Most Americans Wouldn’t Vote for a Socialist President

Memo to Sen. Bernie Sanders:

Americans by overwhelming numbers say they would vote for a qualified presidential candidate nominated by their party who is Catholic, a woman, black, Hispanic or Jewish.

They say they would be somewhat less inclined to support a Mormon, a gay or lesbian, an evangelical Christian or Muslim for president, according to a new Gallup Poll released Monday. Yet more than half of those Americans surveyed said they would be accepting of anyone from this group who managed to garner their party’s presidential nomination. Even a qualified atheist would be acceptable to 58 percent of those questioned.

But only 47 percent said they could vote for a socialist for president. Fifty percent said they would absolutely not.

Related: Where Hillary Clinton, Bernie Sanders and Martin O’Malley Stand on the Issues

Sanders, 73, an independent who is challenging Hillary Clinton for the Democratic nomination, is the only Jewish candidate in the race. And while many wrote him off early on as a fringe candidate with limited appeal, Sanders has subsequently generated considerable buzz among liberals and progressives, and has made respectable showings in some of the early polling, including in New Hampshire.

With his ringing anti-Wall Street populist message, Sanders is tapping into the Democratic Party’s progressive wing – including some who had hoped at one time that Sen. Elizabeth Warren (D-MA) might change her mind and enter the race. However, the former University of Chicago student radical and self-described democratic socialist, supports proposals similar to those of mainstream social democratic governments in Europe, particularly those of Scandinavia.

Five of the declared candidates for president are Catholics – including Republicans Jeb Bush, George Pataki, Marco Rubio and Rick Santorum, and Democrat Martin O'Malley. Two are women -- Clinton and Republican Carly Fiorina. Republican Ben Carson is the only black candidate in the race, while two candidates are Hispanic -- Republicans Rubio and Ted Cruz.

Here are Gallup’s findings:

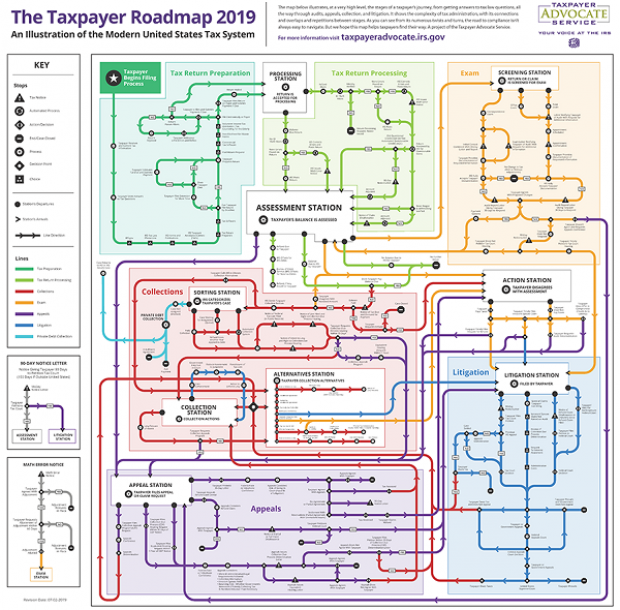

Map of the Day: Navigating the IRS

The Taxpayer Advocate Service – an independent organization within the IRS whose roughly 1,800 employees both assist taxpayers in resolving problems with the tax collection agency and recommend changes aimed at improving the system – released a “subway map” that shows the “the stages of a taxpayer’s journey.” The colorful diagram includes the steps a typical taxpayer takes to prepare and file their tax forms, as well as the many “stations” a tax return can pass through, including processing, audits, appeals and litigation. Not surprisingly, the map is quite complicated. Click here to review a larger version on the taxpayer advocate’s site.

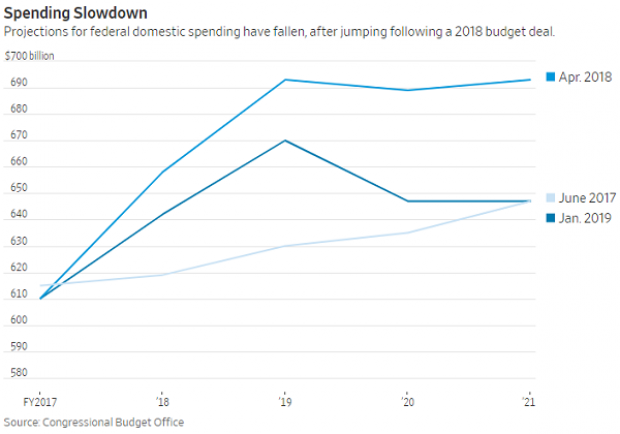

A Surprise Government Spending Slowdown

Economists expected federal spending to boost growth in 2019, but some of the fiscal stimulus provided by the 2018 budget deal has failed to show up this year, according to Kate Davidson of The Wall Street Journal.

Defense spending has come in as expected, but nondefense spending has lagged, and it’s unlikely to catch up to projections even if it accelerates in the coming months. Lower spending on disaster relief, the government shutdown earlier this year, and federal agencies spending less than they have been given by Congress all appear to be playing a role in the spending slowdown, Davidson said.

Number of the Day: $203,500

The Wall Street Journal’s Catherine Lucey reports that acting White House Chief of Staff Mick Mulvaney is making a bit more than his predecessors: “The latest annual report to Congress on White House personnel shows that President Trump’s third chief of staff is getting an annual salary of $203,500, compared with Reince Priebus and John Kelly, each of whom earned $179,700.” The difference is the result of Mulvaney still technically occupying the role of director of the White House Office of Management and Budget, where his salary level is set by law.

The White House told the Journal that if Mulvaney is made permanent chief of staff his salary would be adjusted to the current salary for an assistant to the president, $183,000.

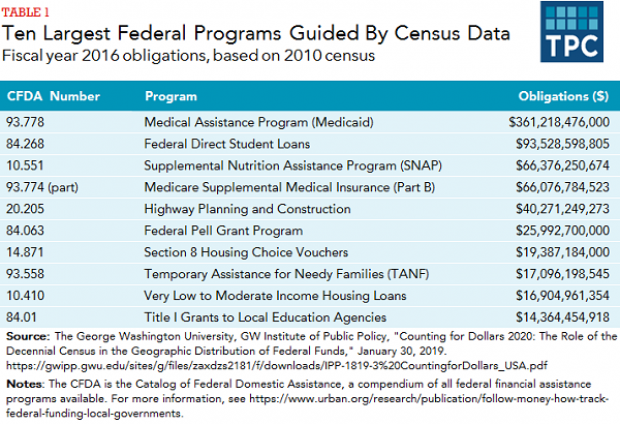

The Census Affects Nearly $1 Trillion in Spending

The 2020 census faces possible delay as the Supreme Court sorts out the legality of a controversial citizenship question added by the Trump administration. Tracy Gordon of the Tax Policy Center notes that in addition to the basic issue of political representation, the decennial population count affects roughly $900 billion in federal spending, ranging from Medicaid assistance funds to Section 8 housing vouchers. Here’s a look at the top 10 programs affected by the census:

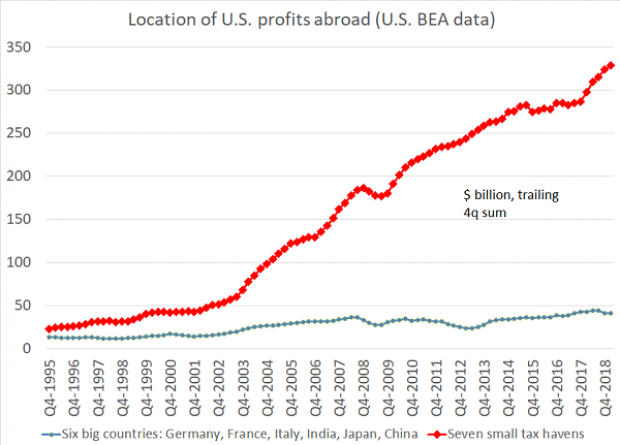

Chart of the Day: Offshore Profits Continue to Rise

Brad Setser, a former U.S. Treasury economist now with the Council on Foreign Relations, added another detail to his assessment of the foreign provisions of the Tax Cuts and Jobs Act: “A bit more evidence that Trump's tax reform didn't change incentives to offshore profits: the enormous profits that U.S. firms report in low tax jurisdictions continues to rise,” Setser wrote. “In fact, there was a bit of a jump up over the course of 2018.”