How Snapchat Wants to Win the 2016 Election

Snapchat is getting a lot of attention for its presidential ambitions.

In an effort to both appeal to the youth vote and bolster its events coverage built on a growing volume of video posted by its users, the app recently posted a job opening for a Content Analyst in Politics & News.

The new hire will curate photos and videos for the app’s “Our Story” curated events coverage of the presidential race and other news events. That stories feature has already proven to be a massive success. On average, Snapchat’s Our Stories draws around 20 million people in a 24-hour window, director of partnerships at Snapchat, Ben Schwerin, told Re/code. The three-day story in April about Coachella, the music festival, generated 40 million unique visitors.

Political events might not be draws on that same scale, but Snapchat apparently believes its massive influence with younger Americans could attract millions millennials to engage in the political process at a time when voter turnout is at its lowest levels since World War II. In the 2012 mid-term election, the national turnout rate was 35.9 percent. Of that, only 13 percent were between the ages of 18 and 29.

Related: Can ‘Project Lightning’ Give Twitter a Fresh Jolt?

Boasting more than 100 million daily users, Snapchat is valued at $16 billion — giving it the reach and the financial clout to become a force in 2016 campaign coverage. About 60 percent of U.S. smartphone users aged between 13 and 24 have used the app, according to The Financial Times. The largest demographic of users is between the ages of 18 and 24 (45 percent), followed by those between 25 and 34 (26 percent).

To capitalize on that user base, Snapchat recently hired former CNN political reporter Peter Hamby to oversee its expanding news team. Snapchat wants to promote content from debates, rallies, appearances and other election events and allow users to follow along. But this isn’t purely an experiment in civic participation. Candidates can pay for political ads to appear on the social media app.

The social media app has an ace up its sleeve to incentivize candidates to purchase ads. The app already has age-gating technology and a form of geographic targeting. Originally put into place to make sure underage kids wouldn’t see alcohol ads, the age gate could be used to reach only voting-age users. The geographic targeting allows Our Stories to only be viewable by people in the same city or area, so politicians could target specific areas, especially ones in a tight race.

Snapchat, best known as the service that allows users to send disappearing photos, claims that ads inserted into “Our Stories” have an advantage over other social media advertisements because they leave more lasting impressions.

If campaigns buy into that and turn to Snapchat as a way to connect with a hard-to-reach demographic, the social media company could be the big winner in the 2016 election.

The High Cost of Child Poverty

Childhood poverty cost $1.03 trillion in 2015, including the loss of economic productivity, increased spending on health care and increased crime rates, according to a recent study in the journal Social Work Research. That annual cost represents about 5.4 percent of U.S. GDP. “It is estimated that for every dollar spent on reducing childhood poverty, the country would save at least $7 with respect to the economic costs of poverty,” says Mark R. Rank, a co-author of the study and professor of social welfare at Washington University in St. Louis. (Futurity)

Do You Know What Your Tax Rate Is?

Complaining about taxes is a favorite American pastime, and the grumbling might reach its annual peak right about now, as tax day approaches. But new research from Michigan State University highlighted by the Money magazine website finds that Americans — or at least Michiganders — dramatically overstate their average tax rate.

In a survey of 978 adults in the Wolverine State, almost 220 people said they didn’t know what percentage of their income went to federal taxes. Of the people who did provide an answer, almost 85 percent overstated their actual rate, sometimes by a large margin. On average, those taxpayers said they pay 25.5 percent of their income in federal taxes. But the study’s authors estimated that their actual average tax rate was just under 14 percent.

The large number of people who didn’t want to venture a guess as to their tax rate and the even larger number who were wildly off both suggest to the researchers “that a very substantial portion of the population is uninformed or misinformed about average federal income-tax rates.”

Why don’t we know what we’re paying?

Part of the answer may be that our tax system is complicated and many of us rely on professionals or specialized software to prepare our filings. Money’s Ian Salisbury notes that taxpayers in the survey who relied on that kind of help tended to be further off in their estimates, after controlling for other factors.

Also, many people likely don’t understand the different types of taxes they pay. While the survey asked specifically about federal taxes, the tax rates people provided more closely matched their total tax rate, including federal, state, local and payroll taxes.

But our politics likely play a role here as well. People who believe that taxes on households like theirs should be lower and those who believe tax dollars are spent ineffectively tended to overstate their tax rates more.

“Since the time of Ronald Reagan, American[s] have been inundated with messages about how high taxes are,” one of the study’s authors told Salisbury. “The notion they are too high has become deeply ingrained.”

Wealthy Investors Are Worried About Washington, and the Debt

A new survey by the Spectrem Group, a market research firm, finds that almost 80 percent of investors with net worth between $100,000 and $25 million (not including their home) say that the U.S. political environment is their biggest concern, followed by government gridlock (76 percent) and the national debt (75 percent).

Trump’s Push to Reverse Parts of $1.3 Trillion Spending Bill May Be DOA

At least two key Republican senators are unlikely to support an effort to roll back parts of the $1.3. trillion spending bill passed by Congress last month, The Washington Post’s Mike DeBonis reported Monday evening. While aides to President Trump are working with House Majority Leader Kevin McCarthy (R-CA) on a package of spending cuts, Sens. Susan Collins (R-ME) and Lisa Murkowski (R-AK) expressed opposition to the idea, meaning a rescission bill might not be able to get a simple majority vote in the Senate. And Roll Call reports that other Republican senators have expressed significant skepticism, too. “It’s going nowhere,” Sen. Lindsey Graham said.

Goldman Sees Profit in the Tax Cuts

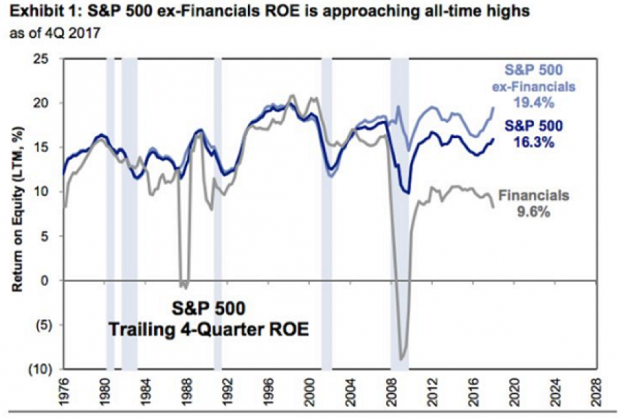

David Kostin, chief U.S. equity strategist at Goldman Sachs, said in a note to clients Friday cited by CNBC that companies in the S&P 500 can expect to see a boost in return on equity (ROE) thanks to the tax cuts. Return on equity should hit the highest level since 2007, Kostin said, providing a strong tailwind for stock prices even as uncertainty grows about possible conflicts over trade.

Return on equity, defined as the amount of net income returned as a percentage of shareholders’ equity, rose to 16.3 percent in 2016, and Kostin is forecasting an increase to 17.6 percent in 2018. "The reduction in the corporate tax rate alone will boost ROE by roughly 70 [basis points], outweighing margin pressures from rising labor, commodity, and borrow costs," Kostin wrote.