A $180 Million Picasso: What’s Making the Art Market Sizzle

The art market is hotter than a hoisted Rembrandt.

Last night at Christie’s in New York, Picasso’s “Les Femmes d’Alger (Version O)” sold for almost $180 million – the highest price ever paid at auction for a piece of art. There were said to be five bidders, and the winner remains anonymous.

At the same sale, a Giacometti sculpture, “L’homme au doigt,” went for a total of more than $141 million.

On May 5, at the first major auction of the spring selling season, Sotheby’s pulled in $368 million. It was the second-highest sale of Impressionist and modern art in the history of the auction house, according to The New York Times. The top seller was van Gogh’s “L’allée Des Alyscamps,” which fetched $66.3 million.

Related: 6 Traits of an Emerging Millionaire. Are you one?

The haul represented a 67 percent increase over Sotheby’s spring sale a year earlier, according to Bloomberg, which noted that many of the buyers were Asian.

The May 5 auction was only the second-highest because Sotheby’s held a sale last November that took in $422 million.

And tonight at a Sotheby’s auction of contemporary art, a painting entitled “The Ring (Engagement)” by the Pop artist Roy Lichtenstein could sell for as much as $50 million, the Times said.

What’s behind all those staggering numbers?

About a year and a half ago, the columnist Felix Salmon (then at Reuters, now at Fusion) ruminated about whether there was a bubble, which he defined as often driven by FOMO (fear of missing out), or a speculative bubble, one fueled by flippers, in the art market. His conclusion: the art market bubble was definitely not speculative.

“The people spending millions of dollars on trophy art aren’t buying to flip…,” he wrote.

Related: Get Ready for Another Real Estate Bubble

Still, Salmon said he was seeing signs that the market could be turning speculative. But they may have been false signals.

Recently, The Wall Street Journal wrote: “Spurred by the momentum of several successful sale seasons and an influx of newly wealthy global bidders, the major auction houses…say demand for status art is at historic levels and shows no signs of tapering off.”

But why?

In an April 17 article, the global news website Worldcrunch asked Financial Times journalist Georgina Adam, who wrote the 2014 book Big Bucks—The Explosion of the Art Market in the 21st Century, why so much money is rolling around the art market and driving up prices.

“Rich people used to be rich in terms of estate or assets, but not so much in terms of cash, like they are today,” she said.

“This growing billionaire population from developed or developing economies has money to spend and invest,” said the Worldcrunch article by Catherine Cochard. “For many of them, art — in the same way as luxury cars or prêt-à-porter — is an entry pass to a globalized way of life accessible through their wealth.”

That is a development that the keen eyes at the auction houses haven’t missed.

Coming Soon: Deductible Relief Day!

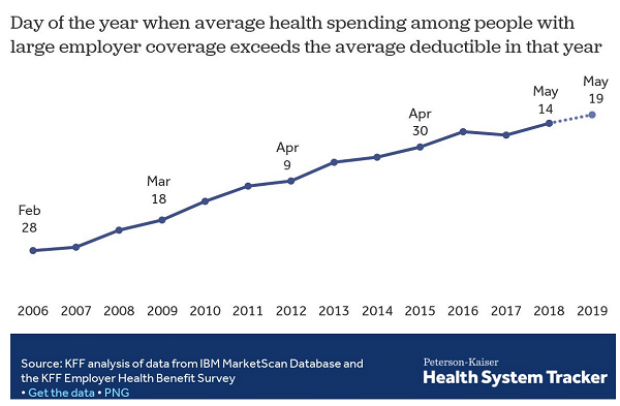

You may be familiar with the concept of Tax Freedom Day – the date on which you have earned enough to pay all of your taxes for the year. Focusing on a different kind of financial burden, analysts at the Kaiser Family Foundation have created Deductible Relief Day – the date on which people in employer-sponsored insurance plans have spent enough on health care to meet the average annual deductible.

Average deductibles have more than tripled over the last decade, forcing people to spend more out of pocket each year. As a result, Deductible Relief Day is “getting later and later in the year,” Kaiser’s Larry Levitt said in a tweet Thursday.

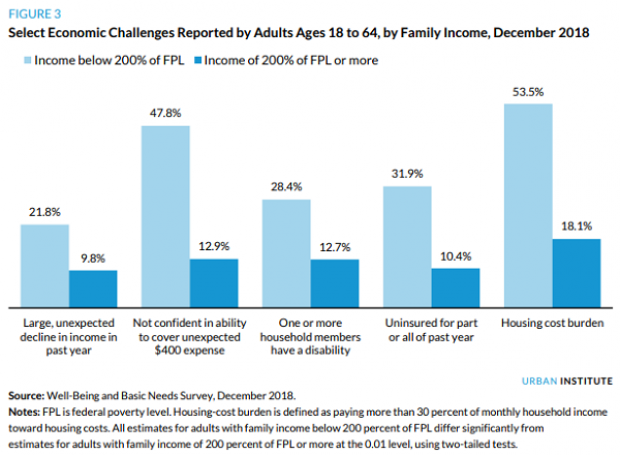

Chart of the Day: Families Still Struggling

Ten years into what will soon be the longest economic expansion in U.S. history, 40% of families say they are still struggling, according to a new report from the Urban Institute. “Nearly 4 in 10 nonelderly adults reported that in 2018, their families experienced material hardship—defined as trouble paying or being unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties for the previous year,” the report says. “Among adults in families with incomes below twice the federal poverty level (FPL), over 60 percent reported at least one type of material hardship in 2018.”

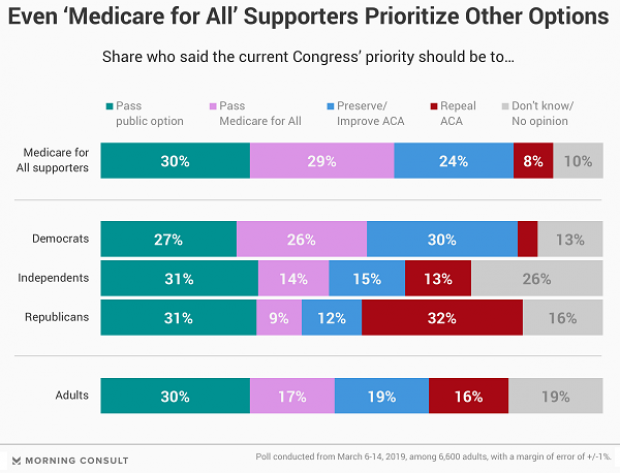

Chart of the Day: Pragmatism on a Public Option

A recent Morning Consult poll 3,073 U.S. adults who say they support Medicare for All shows that they are just as likely to back a public option that would allow Americans to buy into Medicare or Medicaid without eliminating private health insurance. “The data suggests that, in spite of the fervor for expanding health coverage, a majority of Medicare for All supporters, like all Americans, are leaning into their pragmatism in response to the current political climate — one which has left many skeptical that Capitol Hill can jolt into action on an ambitious proposal like Medicare for All quickly enough to wrangle the soaring costs of health care,” Morning Consult said.

Chart of the Day: The Explosive Growth of the EITC

The Earned Income Tax Credit, a refundable tax credit for low- to moderate-income workers, was established in 1975, with nominal claims of about $1.2 billion ($5.6 billion in 2016 dollars) in its first year. According to the Tax Policy Center, by 2016 “the total was $66.7 billion, almost 12 times larger in real terms.”

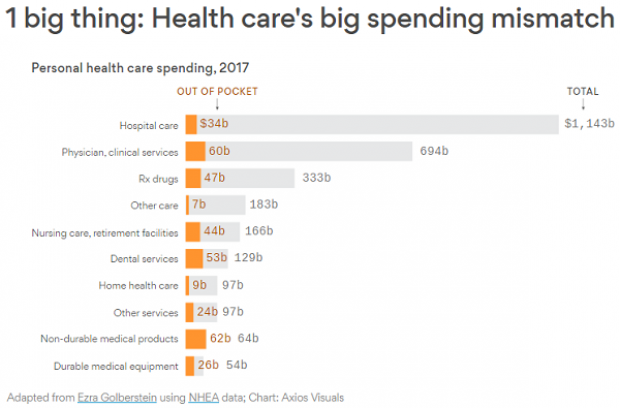

Chart of the Day: The Big Picture on Health Care Costs

“The health care services that rack up the highest out-of-pocket costs for patients aren't the same ones that cost the most to the health care system overall,” says Axios’s Caitlin Owens. That may distort our view of how the system works and how best to fix it. For example, Americans spend more out-of-pocket on dental services ($53 billion) than they do on hospital care ($34 billion), but the latter is a much larger part of national health care spending as a whole.