Cyberattacks on Washington Are Up 50 to 100 Percent

As the government struggles to hire skilled workers to fend off hackers, cyberattacks on federal agencies are up between 50 and 100 percent in the past year.

A new survey by the Professional Services Council found that at least 28 percent of chief information officers at federal agencies reported an increase in cyberattacks of 51 to 100 percent over the past year.

Related: Cyber Security Office Deemed Dysfunctional

The increasing threat of cyber hacks against the government isn’t surprising. Earlier this year, the Government Accountability Office listed federal IT operations as one of the most serious weaknesses in the federal government and in its annual “High Risk” report, the GAO labeled this vulnerability a major threat to national security.

Just last week, the Obama administration announced that Chinese cyber thieves hacked into the Office of Personnel Management’s massive government data system and accessed more than 4 million federal workers’ personal data. ABC News reported that the hackers potentially gained access to some Cabinet member data as well.

In the aftermath of the breach, President Obama called on agencies to ramp up cyber security efforts. However, the problem, according to the PSC survey, is that the government is having trouble recruiting skilled cyber experts.

Related: Federal Government Hacked: Chinese Cyber Thieves Target Fed’s Personal Info

Some 63 percent of CIOs reported that their agencies were not sufficiently prepared to develop necessary talent. Most cited limited resources and government salaries as obstacles to competing with employers in the private sector.

Commerce Department CIO Steve Cooper said hiring young people is a major challenge. The average age of Commerce employees is about 50 years old, NextGov noted.

The CIOs’ responses are in line with a separate GAO report from earlier this year that found there is a major skills gap within the federal workforce when it comes to IT and cybersecurity.

Coming Soon: Deductible Relief Day!

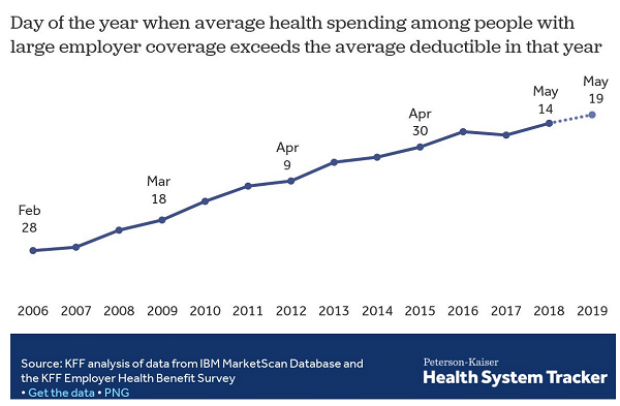

You may be familiar with the concept of Tax Freedom Day – the date on which you have earned enough to pay all of your taxes for the year. Focusing on a different kind of financial burden, analysts at the Kaiser Family Foundation have created Deductible Relief Day – the date on which people in employer-sponsored insurance plans have spent enough on health care to meet the average annual deductible.

Average deductibles have more than tripled over the last decade, forcing people to spend more out of pocket each year. As a result, Deductible Relief Day is “getting later and later in the year,” Kaiser’s Larry Levitt said in a tweet Thursday.

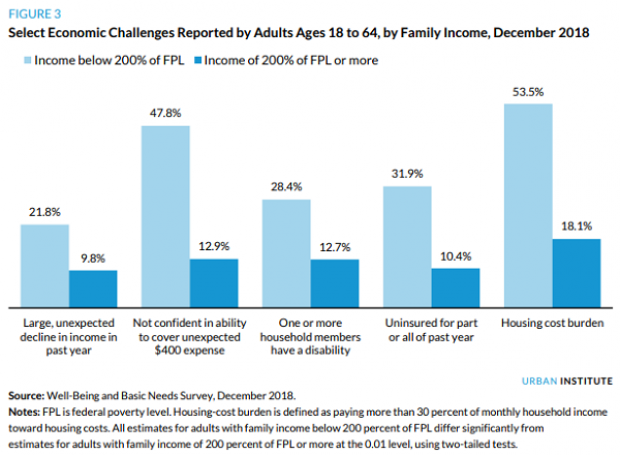

Chart of the Day: Families Still Struggling

Ten years into what will soon be the longest economic expansion in U.S. history, 40% of families say they are still struggling, according to a new report from the Urban Institute. “Nearly 4 in 10 nonelderly adults reported that in 2018, their families experienced material hardship—defined as trouble paying or being unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties for the previous year,” the report says. “Among adults in families with incomes below twice the federal poverty level (FPL), over 60 percent reported at least one type of material hardship in 2018.”

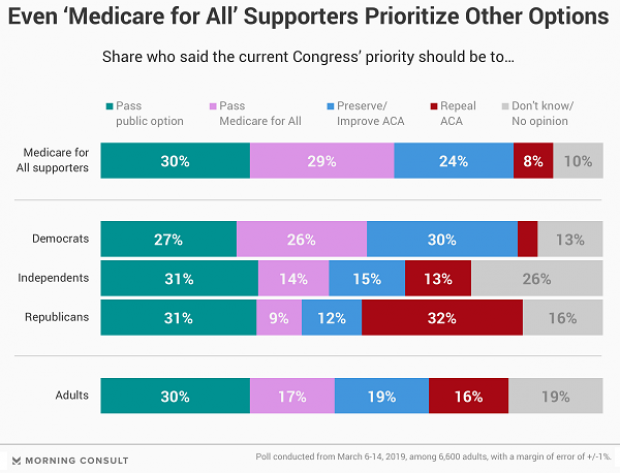

Chart of the Day: Pragmatism on a Public Option

A recent Morning Consult poll 3,073 U.S. adults who say they support Medicare for All shows that they are just as likely to back a public option that would allow Americans to buy into Medicare or Medicaid without eliminating private health insurance. “The data suggests that, in spite of the fervor for expanding health coverage, a majority of Medicare for All supporters, like all Americans, are leaning into their pragmatism in response to the current political climate — one which has left many skeptical that Capitol Hill can jolt into action on an ambitious proposal like Medicare for All quickly enough to wrangle the soaring costs of health care,” Morning Consult said.

Chart of the Day: The Explosive Growth of the EITC

The Earned Income Tax Credit, a refundable tax credit for low- to moderate-income workers, was established in 1975, with nominal claims of about $1.2 billion ($5.6 billion in 2016 dollars) in its first year. According to the Tax Policy Center, by 2016 “the total was $66.7 billion, almost 12 times larger in real terms.”

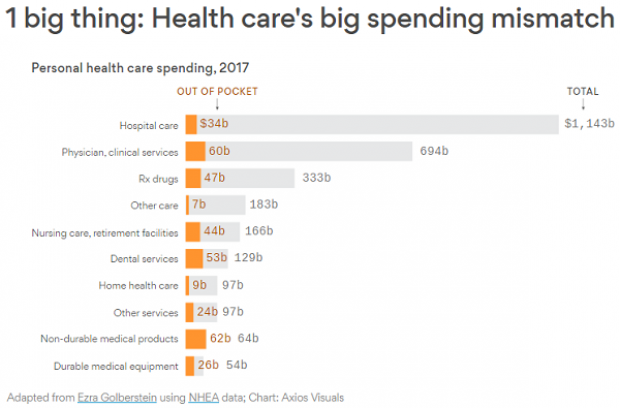

Chart of the Day: The Big Picture on Health Care Costs

“The health care services that rack up the highest out-of-pocket costs for patients aren't the same ones that cost the most to the health care system overall,” says Axios’s Caitlin Owens. That may distort our view of how the system works and how best to fix it. For example, Americans spend more out-of-pocket on dental services ($53 billion) than they do on hospital care ($34 billion), but the latter is a much larger part of national health care spending as a whole.