Where the Gold Is: 40 Nations with Highest Holdings

The World Gold Council is out with its latest report on gold demand.

In the first quarter, demand dropped by 11 tonnes, or 1%, year-over-year.

"Top-line demand was broadly neutral — down just 11t (1%) despite substantial underlying differences across geographies and sectors," the report said.

Related: Putin Is Hoarding Gold and Rattling Sabers--What’s He Up to Now?

"Pockets of strength in jewelry were balanced by weakness elsewhere as demand responded to local conditions in each market. Higher volumes in India, the US, and the smaller Southeast Asian markets were set against declines in China, Turkey, Russia, and the Middle East."

On Thursday, gold continued its rally after breaking above the key $1,200 level on Wednesday.

Gold rose to as high as $1,223 an ounce, its highest level in three months.

And so with gold demand broadly neutral, this chart shows which countries are holding the most gold:

This article originally appeared on Business Insider.

Read more from Business Insider:

Here is the most popular baby name in every state

More than 80% of Americans say they couldn't afford college

The Saudi's just went nuclear on their Obama snub

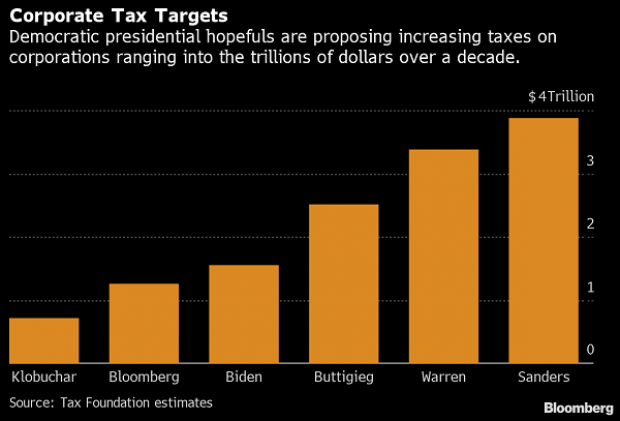

Chart of the Day: Boosting Corporate Tax Revenues

The leading candidates for the Democratic presidential nomination have all proposed increasing taxes on corporations, including raising income tax rates to levels ranging from 25% to 35%, up from the current 21% imposed by the Republican tax cuts in 2017. With Bernie Sanders leading the way at $3.9 trillion, here’s how much revenue the higher proposed corporate taxes, along with additional proposed surtaxes and reduced tax breaks, would generate over a decade, according to calculations by the right-leaning Tax Foundation, highlighted Wednesday by Bloomberg News.

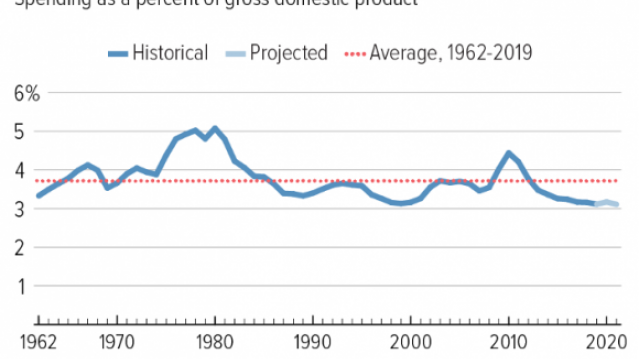

Chart of the Day: Discretionary Spending Droops

The federal government’s total non-defense discretionary spending – which covers everything from education and national parks to veterans’ medical care and low-income housing assistance – equals 3.2% of GDP in 2020, near historic lows going back to 1962, according to an analysis this week from the Center on Budget and Policy Priorities.

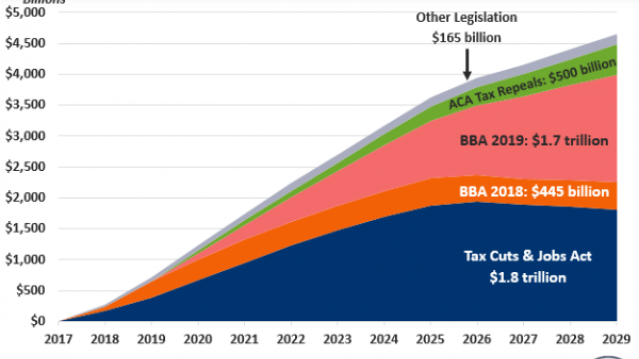

Chart of the Week: Trump Adds $4.7 Trillion in Debt

The Committee for a Responsible Federal Budget estimated this week that President Trump has now signed legislation that will add a total of $4.7 trillion to the national debt between 2017 and 2029. Tax cuts and spending increases account for similar portions of the projected increase, though if the individual tax cuts in the 2017 Republican overhaul are extended beyond their current expiration date at the end of 2025, they would add another $1 trillion in debt through 2029.

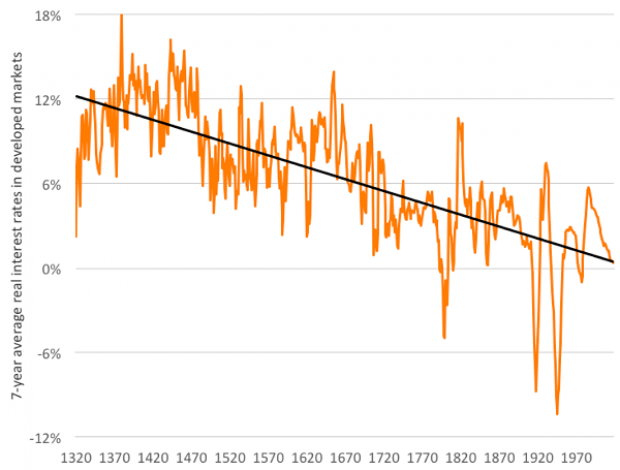

Chart of the Day: The Long Decline in Interest Rates

Are interest rates destined to move higher, increasing the cost of private and public debt? While many experts believe that higher rates are all but inevitable, historian Paul Schmelzing argues that today’s low-interest environment is consistent with a long-term trend stretching back 600 years.

The chart “shows a clear historical downtrend, with rates falling about 1% every 60 years to near zero today,” says Bloomberg’s Aaron Brown. “Rates do tend to revert to a mean, but that mean seems to be declining.”

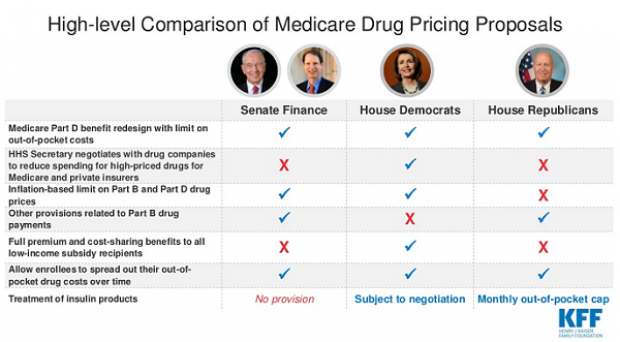

Chart of the Day: Drug Price Plans Compared

Lawmakers are considering three separate bills that are intended to reduce the cost of prescription drugs. Here’s an overview of the proposals, from a series of charts produced by the Kaiser Family Foundation this week. An interesting detail highlighted in another chart: 88% of voters – including 92% of Democrats and 85% of Republicans – want to give the government the power to negotiate prices with drug companies.