Can ‘Project Lightning’ Give Twitter a Fresh Jolt?

The ubiquitous blue bird associated with Twitter (TWTR) has been incessantly chirping out new announcements this month as the social media phenom tries to pick itself back up after being slammed for weak earnings growth and the underperformance of its stock.

Projections from data firm eMarketer call for the Twitter monthly user base to grow at a measly 14.1 percent this year, compared with more than 30 percent growth two years ago, according to Reuters.

While the news last week that CEO Dick Costolo was relinquishing the corner office was not a shock since he has offered to resign in the past, the appointment of co-founder and former chief executive Jack Dorsey as provisional CEO caused a stir in the business and tech worlds. Not only is Dorsey the CEO of his own mobile payments startup, Square, but he was reportedly removed from his role as CEO of Twitter in 2008.

The shakeup caused a brief spike in the company’s shares, but the stock is now back to where it had been before the announcement — and if it’s going to climb higher, investors may to need to see some other changes, too.

That’s where the slew of product announcements comes in. The latest, revealed yesterday on Buzzfeed, is called Project Lightning. Essentially, if there’s a hot topic that people are tweeting about — either prescheduled events, breaking news or ongoing events — Twitter has created an easy way for users to view the most popular and relevant tweets, images and videos, without having to sift through every tedious comment and retweet. Twitter will have a team of editors select the tweets they think will be most popular on the stories they see as the biggest of the moment.

The goal is to make Twitter easier to use and more engaging for an audience that isn’t necessarily interested in actively tweeting. (Twitter’s stock jumped more than 4 percent Friday in response to the new product announcement, its best day in months.) Similarly, Twitter is trying to bring down other obstacles to using its service. The same day the news was released about Costolo, Twitter also announced the removal of the 140-character limit on the direct messages feature. Getting rid of the limit is a step by the company to keep up with rival social networks and messaging apps, like Facebook and WhatsApp.

Related: Instagram Takes Steps to Open Platform to Advertisers

At the same time it tries to draw in users, Twitter executives know they must do more to attract advertisers. Six ad executives surveyed recently by Reuters said they spend more money on rival platforms because they have more users, better data to target consumers and create more effective ad content. To combat that perception, Twitter this week announced a push to bring in advertisers by rolling out video ads that will automatically play in a user’s timeline. Though initially muted, if a user clicks on the video it will switch to full-screen mode with sound. Advertisers will only be charged when a user has watched at least three seconds of the video on a full screen.

Both Facebook and Instagram offer an almost identical ad feature.

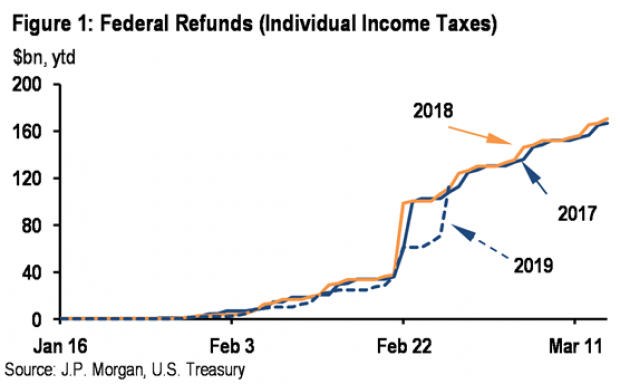

Tax Refunds Rebound

Smaller refunds in the first few weeks of the current tax season were shaping up to be a political problem for Republicans, but new data from the IRS shows that the value of refund checks has snapped back and is now running 1.3 percent higher than last year. The average refund through February 23 last year was $3,103, while the average refund through February 22 of 2019 was $3,143 – a difference of $40. The chart below from J.P. Morgan shows how refunds performed over the last 3 years.

Number of the Day: $22 Trillion

The total national debt surpassed $22 trillion on Monday. Total public debt outstanding reached $22,012,840,891,685.32, to be exact. That figure is up by more than $1.3 trillion over the past 12 months and by more than $2 trillion since President Trump took office.

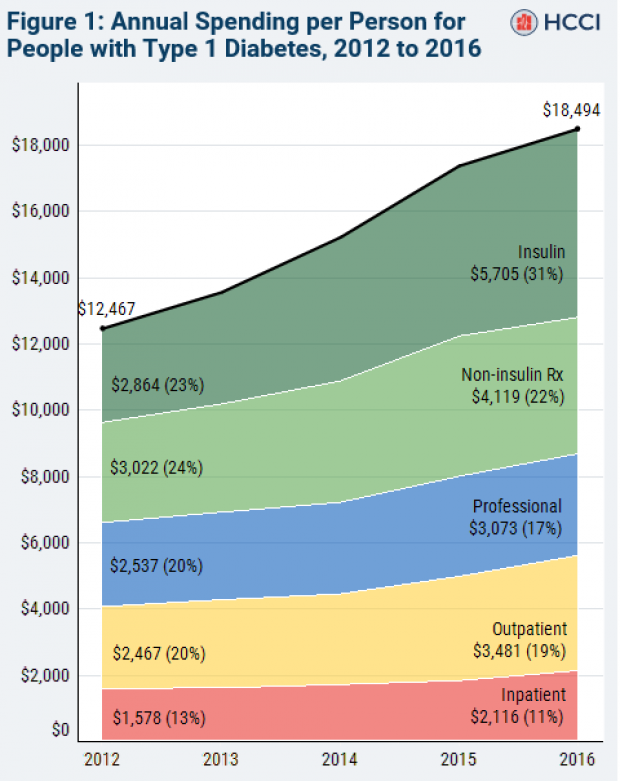

Chart of the Week: The Soaring Cost of Insulin

The cost of insulin used to treat Type 1 diabetes nearly doubled between 2012 and 2016, according to an analysis released this week by the Health Care Cost Institute. Researchers found that the average point-of-sale price increased “from $7.80 a day in 2012 to $15 a day in 2016 for someone using an average amount of insulin (60 units per day).” Annual spending per person on insulin rose from $2,864 to $5,705 over the five-year period. And by 2016, insulin costs accounted for nearly a third of all heath care spending for those with Type 1 diabetes (see the chart below), which rose from $12,467 in 2012 to $18,494.

Chart of the Day: Shutdown Hits Like a Hurricane

The partial government shutdown has hit the economy like a hurricane – and not just metaphorically. Analysts at the Committee for a Responsible Federal Budget said Tuesday that the shutdown has now cost the economy about $26 billion, close to the average cost of $27 billion per hurricane calculated by the Congressional Budget Office for storms striking the U.S. between 2000 and 2015. From an economic point of view, it’s basically “a self-imposed natural disaster,” CRFB said.

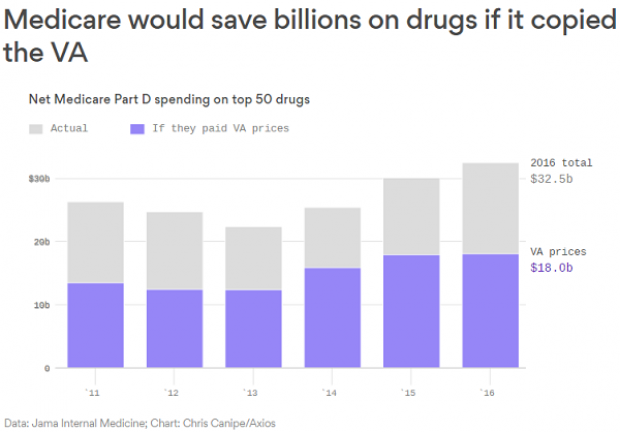

Chart of the Week: Lowering Medicare Drug Prices

The U.S. could save billions of dollars a year if Medicare were empowered to negotiate drug prices directly with pharmaceutical companies, according to a paper published by JAMA Internal Medicine earlier this week. Researchers compared the prices of the top 50 oral drugs in Medicare Part D to the prices for the same drugs at the Department of Veterans Affairs, which negotiates its own prices and uses a national formulary. They found that Medicare’s total spending was much higher than it would have been with VA pricing.

In 2016, for example, Medicare Part D spent $32.5 billion on the top 50 drugs but would have spent $18 billion if VA prices were in effect – or roughly 45 percent less. And the savings would likely be larger still, Axios’s Bob Herman said, since the study did not consider high-cost injectable drugs such as insulin.