Wrist Slap for CEO Who Defrauded USAID out of Hundreds of Millions

Former CEO Derish Wolff of Louis Berger Group, one of the country’s largest engineer contracting firms will be confined to his home for a year and have to pay a $4.5 million fine for helping to defraud the federal government out of hundreds of millions of dollars over 20 years. The fine represents a tiny fraction of the amount the company collected from the government.

Wolff, 70, was sentenced by U.S. District Court Judge Anne Thompson for leading a “conspiracy to defraud USAID by billing the agency on so-called ‘cost-reimbursable’ contracts—including hundreds of millions of dollars of contracts for reconstructive work in Iraq and Afghanistan” and for inflating overhead costs.

Related: U.S. Blew $500k on Melting Afghan Buildings

Federal prosecutors said the company, tasked with building roads and bridges in Afghanistan and Iraq, charged the government 140 percent of the actual cost for every project it did. That means that for every one dollar of work the contractor did, it received $1.40 extra. Louis Berger was paid more than $2 billon by the U.S. government for its infrastructure work in war zones.

Prosecutors said that between 1990 and 2009, Wolff and his colleagues inflated the costs of their work for USAID by telling accountants to “pad time sheets with hours ostensibly devoted to federal government projects when it had not actually worked on such projects.”

Related: Pentagon Won’t Verify $300 Million a Year in Afghanistan is Spent Properly

Beyond logging false work hours, the prosecutor said Wolff routinely instructed his subordinates to bill USAID for all of their overhead expenses—like rent at Louis Berger’s Washington office even though the D.C. office worked on other projects that had nothing to do with the federal government.

After two other company executives pleaded guilty to conspiring to defraud the federal government in 2010, Louis Berger Group agreed to make full restitution to USAID. It settled civil and criminal charges and had to pay $18.7 million in criminal fines and an additional $50.6 million to resolve allegations that it violated the False Claims Act by significantly overbilling USAID.

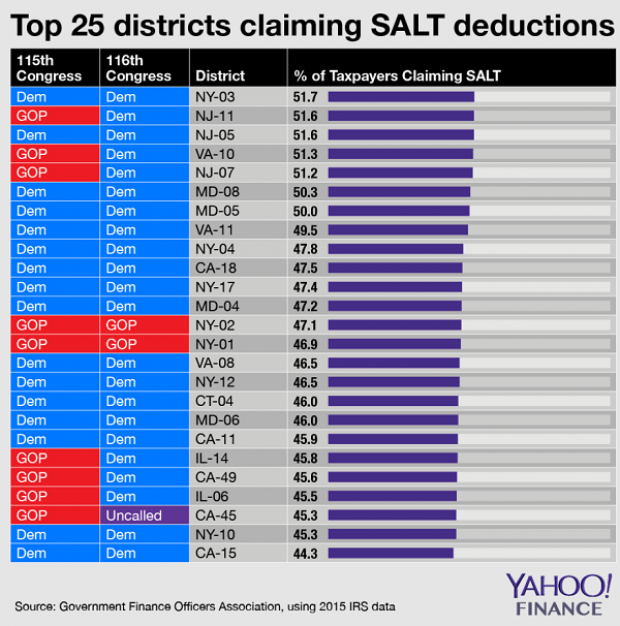

Chart of the Day: SALT in the GOP’s Wounds

The stark and growing divide between urban/suburban and rural districts was one big story in this year’s election results, with Democrats gaining seats in the House as a result of their success in suburban areas. The GOP tax law may have helped drive that trend, Yahoo Finance’s Brian Cheung notes.

The new tax law capped the amount of state and local tax deductions Americans can claim in their federal filings at $10,000. Congressional seats for nine of the top 25 districts where residents claim those SALT deductions were held by Republicans heading into Election Day. Six of the nine flipped to the Democrats in last week’s midterms.

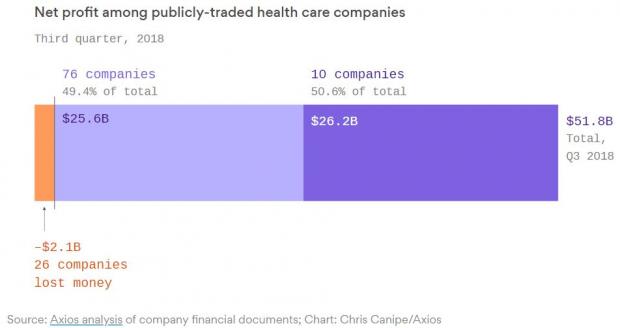

Chart of the Day: Big Pharma's Big Profits

Ten companies, including nine pharmaceutical giants, accounted for half of the health care industry's $50 billion in worldwide profits in the third quarter of 2018, according to an analysis by Axios’s Bob Herman. Drug companies generated 23 percent of the industry’s $636 billion in revenue — and 63 percent of the total profits. “Americans spend a lot more money on hospital and physician care than prescription drugs, but pharmaceutical companies pocket a lot more than other parts of the industry,” Herman writes.

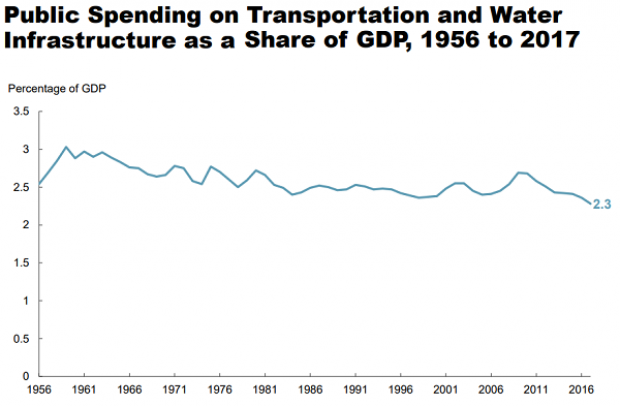

Chart of the Day: Infrastructure Spending Over 60 Years

Federal, state and local governments spent about $441 billion on infrastructure in 2017, with the money going toward highways, mass transit and rail, aviation, water transportation, water resources and water utilities. Measured as a percentage of GDP, total spending is a bit lower than it was 50 years ago. For more details, see this new report from the Congressional Budget Office.

Number of the Day: $3.3 Billion

The GOP tax cuts have provided a significant earnings boost for the big U.S. banks so far this year. Changes in the tax code “saved the nation’s six biggest banks $3.3 billion in the third quarter alone,” according to a Bloomberg report Thursday. The data is drawn from earnings reports from Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo.

Clarifying the Drop in Obamacare Premiums

We told you Thursday about the Trump administration’s announcement that average premiums for benchmark Obamacare plans will fall 1.5 percent next year, but analyst Charles Gaba says the story is a bit more complicated. According to Gaba’s calculations, average premiums for all individual health plans will rise next year by 3.1 percent.

The difference between the two figures is produced by two very different datasets. The Trump administration included only the second-lowest-cost Silver plans in 39 states in its analysis, while Gaba examined all individual plans sold in all 50 states.