respondents to an IRS opinion survey “completely agree” that it’s a civic duty to pay “a fair share of taxes,” and another 26% “mostly agree,” bringing the total in agreement to over 90%. Accounting Today says that attitude has been pretty consistent over the last decade.