Cyber Thieves Hit the IRS—and 100,000 Taxpayers

Identity thieves hacked into an Internal Revenue Service data system earlier this year, potentially gaining access to personal financial information for at least 100,000 taxpayers.

The IRS issued a statement today saying that its online system, “Get Transcript,” was breached between February and May, the Associated Press first reported. The portal possesses information including tax returns and other taxpayer data stored by the IRS.

Related: Tax Thieves Could Boost Their Income by 262 Percent

The IRS’s statement said the tax thieves were able to penetrate the system because they had knowledge of 100,000 taxpayers, including dates of birth, Social Security numbers and tax filing details.

The massive hack comes as identity theft is at a record high. Earlier this year, the Treasury Inspector General for Tax Administration (TIGTA) reported that 1.6 million taxpayers were affected by identity theft in 2014 – compared to just 271,000 in 2010.

The IRS’s ability to catch fraudsters was even added to the GAO’s “High Risk List” or the list of federal programs that are most-vulnerable to waste, fraud and abuse.

Auditors attribute the increase to the uptick in electronic filing, which is more convenient for tax filers, but also easier for fraudsters to file fake returns.

TIGTA says the IRS doled out more than $5.8 billion in fraudulent refunds related to identity theft during the 2013 filing season.

The shift to electronic filing is also apparently making taxpayer information even more vulnerable according to the latest breach.

Related: IRS Struggles to Help Victims of Identity Fraud

The hack is obviously bad news for the agency, which is already struggling to address cases of identity theft as they stack up. TIGTA reported the IRS took about 278 days on average to resolve identity theft cases in 2013, despite the agency claiming that it takes about 180 days or six months to resolve issues of identity theft.

When it does complete cases, the IG found that about 10 percent of the “resolved” were riddled with errors.

The latest report comes at a tough time for the IRS, which is struggling with a recent round of budget cuts and is operating with an even greater workload while enforcing at least 40 new tax provisions under the president’s health care law.

The agency said it has temporarily suspended the online service that was the subject of the breach until the vulnerabilities are resolved.

Top Reads from The Fiscal Times:

- Mike Huckabee and His Tax Plan Get Slammed on Fox

- Putin Isn’t Reviving the USSR, He’s Creating a Fascist State

- States Band Together To Keep Obamacare Afloat

Stat of the Day: 0.2%

The New York Times’ Jim Tankersley tweets: “In order to raise enough revenue to start paying down the debt, Trump would need tariffs to be ~4% of GDP. They're currently 0.2%.”

Read Tankersley’s full breakdown of why tariffs won’t come close to eliminating the deficit or paying down the national debt here.

Number of the Day: 44%

The “short-term” health plans the Trump administration is promoting as low-cost alternatives to Obamacare aren’t bound by the Affordable Care Act’s requirement to spend a substantial majority of their premium revenues on medical care. UnitedHealth is the largest seller of short-term plans, according to Axios, which provided this interesting detail on just how profitable this type of insurance can be: “United’s short-term plans paid out 44% of their premium revenues last year for medical care. ACA plans have to pay out at least 80%.”

Number of the Day: 4,229

The Washington Post’s Fact Checkers on Wednesday updated their database of false and misleading claims made by President Trump: “As of day 558, he’s made 4,229 Trumpian claims — an increase of 978 in just two months.”

The tally, which works out to an average of almost 7.6 false or misleading claims a day, includes 432 problematics statements on trade and 336 claims on taxes. “Eighty-eight times, he has made the false assertion that he passed the biggest tax cut in U.S. history,” the Post says.

Number of the Day: $3 Billion

A new analysis by the Department of Health and Human Services finds that Medicare’s prescription drug program could have saved almost $3 billion in 2016 if pharmacies dispensed generic drugs instead of their brand-name counterparts, Axios reports. “But the savings total is inflated a bit, which HHS admits, because it doesn’t include rebates that brand-name drug makers give to [pharmacy benefit managers] and health plans — and PBMs are known to play games with generic drugs to juice their profits.”

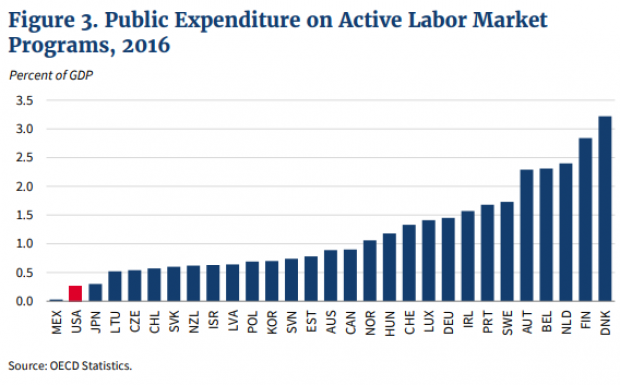

Chart of the Day: Public Spending on Job Programs

President Trump announced on Thursday the creation of a National Council for the American Worker, charged with developing “a national strategy for training and retraining workers for high-demand industries,” his daughter Ivanka wrote in The Wall Street Journal. A report from the president’s National Council on Economic Advisers earlier this week made it clear that the U.S. currently spends less public money on job programs than many other developed countries.