Privacy-Focused DuckDuckGo Search Engine Says Traffic Has Soared Since Snowden Leaks

If you haven’t yet heard about DuckDuckGo, you probably will soon.

On its face, the search engine looks much the same as any other. A little more sparse, maybe, but nothing much separating it from, say, Google. There’s a logo and a box for your search.

Where it differs from its peers, though, is what happens when you hit enter.

Though silly in name, DuckDuckGo has a serious ethos: protection of user privacy at all costs. The engine, launched in 2009, shies away from the personalized filter bubbles so adored by search giants like Google and Bing, refusing to track searches or store user data. Users have the option to completely anonymize their search by routing it through the anonymizing TOR network, rendering it even more invisible to prying eyes. DuckDuckGo earns money through simple keyword-targeted advertising, steering clear of the tracking cookies used by more sophisticated ad campaigns.

Though the slavish dedication to privacy has its drawbacks — for example, results are less tailored to the user searching for them, and thus more likely to be irrelevant — the search engine has seen 3 billion searches a year and has a firm community of fans who are attracted to the site’s long-standing defense of user privacy.

Related: News Companies Have Good Reason to Fear Facebook

That ethos seems to be paying off. Gabe Weinberg, CEO of the Pennsylvania-based company, told CNBC last week that the search engine’s traffic has grown 600 percent since Edward Snowden’s 2013 revelations about the large-scale spying conducted by the government. DuckDuckGo’s search traffic was further assisted last year when Apple integrated it into the Safari mobile browser.

DuckDuckGo’s traffic is still tiny compared to the big players — the 3 billion searches a year that Weinberg claimed to have on CNBC is pretty much the same amount of searches that Google traffics in a single day. But DuckDuckGo expects steady growth as average users become increasingly educated about their privacy.

Tax Refunds Rebound

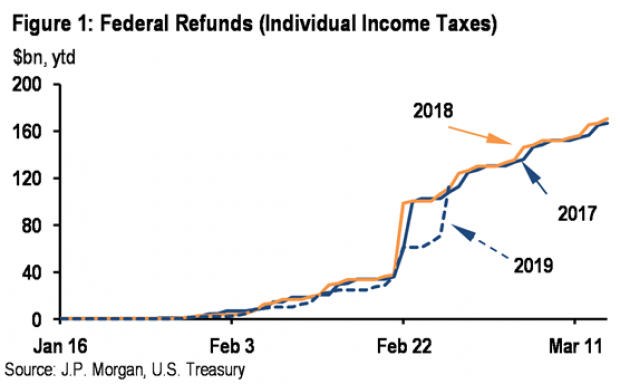

Smaller refunds in the first few weeks of the current tax season were shaping up to be a political problem for Republicans, but new data from the IRS shows that the value of refund checks has snapped back and is now running 1.3 percent higher than last year. The average refund through February 23 last year was $3,103, while the average refund through February 22 of 2019 was $3,143 – a difference of $40. The chart below from J.P. Morgan shows how refunds performed over the last 3 years.

Number of the Day: $22 Trillion

The total national debt surpassed $22 trillion on Monday. Total public debt outstanding reached $22,012,840,891,685.32, to be exact. That figure is up by more than $1.3 trillion over the past 12 months and by more than $2 trillion since President Trump took office.

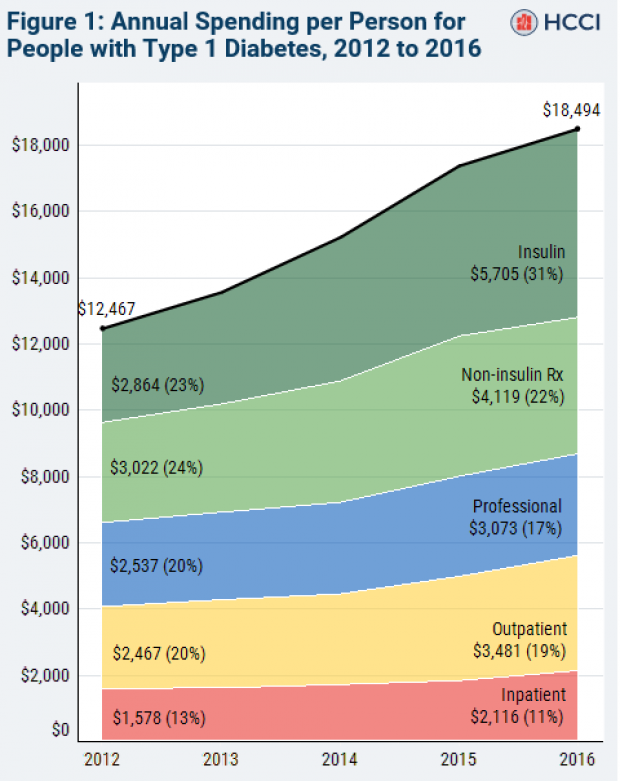

Chart of the Week: The Soaring Cost of Insulin

The cost of insulin used to treat Type 1 diabetes nearly doubled between 2012 and 2016, according to an analysis released this week by the Health Care Cost Institute. Researchers found that the average point-of-sale price increased “from $7.80 a day in 2012 to $15 a day in 2016 for someone using an average amount of insulin (60 units per day).” Annual spending per person on insulin rose from $2,864 to $5,705 over the five-year period. And by 2016, insulin costs accounted for nearly a third of all heath care spending for those with Type 1 diabetes (see the chart below), which rose from $12,467 in 2012 to $18,494.

Chart of the Day: Shutdown Hits Like a Hurricane

The partial government shutdown has hit the economy like a hurricane – and not just metaphorically. Analysts at the Committee for a Responsible Federal Budget said Tuesday that the shutdown has now cost the economy about $26 billion, close to the average cost of $27 billion per hurricane calculated by the Congressional Budget Office for storms striking the U.S. between 2000 and 2015. From an economic point of view, it’s basically “a self-imposed natural disaster,” CRFB said.

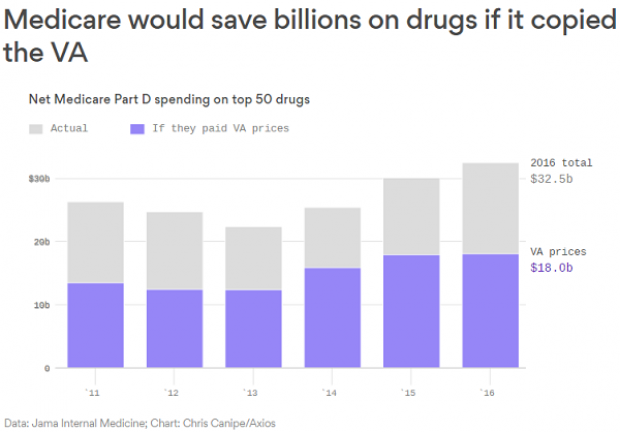

Chart of the Week: Lowering Medicare Drug Prices

The U.S. could save billions of dollars a year if Medicare were empowered to negotiate drug prices directly with pharmaceutical companies, according to a paper published by JAMA Internal Medicine earlier this week. Researchers compared the prices of the top 50 oral drugs in Medicare Part D to the prices for the same drugs at the Department of Veterans Affairs, which negotiates its own prices and uses a national formulary. They found that Medicare’s total spending was much higher than it would have been with VA pricing.

In 2016, for example, Medicare Part D spent $32.5 billion on the top 50 drugs but would have spent $18 billion if VA prices were in effect – or roughly 45 percent less. And the savings would likely be larger still, Axios’s Bob Herman said, since the study did not consider high-cost injectable drugs such as insulin.