Billionaires: 10 Intriguing New Facts About Who’s Getting Rich Now

A new Chinese billionaire was created almost every week in the first quarter of 2015, according to a just-released report by UBS and PwC.

"Asia's billionaires make up 36 percent of self-made billionaire wealth, overtaking Europe for the first time and second only to the U.S.," said Antoinette Hoon, private banking advisory services partner for PwC in Hong Kong. “Looking forward, we expect the region to be the center of new billionaire wealth creation.”

Related: 6 Traits of an Emerging Millionaire: Are You One?

The report, which looked at data for 1,300 billionaires over 19 years, found – unsurprisingly -- that entrepreneurship is a powerful force for wealth creation. “Billionaires: Master architects of great wealth and lasting legacies" also noted that many billionaires are embracing philanthropy to build a legacy.

Here are 10 other findings of the report:

- 917 self-made billionaires generated more than $3.6 trillion of global wealth between 1995 and 2014.

- Of them, 23 percent launched their first business before age 30; 68 percent before turning 40.

- The second-highest number of self-made American billionaires (27.3 percent) in the last two decades came out of the tech sector.

- Finance produced 30 percent of U.S. billionaires, but they aren’t as rich as their counterparts in tech; their average net worth is $4.5 billion, compared with $7.8 billion for tech moneybags.

- In Europe and Asia, self-made billionaires mostly made their money in the consumer industry. Their wealth averages $5.7 billion. Tech entrepreneurs in Europe and Asia were the second-richest group with an average worth of $3.8 billion.

- More than two-thirds of global billionaires are over 60 years old and have more than one child.

- The average age of Asia billionaires is 57, 10 years younger than in the U.S. and Europe.

- About one fourth of Asian billionaires had impoverished childhoods, compared with 8 percent in the U.S. and 6 percent in Europe.

- 60 percent of self-made billionaires in the U.S. and Europe retain their businesses, 30 percent dispose of part of their business via an IPO or trade sale, with 10 percent selling outright.

- In Europe and Asia, billionaires are most likely to create a business dynasty, with 57 percent of European and 56 percent of Asian billionaire families, respectively, taking over the family business when the founder retires. In the U.S., just 36 percent of businesses remain family-run once the founder retires.

The High Cost of Child Poverty

Childhood poverty cost $1.03 trillion in 2015, including the loss of economic productivity, increased spending on health care and increased crime rates, according to a recent study in the journal Social Work Research. That annual cost represents about 5.4 percent of U.S. GDP. “It is estimated that for every dollar spent on reducing childhood poverty, the country would save at least $7 with respect to the economic costs of poverty,” says Mark R. Rank, a co-author of the study and professor of social welfare at Washington University in St. Louis. (Futurity)

Do You Know What Your Tax Rate Is?

Complaining about taxes is a favorite American pastime, and the grumbling might reach its annual peak right about now, as tax day approaches. But new research from Michigan State University highlighted by the Money magazine website finds that Americans — or at least Michiganders — dramatically overstate their average tax rate.

In a survey of 978 adults in the Wolverine State, almost 220 people said they didn’t know what percentage of their income went to federal taxes. Of the people who did provide an answer, almost 85 percent overstated their actual rate, sometimes by a large margin. On average, those taxpayers said they pay 25.5 percent of their income in federal taxes. But the study’s authors estimated that their actual average tax rate was just under 14 percent.

The large number of people who didn’t want to venture a guess as to their tax rate and the even larger number who were wildly off both suggest to the researchers “that a very substantial portion of the population is uninformed or misinformed about average federal income-tax rates.”

Why don’t we know what we’re paying?

Part of the answer may be that our tax system is complicated and many of us rely on professionals or specialized software to prepare our filings. Money’s Ian Salisbury notes that taxpayers in the survey who relied on that kind of help tended to be further off in their estimates, after controlling for other factors.

Also, many people likely don’t understand the different types of taxes they pay. While the survey asked specifically about federal taxes, the tax rates people provided more closely matched their total tax rate, including federal, state, local and payroll taxes.

But our politics likely play a role here as well. People who believe that taxes on households like theirs should be lower and those who believe tax dollars are spent ineffectively tended to overstate their tax rates more.

“Since the time of Ronald Reagan, American[s] have been inundated with messages about how high taxes are,” one of the study’s authors told Salisbury. “The notion they are too high has become deeply ingrained.”

Wealthy Investors Are Worried About Washington, and the Debt

A new survey by the Spectrem Group, a market research firm, finds that almost 80 percent of investors with net worth between $100,000 and $25 million (not including their home) say that the U.S. political environment is their biggest concern, followed by government gridlock (76 percent) and the national debt (75 percent).

Trump’s Push to Reverse Parts of $1.3 Trillion Spending Bill May Be DOA

At least two key Republican senators are unlikely to support an effort to roll back parts of the $1.3. trillion spending bill passed by Congress last month, The Washington Post’s Mike DeBonis reported Monday evening. While aides to President Trump are working with House Majority Leader Kevin McCarthy (R-CA) on a package of spending cuts, Sens. Susan Collins (R-ME) and Lisa Murkowski (R-AK) expressed opposition to the idea, meaning a rescission bill might not be able to get a simple majority vote in the Senate. And Roll Call reports that other Republican senators have expressed significant skepticism, too. “It’s going nowhere,” Sen. Lindsey Graham said.

Goldman Sees Profit in the Tax Cuts

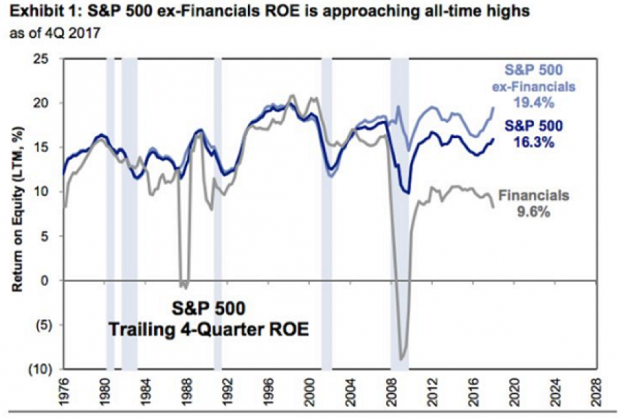

David Kostin, chief U.S. equity strategist at Goldman Sachs, said in a note to clients Friday cited by CNBC that companies in the S&P 500 can expect to see a boost in return on equity (ROE) thanks to the tax cuts. Return on equity should hit the highest level since 2007, Kostin said, providing a strong tailwind for stock prices even as uncertainty grows about possible conflicts over trade.

Return on equity, defined as the amount of net income returned as a percentage of shareholders’ equity, rose to 16.3 percent in 2016, and Kostin is forecasting an increase to 17.6 percent in 2018. "The reduction in the corporate tax rate alone will boost ROE by roughly 70 [basis points], outweighing margin pressures from rising labor, commodity, and borrow costs," Kostin wrote.