Cyber Thieves Hit the IRS—and 100,000 Taxpayers

Identity thieves hacked into an Internal Revenue Service data system earlier this year, potentially gaining access to personal financial information for at least 100,000 taxpayers.

The IRS issued a statement today saying that its online system, “Get Transcript,” was breached between February and May, the Associated Press first reported. The portal possesses information including tax returns and other taxpayer data stored by the IRS.

Related: Tax Thieves Could Boost Their Income by 262 Percent

The IRS’s statement said the tax thieves were able to penetrate the system because they had knowledge of 100,000 taxpayers, including dates of birth, Social Security numbers and tax filing details.

The massive hack comes as identity theft is at a record high. Earlier this year, the Treasury Inspector General for Tax Administration (TIGTA) reported that 1.6 million taxpayers were affected by identity theft in 2014 – compared to just 271,000 in 2010.

The IRS’s ability to catch fraudsters was even added to the GAO’s “High Risk List” or the list of federal programs that are most-vulnerable to waste, fraud and abuse.

Auditors attribute the increase to the uptick in electronic filing, which is more convenient for tax filers, but also easier for fraudsters to file fake returns.

TIGTA says the IRS doled out more than $5.8 billion in fraudulent refunds related to identity theft during the 2013 filing season.

The shift to electronic filing is also apparently making taxpayer information even more vulnerable according to the latest breach.

Related: IRS Struggles to Help Victims of Identity Fraud

The hack is obviously bad news for the agency, which is already struggling to address cases of identity theft as they stack up. TIGTA reported the IRS took about 278 days on average to resolve identity theft cases in 2013, despite the agency claiming that it takes about 180 days or six months to resolve issues of identity theft.

When it does complete cases, the IG found that about 10 percent of the “resolved” were riddled with errors.

The latest report comes at a tough time for the IRS, which is struggling with a recent round of budget cuts and is operating with an even greater workload while enforcing at least 40 new tax provisions under the president’s health care law.

The agency said it has temporarily suspended the online service that was the subject of the breach until the vulnerabilities are resolved.

Top Reads from The Fiscal Times:

- Mike Huckabee and His Tax Plan Get Slammed on Fox

- Putin Isn’t Reviving the USSR, He’s Creating a Fascist State

- States Band Together To Keep Obamacare Afloat

Trump’s Cabinet Would Benefit from Tax Plan Too

“Eliminating the estate tax would save the Trump Cabinet over a billion dollars," Oliver Willis writes. "Like Mnuchin, Trump’s secretaries would make out like bandits. Commerce Secretary Wilbur Ross would get an extra $545 million. The family of Education Secretary Betsy DeVos would rake in $900 million. Linda McMahon, head of the Small Business Administration, and her husband, WWE founder Vince McMahon, would take in $250 million. Trump’s own net worth is in dispute, thanks to his failure to reveal his tax returns, but based on his estimated net worth of $3 billion, the estate tax scheme would net him $564 million.” (Shareblue Media, Bloomberg)

A Liberal Economist Shoots Down the GOP’s Fiscal Chicken Hawks

Republicans want a tax cut, but they don’t want to fully pay for it and may be willing to increase the deficit by $1.5 trillion over 10 years. This would continue a troubling cycle, economist Jared Bernstein writes, in which supposed fiscal conservatives “use the deficit argument to block spending, promote fiscal austerity, and small government, conveniently tossing deficit concerns aside when it comes to tax cuts.”

You’ll hear arguments about how increased economic growth will make up for the budgetary effects of the tax cuts, but don’t believe them. “Our fiscal history on this point is clear: Cutting taxes loses revenues, which, unless offset by higher taxes elsewhere or spending cuts, increases the budget deficit, which in turn raises the debt.” When this happens again, and the promised growth effects don’t materialize, the tax cutters will go back to pushing for spending cuts.

The country faces a number of serious challenges, including an aging population that by itself will require increased government spending, and we need a tax policy that does more than drive up the deficit. “The problem with structural deficits — ones that go up even in good times — is that they reveal that we’re unwilling to raise the necessary revenues to support the government we want and need. This enables those who whose goal is to shrink government to point to deficits and debt as their proof that we can’t afford it, whatever ‘it’ is, except when ‘it’ is tax cuts.” (New York Times)

Health Secretary Tom Price Under Fire for Use of Private Jets

Back in 2009, Tom Price spoke out against House Democrats who wanted to spend $550 million on private jets for lawmakers to use. A Republican representative from Georgia at the time, Price told CNBC that the purchase of the jets was “another example of fiscal irresponsibility run amok.” Now Secretary of Health and Human Services, Price seems to have changed his mind about the virtue of government officials using private jets at taxpayer expense. Just last week, Price used a chartered private jet to travel to three HHS events — including one at a resort in Maine — at an estimated cost of $60,000, Politico reports.

While previous HHS secretaries typically flew commercial, reports indicate that Price has been traveling by private jet for months. “Official travel by the secretary is done in complete accordance with Federal Travel Regulations,” an HHS spokesperson told Politico.

Critics on Twitter have been harsh:

More in-your-face kleptocracy from Tom Price.Take food stamps from poor, hungry kids- spend $25k from taxpayers to charter plane to Philly

— Norman Ornstein (@NormOrnstein) September 20, 2017

1️⃣ Attack Medicaid while trading health stocks.

— Harry Stein (@HarrySteinDC) September 20, 2017

2️⃣ Spend funds that could give someone 4 years of Medicaid coverage to fly a private jet. https://t.co/GO5cfJgWgO

First Mnuchin, now Tom Price. The @realDonaldTrump Cabinet has a big problem charging taxpayers for private flights. https://t.co/th1QbGdfT7

— Ben White (@morningmoneyben) September 20, 2017

Social Security Benefits Due for a Bigger Bump in 2018

In a few weeks the Social Security Administration will announce its cost-of-living adjustment, or COLA, for 2018. Inflation data for the month of August suggests that the adjustment could be the highest in five years, possibly over 2 percent, according to the Washington Examiner. Adjustments for the past five years have been relatively small: The cost of living adjustment for 2017 (announced last October) came in at a modest 0.3 percent, and the adjustment for 2016 was zero. Some retirees have complained in the past about small COLAs, but it’s worth remembering that higher adjustments are driven by higher inflation, which is bad news for people living on fixed incomes.

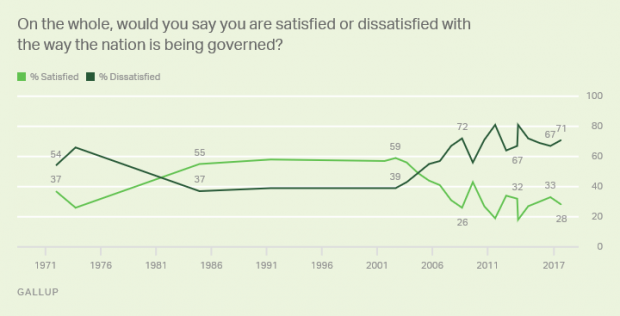

Americans Are Less Satisfied with Government Now Than a Year Ago

Gallup finds that just 28 percent of Americans are satisfied with the way the nation is being governed, down from 33 percent a year ago. And as we approach some potential fiscal battles, it's worth noting that the lowest satisfaction levels since Gallup started updating the measure annually in 2001 came in 2011 (19 percent) after a debt ceiling showdown that led to the U.S. credit rating being downgraded by S&P analysts and in 2013 (18 percent) during a federal government shutdown.