Sick, Uninsured and Charged 10 Times the Cost of Hospital Care

A pack of for-profit hospitals are taking too many liberties with their for-profit names. A new study by Health Affairs found 50 hospitals in the U.S. have markups over 10 times the actual cost of care. The data was found using 2012 Medicare cost reports.

At the top of the list is North Okaloosa Medical Center, located about an hour outside of Pensacola, Fla. The hospital was found to charge uninsured patients 12.6 times the actual cost of patient care. A typical hospital charges 3.4 times the cost of patient care.

The largest numbers of the hospitals on the list – 20 – are in Florida. Of the 50, 49 are for-profit and 46 are owned by for-profit hospital systems. One for-profit hospital system, Community Health Systems, owns and operates 25 of the hospitals on the list. Hospital Corporation of America operates 14 others.

Related: If SCOTUS Rule Against Obamacare, Health Care Costs Will Soar

Uninsured individuals are commonly asked to pay the full amount, unaware they are being scammed. The markups can lead to personal bankruptcy or the avoidance of necessary medical attention.

"The main causes of these extremely high markups are a lack of price transparency and negotiating power by uninsured patients, out-of network patients, casualty and workers' compensation insurers and even in-network insurers," the study reads. "Federal and state policymakers need to recognize the extent of hospital markups and consider policy solutions to contain them."

Most astounding of all, these markups are not illegal. Maryland and West Virginia are the only states with laws limiting hospital fees.

Researchers offered solutions in the study, including limitations on the charge-to-cost ratio, mandated price disclosure to regulate the markups or some form of all-payer rate setting.

Coming Soon: Deductible Relief Day!

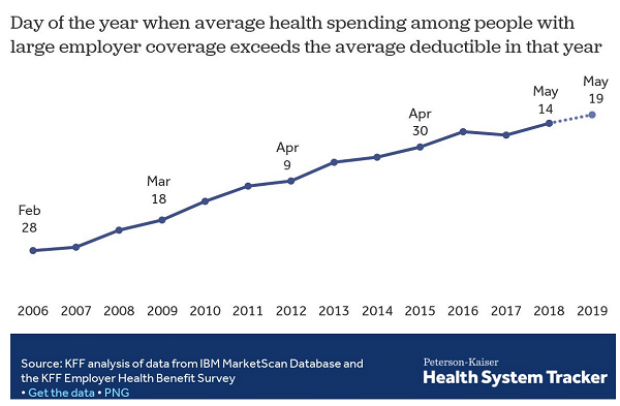

You may be familiar with the concept of Tax Freedom Day – the date on which you have earned enough to pay all of your taxes for the year. Focusing on a different kind of financial burden, analysts at the Kaiser Family Foundation have created Deductible Relief Day – the date on which people in employer-sponsored insurance plans have spent enough on health care to meet the average annual deductible.

Average deductibles have more than tripled over the last decade, forcing people to spend more out of pocket each year. As a result, Deductible Relief Day is “getting later and later in the year,” Kaiser’s Larry Levitt said in a tweet Thursday.

Chart of the Day: Families Still Struggling

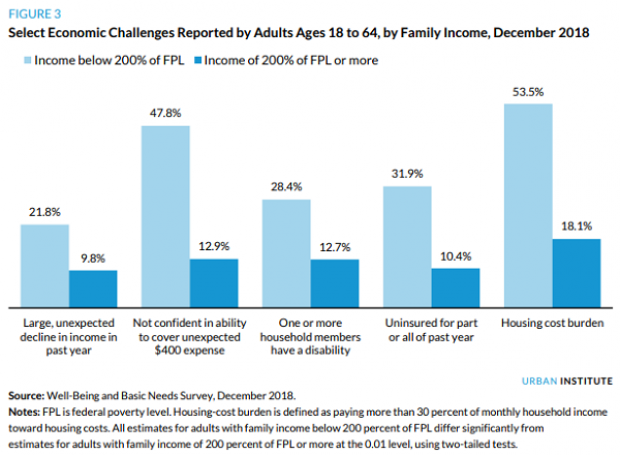

Ten years into what will soon be the longest economic expansion in U.S. history, 40% of families say they are still struggling, according to a new report from the Urban Institute. “Nearly 4 in 10 nonelderly adults reported that in 2018, their families experienced material hardship—defined as trouble paying or being unable to pay for housing, utilities, food, or medical care at some point during the year—which was not significantly different from the share reporting these difficulties for the previous year,” the report says. “Among adults in families with incomes below twice the federal poverty level (FPL), over 60 percent reported at least one type of material hardship in 2018.”

Chart of the Day: Pragmatism on a Public Option

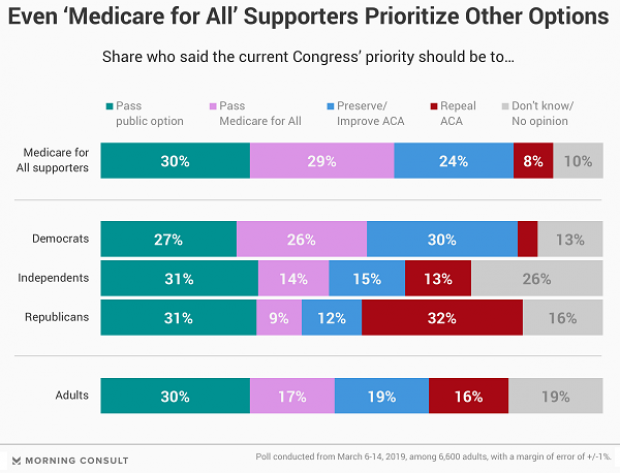

A recent Morning Consult poll 3,073 U.S. adults who say they support Medicare for All shows that they are just as likely to back a public option that would allow Americans to buy into Medicare or Medicaid without eliminating private health insurance. “The data suggests that, in spite of the fervor for expanding health coverage, a majority of Medicare for All supporters, like all Americans, are leaning into their pragmatism in response to the current political climate — one which has left many skeptical that Capitol Hill can jolt into action on an ambitious proposal like Medicare for All quickly enough to wrangle the soaring costs of health care,” Morning Consult said.

Chart of the Day: The Explosive Growth of the EITC

The Earned Income Tax Credit, a refundable tax credit for low- to moderate-income workers, was established in 1975, with nominal claims of about $1.2 billion ($5.6 billion in 2016 dollars) in its first year. According to the Tax Policy Center, by 2016 “the total was $66.7 billion, almost 12 times larger in real terms.”

Chart of the Day: The Big Picture on Health Care Costs

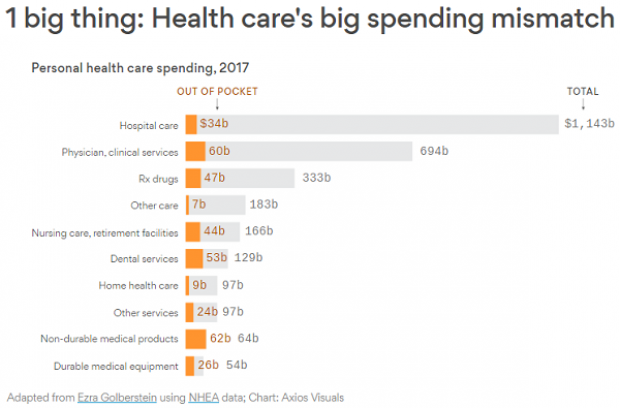

“The health care services that rack up the highest out-of-pocket costs for patients aren't the same ones that cost the most to the health care system overall,” says Axios’s Caitlin Owens. That may distort our view of how the system works and how best to fix it. For example, Americans spend more out-of-pocket on dental services ($53 billion) than they do on hospital care ($34 billion), but the latter is a much larger part of national health care spending as a whole.