Did Airlines Collude to Keep Air Fares High?

For months now, oil and gas prices have been dropping—and that includes jet fuel. So why haven’t airline ticket prices dropped as well? That’s one of the questions the Justice Department wants answered as it investigates the possibility of collusion among carriers to keep airfares high.

The DOJ also wants to know if companies conspired to limit the number of available seats in order to drive prices up. Yesterday, the Associated Press broke the news that major U.S. carriers had received a letter demanding copies of all communications the airlines had with each other, Wall Street analysts, and major shareholders about their plans for passenger-carrying capacity, going back to January 2010. The civil antitrust investigation is focusing on whether airlines illegally indicated to each other how quickly they would add new flights, routes, and extra seats in an effort to prop up ticket prices.

Related: 6 Sneaky Fees That Are Making Airlines a Bundle

Just minutes after the news broke, stocks of the major U.S. airlines fell four to five percent, with the S&P 500 airlines index off more than four percent. Until now, the U.S. airline industry had been enjoying record profits, due to increasing numbers of Americans flying and a huge drop in the price of jet fuel. In April, the price of jet fuel was $1.94 per gallon, a decrease of 34 percent from the previous year.

The investigation marks a notable shift for the Justice Department, which approved the merger of American Airlines and US Airways back in November 2013, despite previously blocking it over concerns that the airlines would collude on fares. The probe could signal a more aggressive approach on antitrust enforcement, under the strong leadership of Loretta Lynch, who was confirmed in April.

Justice Department spokesperson Emily Pierce confirmed that the department was investigating potential “unlawful coordination” among some airlines.

Just two weeks ago, U.S. Senator Richard Blumenthal (D-CT) urged the Justice Department to investigate what he called “anti-competitive, anti-consumer conduct and misuse of market power in the airline industry.”

Related: United Airlines Bullish on First Quarter from Lower Fuel Costs

Since 2008, various mergers have resulted in four major airlines (down from nine)—American, Delta, Southwest, and United—controlling about 80 percent of all domestic air travel. All four airlines have confirmed that they received the letter and that they were cooperating with the investigation.

According to Bureau of Transportation Statistics, the average domestic airfare rose 13 percent from 2009 to 2014 (adjusted for inflation). The average domestic flight last year cost $391. In the past year alone, airlines received an additional $3.6 billion from bag fees and another $3 billion from reservation-change fees. All of the major airlines—American Airlines, United Continental Holdings, Delta Air Lines, Southwest Airlines, JetBlue Airways, and Alaska Air Group—posted record profits with a consolidated net income of over $3 billion during the first quarter of 2015.

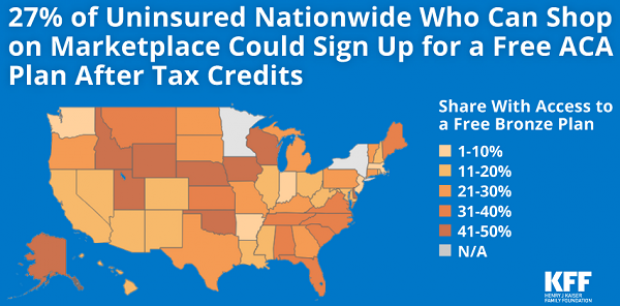

4.2 Million Uninsured People Could Get Free Obamacare Plans

About 4.2 million uninsured people could sign up for a bronze-level Obamacare health plan and pay nothing for it after tax credits are applied, the Kaiser Family Foundation said Tuesday. That means that 27 percent of the country’s 15.9 million uninsured people could get covered for free. The chart below breaks down the eligible population by state.

Takedown of the Day: Ezra Klein on Paul Ryan's Legacy of Debt

Vox’s Ezra Klein says that retiring House Speaker Paul Ryan’s legacy can be summed up in one number: $343 billion. “That’s the increase between the deficit for fiscal year 2015 and fiscal year 2018— that is, the difference between the fiscal year before Ryan became speaker of the House and the fiscal year in which he retired.”

Klein writes that Ryan’s choices while in office — especially the 2017 tax cuts and the $1.3 trillion spending bill he helped pass and the expansion of the earned income tax credit he talked up but never acted on — should be what define his legacy:

“[N]ow, as Ryan prepares to leave Congress, it is clear that his critics were correct and a credulous Washington press corps — including me — that took him at his word was wrong. In the trillions of long-term debt he racked up as speaker, in the anti-poverty proposals he promised but never passed, and in the many lies he told to sell unpopular policies, Ryan proved as much a practitioner of post-truth politics as Donald Trump. …

“Ultimately, Ryan put himself forward as a test of a simple, but important, proposition: Is fiscal responsibility something Republicans believe in or something they simply weaponize against Democrats to win back power so they can pass tax cuts and defense spending? Over the past three years, he provided a clear answer. That is his legacy, and it will haunt his successors.”

Number of the Day: $300 Million

Mick Mulvaney, the acting director of the Consumer Financial Protection Bureau, wants the agency to be known as the Bureau of Consumer Financial Protection, the name under which it was established by Title X of the 2010 Dodd-Frank Wall Street reform law. Mulvaney even had new signage put up in the lobby of the bureau. But the rebranding could cost the banks and other financial businesses regulated by the bureau more than $300 million, according to an internal agency analysis reported by The Hill’s Sylvan Lane. The costs would arise from having to update internal databases, regulatory filings and disclosure forms with the new name. The rebranding would cost the agency itself between $9 million and $19 million, the analysis estimated. Lane adds that it’s not clear whether Kathy Kraninger, President Trump’s nominee to serve as the bureau’s full-time director, would follow through on Mulvaney’s name change once she is confirmed by the Senate.

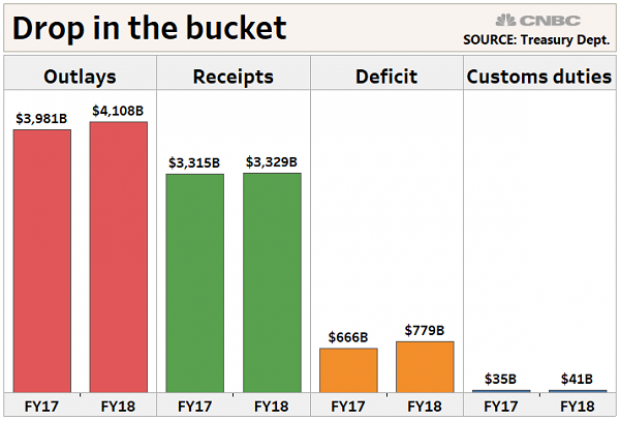

Why Trump's Tariffs Are Just a Drop in the Bucket

President Trump said this week that tariff increases by his administration are producing "billions of dollars" in revenues, thereby improving the country’s fiscal situation. But CNBC’s John Schoen points out that while tariff revenues are indeed higher by several billion dollars this year, the total revenue is a drop in the bucket compared to the sheer size of government outlays and receipts – and the growing annual deficit.

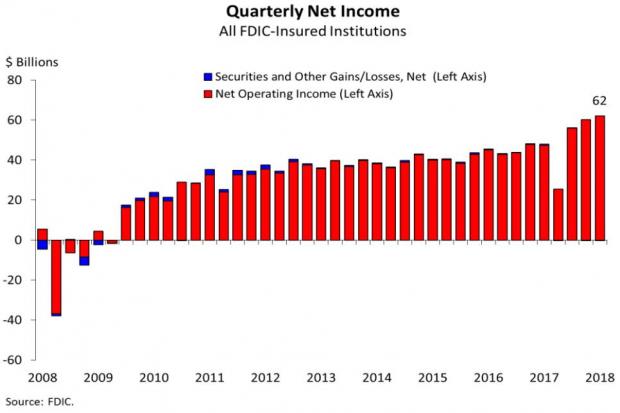

Bank Profits Hit New Record Thanks to 2017 Tax Law

Bank profits reached a record $62 billion in the third quarter, up $14 billion, or 29.3 percent, from the same period last year, according to data from the Federal Deposit Insurance Corporation. The FDIC said that about half of the increase in net income was attributable to last year’s tax cuts. The FDIC estimated that, with the effective tax rates from before the new law, bank profits for the quarter would have risen by about 14 percent, to $54.6 billion.