Watch Out, YouTube! Facebook Wants Your Video Action

It was only a matter of time before Facebook figured out a way to make money from the videos that are played on their platform. As Fortune points out, before now, video creators didn’t have a way to make money on the Facebook platform. That all changes today, with Facebook’s new plan to monetize videos and share the revenue with creators. The revenue arrangement is the same as YouTube’s: 55 percent of the money earned from ads goes to the creator, and 45 percent goes to Facebook. So far, the program has a couple of dozen partners who have signed up, including the NBA, Fox Sports, Hearst, and Funny or Die.

Related: Facebook gaining ground on YouTube in video ads, report says

Prior to the new plan, Feed videos would only play mutely until the user clicked on them. Now, when users play a video on mobile, they will get a feed of “Suggested Videos.” It’s not until a few of these videos play, that the user will see an actual ad. And these ads, unlike Facebook’s autoplay videos, will play with the sound turned on.

In the past few weeks, the social media giant has tested the “Suggested Videos” product with a small number of iOS users. Today the test goes wider, and will eventually expand to include Android and desktop users.

Unlike YouTube, which gives content creators 55 percent of the revenue from the ads it plays before videos, Facebook will divvy up the 55 percent in revenue among multiple creators or partners. For example, if you watched a three-minute video from the NBA, and a two-minute video from Funny or Die, the 55 percent in ad revenue would be split proportionately between the NBA and Funny or Die.

Related: Will Facebook Kill the News Media or Save It?

Industry experts fully expect video—especially mobile video—to be a major source of revenue for Facebook in the future since users already deliver four billion videos views daily. The company made $3.3 billion in ad revenue in the first quarter of 2015, 73 percent of it from mobile ads alone. For now, Facebook says it is focused on shorter video formats, not long-form video formats like TV shows and movies.

To date, YouTube has been the only major player in user-posted video, but Facebook is stepping up its game. It just announced to advertisers the option to pay for video ads only after a video has played for 10 seconds. It’s a response to announcements that Snapchat and Twitter are rolling out video divisions too. In May, Spotify added video-streaming to its music-streaming app. And Hulu, Yahoo, and AOL are also pushing their video strategies.

For content providers, it’s a new way to play—and pay.

Trump’s Cabinet Would Benefit from Tax Plan Too

“Eliminating the estate tax would save the Trump Cabinet over a billion dollars," Oliver Willis writes. "Like Mnuchin, Trump’s secretaries would make out like bandits. Commerce Secretary Wilbur Ross would get an extra $545 million. The family of Education Secretary Betsy DeVos would rake in $900 million. Linda McMahon, head of the Small Business Administration, and her husband, WWE founder Vince McMahon, would take in $250 million. Trump’s own net worth is in dispute, thanks to his failure to reveal his tax returns, but based on his estimated net worth of $3 billion, the estate tax scheme would net him $564 million.” (Shareblue Media, Bloomberg)

A Liberal Economist Shoots Down the GOP’s Fiscal Chicken Hawks

Republicans want a tax cut, but they don’t want to fully pay for it and may be willing to increase the deficit by $1.5 trillion over 10 years. This would continue a troubling cycle, economist Jared Bernstein writes, in which supposed fiscal conservatives “use the deficit argument to block spending, promote fiscal austerity, and small government, conveniently tossing deficit concerns aside when it comes to tax cuts.”

You’ll hear arguments about how increased economic growth will make up for the budgetary effects of the tax cuts, but don’t believe them. “Our fiscal history on this point is clear: Cutting taxes loses revenues, which, unless offset by higher taxes elsewhere or spending cuts, increases the budget deficit, which in turn raises the debt.” When this happens again, and the promised growth effects don’t materialize, the tax cutters will go back to pushing for spending cuts.

The country faces a number of serious challenges, including an aging population that by itself will require increased government spending, and we need a tax policy that does more than drive up the deficit. “The problem with structural deficits — ones that go up even in good times — is that they reveal that we’re unwilling to raise the necessary revenues to support the government we want and need. This enables those who whose goal is to shrink government to point to deficits and debt as their proof that we can’t afford it, whatever ‘it’ is, except when ‘it’ is tax cuts.” (New York Times)

Health Secretary Tom Price Under Fire for Use of Private Jets

Back in 2009, Tom Price spoke out against House Democrats who wanted to spend $550 million on private jets for lawmakers to use. A Republican representative from Georgia at the time, Price told CNBC that the purchase of the jets was “another example of fiscal irresponsibility run amok.” Now Secretary of Health and Human Services, Price seems to have changed his mind about the virtue of government officials using private jets at taxpayer expense. Just last week, Price used a chartered private jet to travel to three HHS events — including one at a resort in Maine — at an estimated cost of $60,000, Politico reports.

While previous HHS secretaries typically flew commercial, reports indicate that Price has been traveling by private jet for months. “Official travel by the secretary is done in complete accordance with Federal Travel Regulations,” an HHS spokesperson told Politico.

Critics on Twitter have been harsh:

More in-your-face kleptocracy from Tom Price.Take food stamps from poor, hungry kids- spend $25k from taxpayers to charter plane to Philly

— Norman Ornstein (@NormOrnstein) September 20, 2017

1️⃣ Attack Medicaid while trading health stocks.

— Harry Stein (@HarrySteinDC) September 20, 2017

2️⃣ Spend funds that could give someone 4 years of Medicaid coverage to fly a private jet. https://t.co/GO5cfJgWgO

First Mnuchin, now Tom Price. The @realDonaldTrump Cabinet has a big problem charging taxpayers for private flights. https://t.co/th1QbGdfT7

— Ben White (@morningmoneyben) September 20, 2017

Social Security Benefits Due for a Bigger Bump in 2018

In a few weeks the Social Security Administration will announce its cost-of-living adjustment, or COLA, for 2018. Inflation data for the month of August suggests that the adjustment could be the highest in five years, possibly over 2 percent, according to the Washington Examiner. Adjustments for the past five years have been relatively small: The cost of living adjustment for 2017 (announced last October) came in at a modest 0.3 percent, and the adjustment for 2016 was zero. Some retirees have complained in the past about small COLAs, but it’s worth remembering that higher adjustments are driven by higher inflation, which is bad news for people living on fixed incomes.

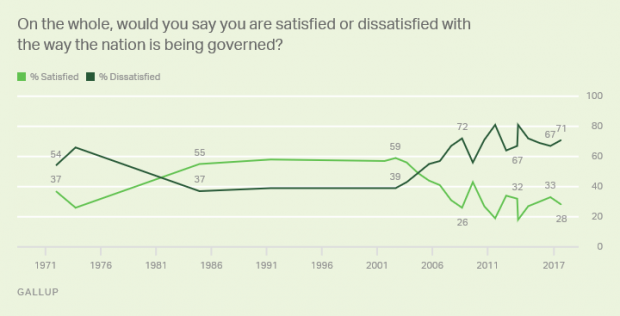

Americans Are Less Satisfied with Government Now Than a Year Ago

Gallup finds that just 28 percent of Americans are satisfied with the way the nation is being governed, down from 33 percent a year ago. And as we approach some potential fiscal battles, it's worth noting that the lowest satisfaction levels since Gallup started updating the measure annually in 2001 came in 2011 (19 percent) after a debt ceiling showdown that led to the U.S. credit rating being downgraded by S&P analysts and in 2013 (18 percent) during a federal government shutdown.