Taylor Swift Gets Apple Music to Pay Up

On Sunday morning, Taylor Swift took Apple to task for the royalty agreement on its news music streaming service. Her open letter on Tumblr, titled “To Apple, Love Taylor,” said, “I’m sure you are aware that Apple Music will be offering a free 3 month trial to anyone who signs up for the service. I’m not sure you know that Apple Music will not be paying writers, producers, or artists for those three months. I find it to be shocking, disappointing and completely unlike this historically progressive and generous company.”

Related Link: How the Video Game Industry Is Failing Its Fans

“Three months is a long time to go unpaid, and it is unfair to ask anyone to work for nothing,” the pop singer argued on the behalf of music-makers everywhere, many of whom had voiced their discontent with the royalty policy. She concluded her letter saying, “We don’t ask you for free iPhones. Please don’t ask us to provide you with our music for no compensation.”

It was a sentiment shared by many independent music artists and producers. Just a few weeks earlier, the American Association for Independent Music had chimed in, “Since a sizable percentage of Apple’s most voracious music consumers are likely to initiate their free trials at launch, we are struggling to understand why rights holders would authorize their content on the service before October 1st.”

It took less than 24 hours for the “historically progressive and generous company” to respond via Twitter, and it didn’t wait until morning to make its announcement. Eddy Cue, Apple’s senior vice president of Internet Software and Services, personally called Swift to deliver the news before tweeting at 11:29 p.m., “#AppleMusic will pay artists for streaming, even during customers’ free trial period.”

Cue followed up with a feel-good response a minute later: “We hear you @taylorswift13 and indie artists. Love, Apple.” Later, Cue said that the company will pay artists on a per stream basis during the free trial period, although Cue declined to say what the rate would be. Once the free introductory period is over, Apple Music will pay music owners 71.5 percent of Apple Music’s overall subscription revenue in the United States.

Swift tweeted her response and addressed it to her fans and supporters: “I am elated and relieved. Thank you for your words of support today. They listened to us.”

Related Link: Apple Muscles Into Streaming Music Market

Swift’s crusade on social media showed the increasing weight that collective opinions on Twitter, Instagram and Facebook can have to force a change in corporate policy and direction. In a comic echo of that power, BuzzFeed promptly put together a list of 18 more issues Swift could fix through the power of social media, ranging from the battery life of iPhones to the size of Pringles cans.

Apple Music is launching on June 30, offering users a free, three-month subscription period. After that, the service will charge $9.99 a month for individuals and $14.99 a month for families with up to six members.

The High Cost of Child Poverty

Childhood poverty cost $1.03 trillion in 2015, including the loss of economic productivity, increased spending on health care and increased crime rates, according to a recent study in the journal Social Work Research. That annual cost represents about 5.4 percent of U.S. GDP. “It is estimated that for every dollar spent on reducing childhood poverty, the country would save at least $7 with respect to the economic costs of poverty,” says Mark R. Rank, a co-author of the study and professor of social welfare at Washington University in St. Louis. (Futurity)

Do You Know What Your Tax Rate Is?

Complaining about taxes is a favorite American pastime, and the grumbling might reach its annual peak right about now, as tax day approaches. But new research from Michigan State University highlighted by the Money magazine website finds that Americans — or at least Michiganders — dramatically overstate their average tax rate.

In a survey of 978 adults in the Wolverine State, almost 220 people said they didn’t know what percentage of their income went to federal taxes. Of the people who did provide an answer, almost 85 percent overstated their actual rate, sometimes by a large margin. On average, those taxpayers said they pay 25.5 percent of their income in federal taxes. But the study’s authors estimated that their actual average tax rate was just under 14 percent.

The large number of people who didn’t want to venture a guess as to their tax rate and the even larger number who were wildly off both suggest to the researchers “that a very substantial portion of the population is uninformed or misinformed about average federal income-tax rates.”

Why don’t we know what we’re paying?

Part of the answer may be that our tax system is complicated and many of us rely on professionals or specialized software to prepare our filings. Money’s Ian Salisbury notes that taxpayers in the survey who relied on that kind of help tended to be further off in their estimates, after controlling for other factors.

Also, many people likely don’t understand the different types of taxes they pay. While the survey asked specifically about federal taxes, the tax rates people provided more closely matched their total tax rate, including federal, state, local and payroll taxes.

But our politics likely play a role here as well. People who believe that taxes on households like theirs should be lower and those who believe tax dollars are spent ineffectively tended to overstate their tax rates more.

“Since the time of Ronald Reagan, American[s] have been inundated with messages about how high taxes are,” one of the study’s authors told Salisbury. “The notion they are too high has become deeply ingrained.”

Wealthy Investors Are Worried About Washington, and the Debt

A new survey by the Spectrem Group, a market research firm, finds that almost 80 percent of investors with net worth between $100,000 and $25 million (not including their home) say that the U.S. political environment is their biggest concern, followed by government gridlock (76 percent) and the national debt (75 percent).

Trump’s Push to Reverse Parts of $1.3 Trillion Spending Bill May Be DOA

At least two key Republican senators are unlikely to support an effort to roll back parts of the $1.3. trillion spending bill passed by Congress last month, The Washington Post’s Mike DeBonis reported Monday evening. While aides to President Trump are working with House Majority Leader Kevin McCarthy (R-CA) on a package of spending cuts, Sens. Susan Collins (R-ME) and Lisa Murkowski (R-AK) expressed opposition to the idea, meaning a rescission bill might not be able to get a simple majority vote in the Senate. And Roll Call reports that other Republican senators have expressed significant skepticism, too. “It’s going nowhere,” Sen. Lindsey Graham said.

Goldman Sees Profit in the Tax Cuts

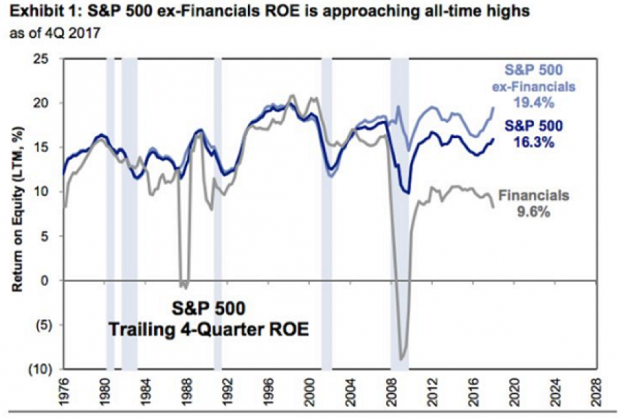

David Kostin, chief U.S. equity strategist at Goldman Sachs, said in a note to clients Friday cited by CNBC that companies in the S&P 500 can expect to see a boost in return on equity (ROE) thanks to the tax cuts. Return on equity should hit the highest level since 2007, Kostin said, providing a strong tailwind for stock prices even as uncertainty grows about possible conflicts over trade.

Return on equity, defined as the amount of net income returned as a percentage of shareholders’ equity, rose to 16.3 percent in 2016, and Kostin is forecasting an increase to 17.6 percent in 2018. "The reduction in the corporate tax rate alone will boost ROE by roughly 70 [basis points], outweighing margin pressures from rising labor, commodity, and borrow costs," Kostin wrote.