A $180 Million Picasso: What’s Making the Art Market Sizzle

The art market is hotter than a hoisted Rembrandt.

Last night at Christie’s in New York, Picasso’s “Les Femmes d’Alger (Version O)” sold for almost $180 million – the highest price ever paid at auction for a piece of art. There were said to be five bidders, and the winner remains anonymous.

At the same sale, a Giacometti sculpture, “L’homme au doigt,” went for a total of more than $141 million.

On May 5, at the first major auction of the spring selling season, Sotheby’s pulled in $368 million. It was the second-highest sale of Impressionist and modern art in the history of the auction house, according to The New York Times. The top seller was van Gogh’s “L’allée Des Alyscamps,” which fetched $66.3 million.

Related: 6 Traits of an Emerging Millionaire. Are you one?

The haul represented a 67 percent increase over Sotheby’s spring sale a year earlier, according to Bloomberg, which noted that many of the buyers were Asian.

The May 5 auction was only the second-highest because Sotheby’s held a sale last November that took in $422 million.

And tonight at a Sotheby’s auction of contemporary art, a painting entitled “The Ring (Engagement)” by the Pop artist Roy Lichtenstein could sell for as much as $50 million, the Times said.

What’s behind all those staggering numbers?

About a year and a half ago, the columnist Felix Salmon (then at Reuters, now at Fusion) ruminated about whether there was a bubble, which he defined as often driven by FOMO (fear of missing out), or a speculative bubble, one fueled by flippers, in the art market. His conclusion: the art market bubble was definitely not speculative.

“The people spending millions of dollars on trophy art aren’t buying to flip…,” he wrote.

Related: Get Ready for Another Real Estate Bubble

Still, Salmon said he was seeing signs that the market could be turning speculative. But they may have been false signals.

Recently, The Wall Street Journal wrote: “Spurred by the momentum of several successful sale seasons and an influx of newly wealthy global bidders, the major auction houses…say demand for status art is at historic levels and shows no signs of tapering off.”

But why?

In an April 17 article, the global news website Worldcrunch asked Financial Times journalist Georgina Adam, who wrote the 2014 book Big Bucks—The Explosion of the Art Market in the 21st Century, why so much money is rolling around the art market and driving up prices.

“Rich people used to be rich in terms of estate or assets, but not so much in terms of cash, like they are today,” she said.

“This growing billionaire population from developed or developing economies has money to spend and invest,” said the Worldcrunch article by Catherine Cochard. “For many of them, art — in the same way as luxury cars or prêt-à-porter — is an entry pass to a globalized way of life accessible through their wealth.”

That is a development that the keen eyes at the auction houses haven’t missed.

Stat of the Day: 0.2%

The New York Times’ Jim Tankersley tweets: “In order to raise enough revenue to start paying down the debt, Trump would need tariffs to be ~4% of GDP. They're currently 0.2%.”

Read Tankersley’s full breakdown of why tariffs won’t come close to eliminating the deficit or paying down the national debt here.

Number of the Day: 44%

The “short-term” health plans the Trump administration is promoting as low-cost alternatives to Obamacare aren’t bound by the Affordable Care Act’s requirement to spend a substantial majority of their premium revenues on medical care. UnitedHealth is the largest seller of short-term plans, according to Axios, which provided this interesting detail on just how profitable this type of insurance can be: “United’s short-term plans paid out 44% of their premium revenues last year for medical care. ACA plans have to pay out at least 80%.”

Number of the Day: 4,229

The Washington Post’s Fact Checkers on Wednesday updated their database of false and misleading claims made by President Trump: “As of day 558, he’s made 4,229 Trumpian claims — an increase of 978 in just two months.”

The tally, which works out to an average of almost 7.6 false or misleading claims a day, includes 432 problematics statements on trade and 336 claims on taxes. “Eighty-eight times, he has made the false assertion that he passed the biggest tax cut in U.S. history,” the Post says.

Number of the Day: $3 Billion

A new analysis by the Department of Health and Human Services finds that Medicare’s prescription drug program could have saved almost $3 billion in 2016 if pharmacies dispensed generic drugs instead of their brand-name counterparts, Axios reports. “But the savings total is inflated a bit, which HHS admits, because it doesn’t include rebates that brand-name drug makers give to [pharmacy benefit managers] and health plans — and PBMs are known to play games with generic drugs to juice their profits.”

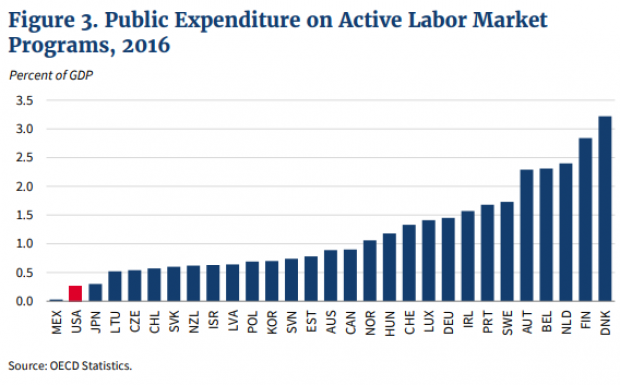

Chart of the Day: Public Spending on Job Programs

President Trump announced on Thursday the creation of a National Council for the American Worker, charged with developing “a national strategy for training and retraining workers for high-demand industries,” his daughter Ivanka wrote in The Wall Street Journal. A report from the president’s National Council on Economic Advisers earlier this week made it clear that the U.S. currently spends less public money on job programs than many other developed countries.