Nailed a Job Interview? Prepare to Wait for an Offer

The improving job market may have more people looking for jobs, but the experience of doing so has gotten rougher.

Job seekers last year had to wait an average of 23 days after an initial interview to find out whether they gotten the job or not. That’s nearly twice the 13 days the interview process took in 2010, according to a new report from Glassdoor.com.

It’s also far longer than the global average of just under four days. Part of the reason for the extended process in the United States is an increase in the use of background checks, skills tests, and drug tests.

Related: The Top 10 Hiring Myths

Police officers faced the longest hiring process (128 days), followed by patent examiners (88 days), and assistant professors (58.7) days.

“Right now hiring delays can represent money left on the table both for workers and employers,” Glassdoor Chief Economist Andrew Chamberlain said in a statement.

When employers can’t find the right worker, vacancies stay open for an average of two months, according to a separate report last spring by CareerBuilder. A fifth of employers said those vacancies stay open for more than six months, on average.

Those employers said the extended vacancies led to lower morale, a reduction in productivity, and declines in customer service.

Lower-skilled jobs tended to get filled most quickly. Entry-level marketing jobs were filled most quickly (four days), followed by entry-level sales (five days), and servers and bartenders (six days), according to the GlassDoor report.

It’s Official: No Government Shutdown – for Now

President Trump signed a short-term continuing resolution today to fund the federal government through Friday, December 22.

Bloomberg called the maneuver “a monumental piece of can kicking,” which is no doubt the case, but at least you’ll be able to visit your favorite national park over the weekend.

Here's to small victories!

Greenspan Has a Warning About the GOP Tax Plan

The Republican tax cuts won’t do much for economic growth, former Federal Reserve Chair Alan Greenspan told CNBC Wednesday, but they will damage the country’s fiscal situation while creating the threat of stagflation. "This is a terrible fiscal situation we've got ourselves into," Greenspan said. "The administration is doing tax cuts and a spending decrease, but he's doing them in the wrong order. What we need right now is to focus totally on reducing the debt."

The US Economy Hits a Sweet Spot

“The U.S. economy is running at its full potential for the first time in a decade, a new milestone for an expansion now in its ninth year,” The Wall Street Journal reports. But the milestone was reached, in part, because the Congressional Budget Office has, over the last 10 years, downgraded its estimate of the economy’s potential output. “Some economists think more slack remains in the job market than October’s 4.1% unemployment rate would suggest. Also, economic output is still well below its potential level based on estimates produced a decade ago by the CBO.”

The New York Times Drums Up Opposition to the Tax Bill

The New York Times editorial board took to Twitter Wednesday “to urge the Senate to reject a tax bill that hurts the middle class & the nation's fiscal health.”

Using the hashtag #thetaxbillshurts, the NYT Opinion account posted phone numbers for Sens. Susan Collins, Bob Corker, Jeff Flake, James Lankford, John McCain, Lisa Murkowski and Jerry Moran. It urged readers to call the senators and encourage them to oppose the bill.

In an editorial published Tuesday night, the Times wrote that “Republican senators have a choice. They can follow the will of their donors and vote to take money from the middle class and give it to the wealthiest people in the world. Or they can vote no, to protect the public and the financial health of the government.”

Like what you're reading? Sign up for our free newsletter.

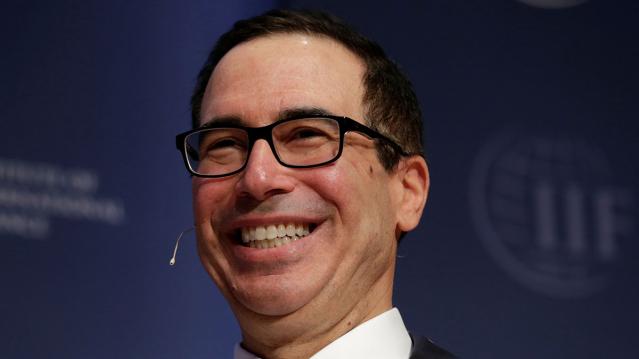

Can Trump Succeed Where Mnuchin and Cohn Have Flopped?

President Trump met with members of the Senate Finance Committee Monday and is scheduled to attend Senate Republicans’ weekly policy lunch and make a personal push for the tax plan on Tuesday. Will he be a more effective salesman than surrogates in his administration?

Politico’s Annie Karni and Eliana Johnson report that both Democrats and Republicans say Mnuchin and chief economic adviser Gary Cohn have repeatedly botched their tax pitches, “in part due to their own backgrounds” as wealthy Goldman Sachs alums. “House Speaker Paul Ryan earlier this month asked the White House not to send Mnuchin to the Hill to talk with Republican lawmakers about the bill, according to two people familiar with the discussions — though Ryan has praised the Treasury secretary’s ability to improve the legislation itself,” Karni and Johnson write.