Privacy-Focused DuckDuckGo Search Engine Says Traffic Has Soared Since Snowden Leaks

If you haven’t yet heard about DuckDuckGo, you probably will soon.

On its face, the search engine looks much the same as any other. A little more sparse, maybe, but nothing much separating it from, say, Google. There’s a logo and a box for your search.

Where it differs from its peers, though, is what happens when you hit enter.

Though silly in name, DuckDuckGo has a serious ethos: protection of user privacy at all costs. The engine, launched in 2009, shies away from the personalized filter bubbles so adored by search giants like Google and Bing, refusing to track searches or store user data. Users have the option to completely anonymize their search by routing it through the anonymizing TOR network, rendering it even more invisible to prying eyes. DuckDuckGo earns money through simple keyword-targeted advertising, steering clear of the tracking cookies used by more sophisticated ad campaigns.

Though the slavish dedication to privacy has its drawbacks — for example, results are less tailored to the user searching for them, and thus more likely to be irrelevant — the search engine has seen 3 billion searches a year and has a firm community of fans who are attracted to the site’s long-standing defense of user privacy.

Related: News Companies Have Good Reason to Fear Facebook

That ethos seems to be paying off. Gabe Weinberg, CEO of the Pennsylvania-based company, told CNBC last week that the search engine’s traffic has grown 600 percent since Edward Snowden’s 2013 revelations about the large-scale spying conducted by the government. DuckDuckGo’s search traffic was further assisted last year when Apple integrated it into the Safari mobile browser.

DuckDuckGo’s traffic is still tiny compared to the big players — the 3 billion searches a year that Weinberg claimed to have on CNBC is pretty much the same amount of searches that Google traffics in a single day. But DuckDuckGo expects steady growth as average users become increasingly educated about their privacy.

Tweet of the Day: The Black Hole of Big Pharma

Billionaire John D. Arnold, a former energy trader and hedge fund manager turned philanthropist with a focus on health care, says Big Pharma appears to have a powerful hold on members of Congress.

Arnold pointed out that PhRMA, the main pharmaceutical industry lobbying group, had revenues of $459 million in 2018, and that total lobbying on behalf of the sector probably came to about $1 billion last year. “I guess $1 bil each year is an intractable force in our political system,” he concluded.

Warren’s Taxes Could Add Up to More Than 100%

The Wall Street Journal’s Richard Rubin says Elizabeth Warren’s proposed taxes could claim more than 100% of income for some wealthy investors. Here’s an example Rubin discussed Friday:

“Consider a billionaire with a $1,000 investment who earns a 6% return, or $60, received as a capital gain, dividend or interest. If all of Ms. Warren’s taxes are implemented, he could owe 58.2% of that, or $35 in federal tax. Plus, his entire investment would incur a 6% wealth tax, i.e., at least $60. The result: taxes as high as $95 on income of $60 for a combined tax rate of 158%.”

In Rubin’s back-of-the-envelope analysis, an investor worth $2 billion would need to achieve a return of more than 10% in order to see any net gain after taxes. Rubin notes that actual tax bills would likely vary considerably depending on things like location, rates of return, and as-yet-undefined policy details. But tax rates exceeding 100% would not be unusual, especially for billionaires.

Biden Proposes $1.3 Trillion Infrastructure Plan

Joe Biden on Thursday put out a $1.3 trillion infrastructure proposal. The 10-year “Plan to Invest in Middle Class Competitiveness” calls for investments to revitalize the nation’s roads, highways and bridges, speed the adoption of electric vehicles, launch a “second great railroad revolution” and make U.S. airports the best in the world.

“The infrastructure plan Joe Biden released Thursday morning is heavy on high-speed rail, transit, biking and other items that Barack Obama championed during his presidency — along with a complete lack of specifics on how he plans to pay for it all,” Politico’s Tanya Snyder wrote. Biden’s campaign site says that every cent of the $1.3 trillion would be paid for by reversing the 2017 corporate tax cuts, closing tax loopholes, cracking down on tax evasion and ending fossil-fuel subsidies.

Read more about Biden’s plan at Politico.

Number of the Day: 18 Million

There were 18 million military veterans in the United States in 2018, according to the Census Bureau. That figure includes 485,000 World War II vets, 1.3 million who served in the Korean War, 6.4 million from the Vietnam War era, 3.8 million from the first Gulf War and another 3.8 million since 9/11. We join with the rest of the country today in thanking them for their service.

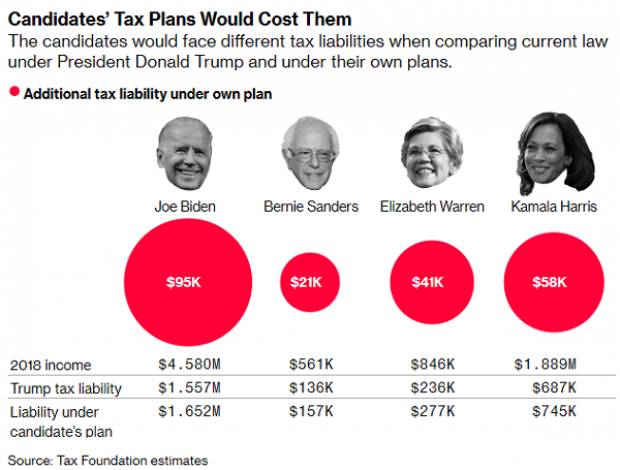

Chart of the Day: Dem Candidates Face Their Own Tax Plans

Democratic presidential candidates are proposing a variety of new taxes to pay for their preferred social programs. Bloomberg’s Laura Davison and Misyrlena Egkolfopoulou took a look at how the top four candidates would fare under their own tax proposals.