This Man Just Lost $15 Billion in a Half Hour

In the history of sudden wealth loss, Li Hejun may have set a new record.

Li, who was China's richest man until this week, saw his fortune drop by as much as $15 billion in a half-hour as the stock in his company, Hanergy Thin Film Power Group, fell by nearly half. Trading in the shares was halted Wednesday and Li didn't attend the company's annual meeting.

While plenty of billionaires have seen their fortunes cut in half over time, few if any have seen $15 billion wiped out in a half-hour. Li's total fortune was around $30 billion before the stock plunged.

Prior to the drop, the company's shares had risen by more than fivefold since September, baffling analysts. Reuters reports that Hong Kong regulators are looking at alleged market manipulation with the stock.

Related: America’s Highest Paid CEO: It’s Not Who You Think

In a similar wealth decline, Hong Kong property and electronics magnate Pan Sutong has lost more than $11 billion this week as shares of two listed companies, Goldin Financial and Goldin Property, both closed down more than 40 percent.

Pan owns around 65 percent of Goldin Property and more than 70 percent of Goldin Financial, according to filings. His fortune was listed at more than $28 billion, making him Hong Kong's second-richest man.

That means that the two men have lost more in one day that the total net worth of Carl Icahn, Steve Ballmer or Michael Dell.

Pan is known for his large lifestyle. He's a big polo supporter and has sponsored a polo event in Britain attended by Princes William and Harry. He's said that the sport "is a way of life and belief in a sense of nobility."

Pan also owns vineyards around the world, including three in France and one in California's Napa Valley, called the Sloan Estate, which he purchased in 2011 for around $40 million.

This article originally appeared on CNBC

Read more from CNBC:

Playboy keeps it's clothes on

Kickstarter darling Pebble may be in a rough patch

McDonald's CEO: Ronald is here to stay

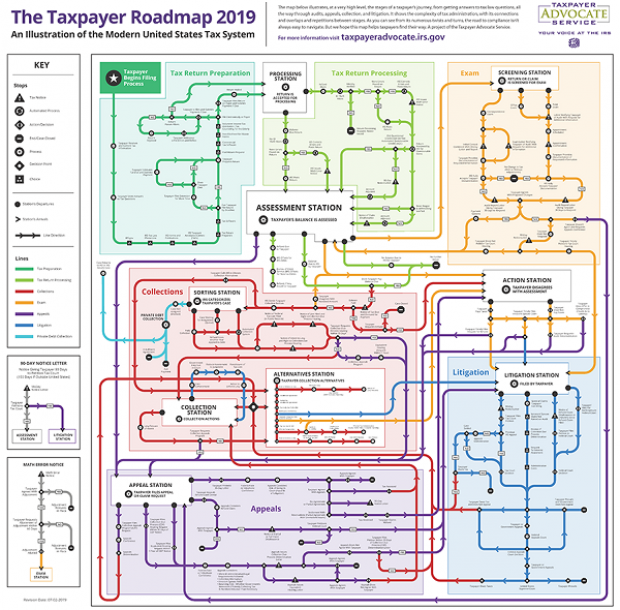

Map of the Day: Navigating the IRS

The Taxpayer Advocate Service – an independent organization within the IRS whose roughly 1,800 employees both assist taxpayers in resolving problems with the tax collection agency and recommend changes aimed at improving the system – released a “subway map” that shows the “the stages of a taxpayer’s journey.” The colorful diagram includes the steps a typical taxpayer takes to prepare and file their tax forms, as well as the many “stations” a tax return can pass through, including processing, audits, appeals and litigation. Not surprisingly, the map is quite complicated. Click here to review a larger version on the taxpayer advocate’s site.

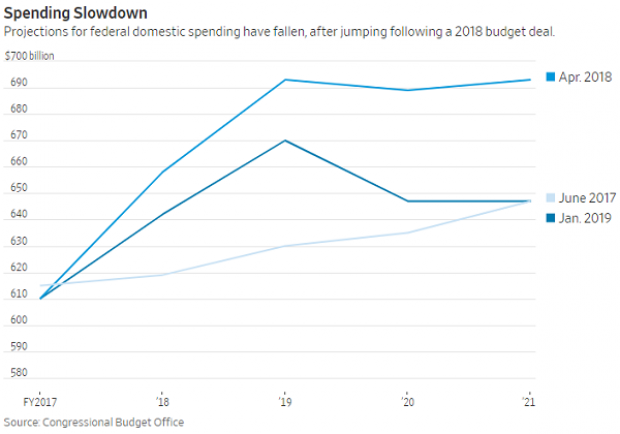

A Surprise Government Spending Slowdown

Economists expected federal spending to boost growth in 2019, but some of the fiscal stimulus provided by the 2018 budget deal has failed to show up this year, according to Kate Davidson of The Wall Street Journal.

Defense spending has come in as expected, but nondefense spending has lagged, and it’s unlikely to catch up to projections even if it accelerates in the coming months. Lower spending on disaster relief, the government shutdown earlier this year, and federal agencies spending less than they have been given by Congress all appear to be playing a role in the spending slowdown, Davidson said.

Number of the Day: $203,500

The Wall Street Journal’s Catherine Lucey reports that acting White House Chief of Staff Mick Mulvaney is making a bit more than his predecessors: “The latest annual report to Congress on White House personnel shows that President Trump’s third chief of staff is getting an annual salary of $203,500, compared with Reince Priebus and John Kelly, each of whom earned $179,700.” The difference is the result of Mulvaney still technically occupying the role of director of the White House Office of Management and Budget, where his salary level is set by law.

The White House told the Journal that if Mulvaney is made permanent chief of staff his salary would be adjusted to the current salary for an assistant to the president, $183,000.

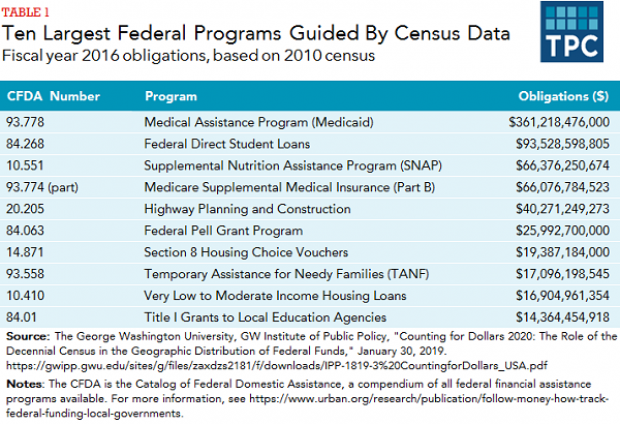

The Census Affects Nearly $1 Trillion in Spending

The 2020 census faces possible delay as the Supreme Court sorts out the legality of a controversial citizenship question added by the Trump administration. Tracy Gordon of the Tax Policy Center notes that in addition to the basic issue of political representation, the decennial population count affects roughly $900 billion in federal spending, ranging from Medicaid assistance funds to Section 8 housing vouchers. Here’s a look at the top 10 programs affected by the census:

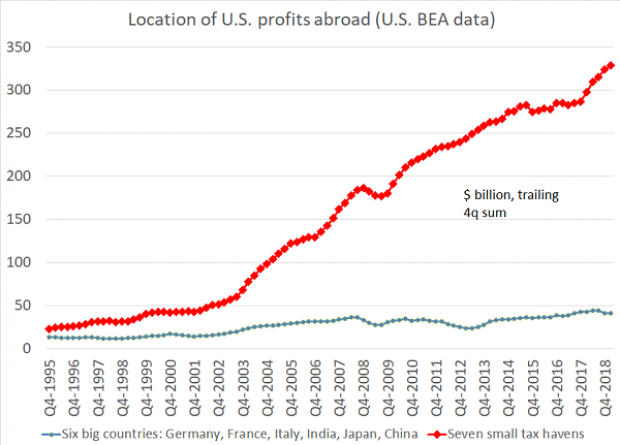

Chart of the Day: Offshore Profits Continue to Rise

Brad Setser, a former U.S. Treasury economist now with the Council on Foreign Relations, added another detail to his assessment of the foreign provisions of the Tax Cuts and Jobs Act: “A bit more evidence that Trump's tax reform didn't change incentives to offshore profits: the enormous profits that U.S. firms report in low tax jurisdictions continues to rise,” Setser wrote. “In fact, there was a bit of a jump up over the course of 2018.”