A Made-Up Holiday That Could Help Your Kids Go to College

Marketers are great at making up holidays—and who doesn’t love having an excuse to eat donuts on National Donut Day or pizza on National Pizza Day?

Most of these special days, however, tend to take a toll on both our wallets and our waistlines. Today may be an exception: The personal finance and college saving industries have dubbed today 529 Day (Get it? 5/29), a day to celebrate saving for college via tax-favored 529 plans.

Americans could benefit from any impetus to save more for higher education. The average American family that’s saving for college put away about $2,600 last year and has a total of just over $10,000 socked away for education, according to Sallie Mae’s annual How America Saves for College report. That’s the lowest amount since the survey began in 2009 — or about enough to send one kid to college for one semester at today’s prices.

Related: Top-rated 529 Plans Probably Are Not For You

Many states are “celebrating” the day with everything from waived enrollment fees to discounted admission to local baseball games. (Each plan is sponsored by a state but run by financial firms.) Check out this interactive map to find out if your state is offering any incentives today.

Contributions to a 529 plan are made after federal taxes, but the money grows tax-free as long as the proceeds are used for education costs. Some states also offer tax breaks on contributions.

The average cost of attending public college this year is $19,000. For private college it’s $33,000, according to The College Board. So there’s no time like today to start saving.

Number of the Day: $132,900

The cap on Social Security payroll taxes will rise to $132,900 next year, an increase of 3.5 percent. (Earnings up to that level are subject to the Social Security tax.) The increase will affect about 11.6 million workers, Politico reports. Beneficiaries are also getting a boost, with a 2.8 percent cost-of-living increase coming in 2019.

Photo of the Day: Kanye West at the White House

This is 2018: Kanye West visited President Trump at the White House Thursday and made a rambling 10-minute statement that aired on TV news networks. West’s lunch with the president was supposed to focus on clemency, crime in his hometown of Chicago and economic investment in urban areas, but his Oval Office rant veered into the bizarre. And since this is the world we live in, we’ll also point out that West apparently became “the first person to ever publicly say 'mother-f***er' in the Oval Office.”

Trump called Kanye’s monologue “pretty impressive.”

“That was bonkers,” MSNBC’s Ali Velshi said afterward.

Again, this is 2018.

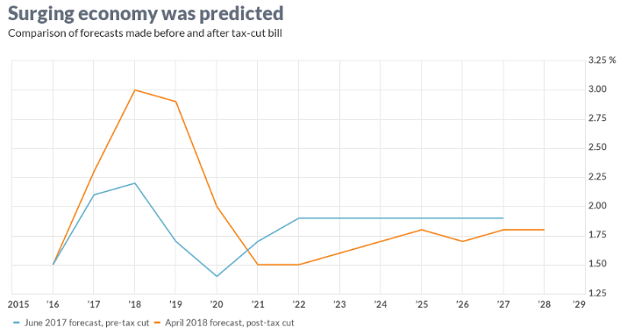

Chart of the Day: GDP Growth Before and After the Tax Bill

President Trump and the rest of the GOP are celebrating the recent burst in economic growth in the wake of the tax cuts, with the president claiming that it’s unprecedented and defies what the experts were predicting just a year ago. But Rex Nutting of MarketWatch points out that elevated growth rates over a few quarters have been seen plenty of times in recent years, and the extra growth generated by the Republican tax cuts was predicted by most economists, including those at the Congressional Budget Office, whose revised projections are shown below.

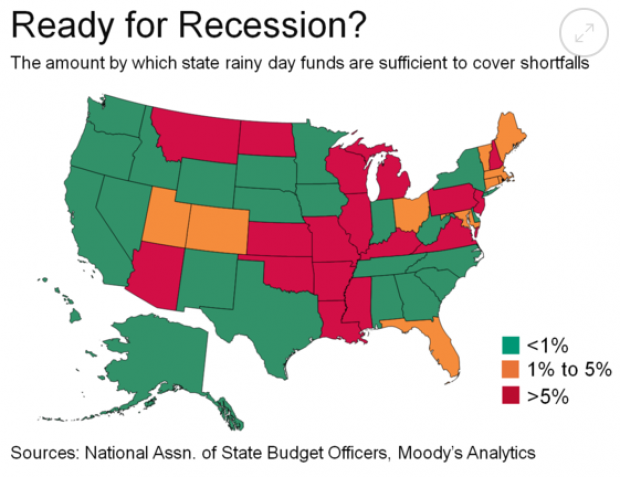

Are States Ready for the Next Downturn?

The Great Recession hit state budgets hard, but nearly half are now prepared to weather the next modest downturn. Moody’s Analytics says that 23 states have enough reserves to meet budget shortfalls in a moderate economic contraction, up from just 16 last year, Bloomberg reports. Another 10 states are close. The map below shows which states are within 1 percent of their funding needs for their rainy day funds (in green) and which states are falling short.

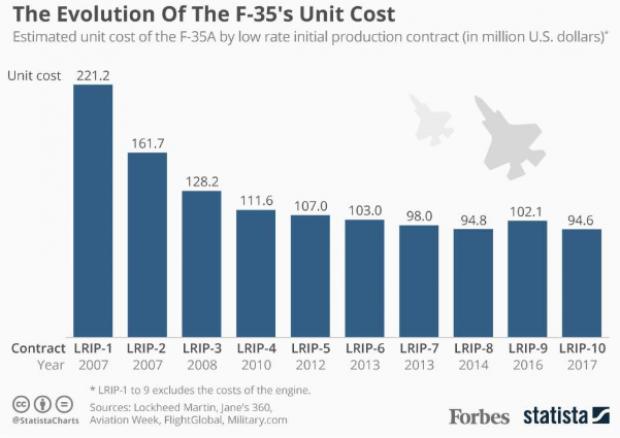

Chart of the Day: Evolving Price of the F-35

The 2019 National Defense Authorization Act signed in August included 77 F-35 Lightning II jets for the Defense Department, but Congress decided to bump up that number in the defense spending bill finalized this week, for a total of 93 in the next fiscal year – 16 more than requested by the Pentagon. Here’s a look from Forbes at the evolving per unit cost of the stealth jet, which is expected to eventually fall to roughly $80 million when full-rate production begins in the next few years.