House Democrat Calls Congress ‘The Poster Child for Cowardice” on ISIS

Amid growing signs that the U.S. faces nothing but bad choices in its war against ISIS, Rep. Jim McGovern, a liberal Democrat from Massachusetts, today denounced Congress as “the poster child for cowardice” for refusing to debate a new war powers resolution to set parameters for the Obama administration’s efforts to “degrade and defeat” the jihadist terrorists in Iraq and Syria.

At the behest of Republican and Democratic leaders, Obama sent a proposed war powers resolution to Congress in February outlining his core objectives of systematically destroying the jihadist terror group through a sustained campaign of airstrikes, supporting and training allied forces on the ground and humanitarian assistance – but without committing a large number of U.S. combat troops to the effort.

Related: U.S. Shoots Itself in the Foot By Accidentally Arming ISIS

The administration proposal would give the military “flexibility” to confront unforeseen circumstances, potentially by deploying Special Forces in the region. But it would limit the mission to three years and would not authorize “enduring offensive ground combat operations.”

But rather than roll up their sleeves and debate and vote on the president’s request for new military authorization, Republican leaders have effectively shelved the issue and moved on to other things, such as rewriting the rules for NSA spying on Americans’ phone calls and providing Obama with fast track authority to negotiate a new trade pact with Asian countries.

With many conservative Republicans including Sens. John McCain of Arizona and Lindsey Graham of South Carolina complaining that the president’s strategy for defeating ISIS woefully inadequate and some Democrats worried that it goes too far in committing U.S. troops and resources to a no-win situation in the Middle East, Senate Foreign Relations Committee Chair Bob Corker (R-TN) said recently he had no incentive to take up the issue in his committee.

Related: Why Congress Should Simply Bag the War Powers Debate

Frankly speaking, this is unacceptable,” McGovern, a member of the House Rules Committee, said on the House floor today, adding that if the Congress “doesn’t have the stomach” to authorize the war it should vote to bring U.S. forces home, according to Politico. McGovern introduced a bipartisan resolution that would require full debate within 15 days on whether U.S. troops should withdraw from Iraq and Syria. His bipartisan resolution is co-sponsored by Reps. Walter Jones (R-NC) and Barbara Lee (D-CA).

“This House appears to have no problem sending our uniformed men and women into harm’s way,” McGovern said in prepared remarks. “It appears to have no problem spending billions of dollars for the arms, equipment and airpower to carry out these wars. But it just can’t bring itself to step up to the plate and take responsibility for these wars.”

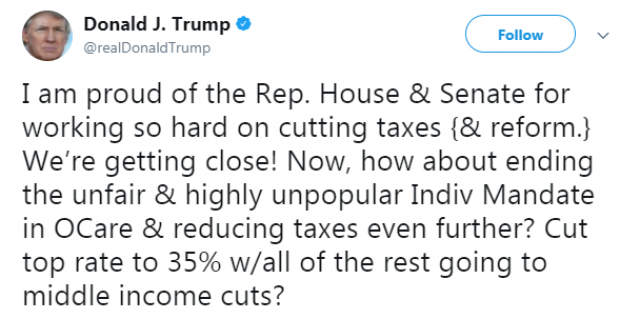

Trump: Repeal the Obamacare Mandate to Cut the Top Tax Rate

President Trump repeated his call Monday to repeal the Affordable Care Act’s individual mandate as part of the tax bill. In a tweet — geotagged from Pennsylvania, not the Philippines , where Trump currently is — Trump added that the billions in savings from ending the mandate should be used to cut the top marginal rate to 35 percent and the rest on cuts for the middle class.

The Congressional Budget Office said last week that eliminating the mandate would save $338 billion over the next decade.

The current version of the House tax bill keeps the top individual income tax rate at 39.6 percent, while the Senate bill lowers it to 38.5 percent. However, mandate repeal is not currently part of either tax bill, and, as The New York Times notes, “repeal of the individual mandate was not on the list of 355 amendments that the [Senate Finance Committee] released on Sunday night.”

Tax Reform Is Hard, but the GOP Could Have Made This Easier

The Tax Policy Center’s William G. Gale writes that the GOP’s approach to the tax bill combines a $5.8 trillion tax cut with a $4.3 trillion tax increase to offset the costs. There may have been an easier way. “What if the House GOP simply tried to cut business and individual taxes by $1.5 trillion. No offsets needed. They could have distributed small tax cuts to middle-income individuals by, say, modestly expanding the earned income tax credit and raising the standard deduction. And they could have trimmed the top corporate tax rate by a few percentage points. It would not have been base-broadening tax reform, but neither is the current bill. ... Tax reform is never easy, but crafting the bill this way has vastly increased the challenge of passing it.”

Alan Greenspan: Deal with the National Debt Before Cutting Taxes

Former Federal Reserve Chairman Alan Greenspan is warning that sharply cutting taxes right now would be an economic “mistake.”

In an interview with Maria Bartiromo on the Fox Business Network Thursday, the 91-year-old Greenspan said it’s more important for President Trump and Congress to put the nation on a sustainable fiscal path by addressing rising entitlement spending driven by the aging of the U.S. population.

“Frankly, I think what we ought to be concerned about is the fact the federal debt is rising at a very rapid pace, and there’s nothing in this bill that will essentially stop that from happening," Greenspan said. "So my view is that we’re premature on fiscal stimulus, whether it’s tax cuts or expenditure increases. We’ve got to get the debt stabilized before we can even think in those terms.”

GOP’s Estate-Tax Repeal Details Would Save Super-Rich Tens of Billions Extra

It’s no surprise that the House Republicans’ tax bill includes the eventual repeal of the estate tax, a long-held GOP goal. But The Washington Post’s Glenn Kessler highlights an unexpectedly generous aspect of the current bill: It “allows the beneficiaries of estates to not pay capital gains taxes on the increase in value of assets held by the estates. That has not been a feature of most previous estate-tax bills.”

Currently, estates face a federal tax if they’re valued at more than $5.49 million for individuals or almost $11 million for couples. But, for tax purposes, the value of assets passed on to heirs gets “stepped-up” or reset to their value at the time of death. Kessler’s example: “Imagine a home that had been purchased for $250,000 but was now worth $1 million. The ‘stepped-up basis’ would be $1 million. If the heirs sold the house for $1.1 million, they would only owe capital-gains tax on the $100,000 difference, not the $850,000 difference from the original purchase price.”

The GOP bill repeals the estate tax, but also keeps the stepped-up basis — a seemingly small detail that creates a huge tax shelter. It means that heirs of large estates would save tens of billions of dollars a year when they sell assets that have appreciated in value over time — or, as Kessler puts it, that the bill will allow “tens of billions of untapped capital gains to remain beyond the reach of the U.S. government.”

Republicans Are Still Coming After Obamacare’s Individual Mandate

Speaker Paul Ryan said Sunday that House Republicans are still considering a repeal of the Obamacare individual mandate as part of their tax bill. "We have an active conversation with our members and a whole host of ideas on things to add to this bill. And that’s one of the things that’s being discussed," Ryan said on Fox News. President Trump touted the idea in a tweet last week, and Sens. Tom Cotton and Rand Paul have recently spoken in favor of using the tax bill to eliminate the mandate. The move would save the government $416 billion over 10 years as roughly 15 million people go without insurance due to lower spending on subsidies and health care services, according to the CBO. Those savings could be appealing as Republicans look for revenues in their revised tax bill. But if the controversial repeal of the mandate isn’t included in the tax bill, the White House is reportedly ready to roll out an executive order weakening the requirement that taxpayers provide proof of insurance to avoid paying a penalty.