This Man Just Lost $15 Billion in a Half Hour

In the history of sudden wealth loss, Li Hejun may have set a new record.

Li, who was China's richest man until this week, saw his fortune drop by as much as $15 billion in a half-hour as the stock in his company, Hanergy Thin Film Power Group, fell by nearly half. Trading in the shares was halted Wednesday and Li didn't attend the company's annual meeting.

While plenty of billionaires have seen their fortunes cut in half over time, few if any have seen $15 billion wiped out in a half-hour. Li's total fortune was around $30 billion before the stock plunged.

Prior to the drop, the company's shares had risen by more than fivefold since September, baffling analysts. Reuters reports that Hong Kong regulators are looking at alleged market manipulation with the stock.

Related: America’s Highest Paid CEO: It’s Not Who You Think

In a similar wealth decline, Hong Kong property and electronics magnate Pan Sutong has lost more than $11 billion this week as shares of two listed companies, Goldin Financial and Goldin Property, both closed down more than 40 percent.

Pan owns around 65 percent of Goldin Property and more than 70 percent of Goldin Financial, according to filings. His fortune was listed at more than $28 billion, making him Hong Kong's second-richest man.

That means that the two men have lost more in one day that the total net worth of Carl Icahn, Steve Ballmer or Michael Dell.

Pan is known for his large lifestyle. He's a big polo supporter and has sponsored a polo event in Britain attended by Princes William and Harry. He's said that the sport "is a way of life and belief in a sense of nobility."

Pan also owns vineyards around the world, including three in France and one in California's Napa Valley, called the Sloan Estate, which he purchased in 2011 for around $40 million.

This article originally appeared on CNBC

Read more from CNBC:

Playboy keeps it's clothes on

Kickstarter darling Pebble may be in a rough patch

McDonald's CEO: Ronald is here to stay

Number of the Day: $132,900

The cap on Social Security payroll taxes will rise to $132,900 next year, an increase of 3.5 percent. (Earnings up to that level are subject to the Social Security tax.) The increase will affect about 11.6 million workers, Politico reports. Beneficiaries are also getting a boost, with a 2.8 percent cost-of-living increase coming in 2019.

Photo of the Day: Kanye West at the White House

This is 2018: Kanye West visited President Trump at the White House Thursday and made a rambling 10-minute statement that aired on TV news networks. West’s lunch with the president was supposed to focus on clemency, crime in his hometown of Chicago and economic investment in urban areas, but his Oval Office rant veered into the bizarre. And since this is the world we live in, we’ll also point out that West apparently became “the first person to ever publicly say 'mother-f***er' in the Oval Office.”

Trump called Kanye’s monologue “pretty impressive.”

“That was bonkers,” MSNBC’s Ali Velshi said afterward.

Again, this is 2018.

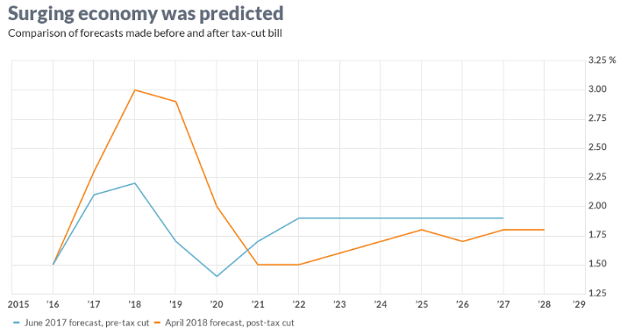

Chart of the Day: GDP Growth Before and After the Tax Bill

President Trump and the rest of the GOP are celebrating the recent burst in economic growth in the wake of the tax cuts, with the president claiming that it’s unprecedented and defies what the experts were predicting just a year ago. But Rex Nutting of MarketWatch points out that elevated growth rates over a few quarters have been seen plenty of times in recent years, and the extra growth generated by the Republican tax cuts was predicted by most economists, including those at the Congressional Budget Office, whose revised projections are shown below.

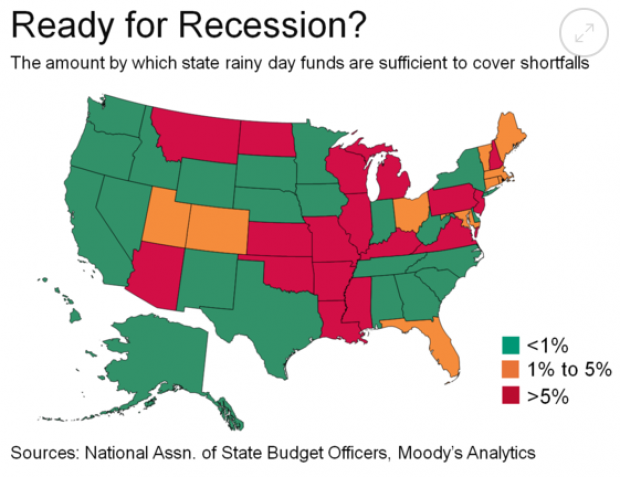

Are States Ready for the Next Downturn?

The Great Recession hit state budgets hard, but nearly half are now prepared to weather the next modest downturn. Moody’s Analytics says that 23 states have enough reserves to meet budget shortfalls in a moderate economic contraction, up from just 16 last year, Bloomberg reports. Another 10 states are close. The map below shows which states are within 1 percent of their funding needs for their rainy day funds (in green) and which states are falling short.

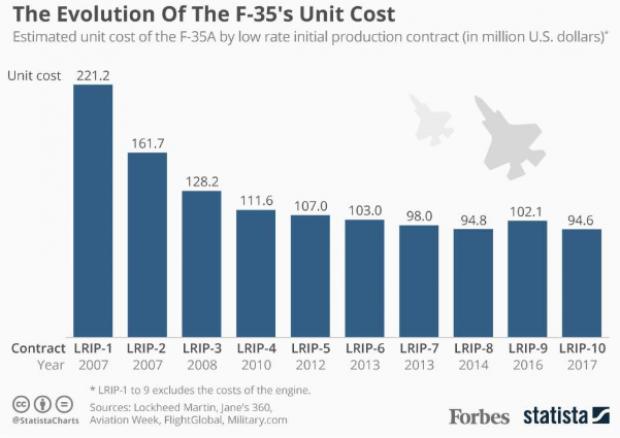

Chart of the Day: Evolving Price of the F-35

The 2019 National Defense Authorization Act signed in August included 77 F-35 Lightning II jets for the Defense Department, but Congress decided to bump up that number in the defense spending bill finalized this week, for a total of 93 in the next fiscal year – 16 more than requested by the Pentagon. Here’s a look from Forbes at the evolving per unit cost of the stealth jet, which is expected to eventually fall to roughly $80 million when full-rate production begins in the next few years.