Watch Out, YouTube! Facebook Wants Your Video Action

It was only a matter of time before Facebook figured out a way to make money from the videos that are played on their platform. As Fortune points out, before now, video creators didn’t have a way to make money on the Facebook platform. That all changes today, with Facebook’s new plan to monetize videos and share the revenue with creators. The revenue arrangement is the same as YouTube’s: 55 percent of the money earned from ads goes to the creator, and 45 percent goes to Facebook. So far, the program has a couple of dozen partners who have signed up, including the NBA, Fox Sports, Hearst, and Funny or Die.

Related: Facebook gaining ground on YouTube in video ads, report says

Prior to the new plan, Feed videos would only play mutely until the user clicked on them. Now, when users play a video on mobile, they will get a feed of “Suggested Videos.” It’s not until a few of these videos play, that the user will see an actual ad. And these ads, unlike Facebook’s autoplay videos, will play with the sound turned on.

In the past few weeks, the social media giant has tested the “Suggested Videos” product with a small number of iOS users. Today the test goes wider, and will eventually expand to include Android and desktop users.

Unlike YouTube, which gives content creators 55 percent of the revenue from the ads it plays before videos, Facebook will divvy up the 55 percent in revenue among multiple creators or partners. For example, if you watched a three-minute video from the NBA, and a two-minute video from Funny or Die, the 55 percent in ad revenue would be split proportionately between the NBA and Funny or Die.

Related: Will Facebook Kill the News Media or Save It?

Industry experts fully expect video—especially mobile video—to be a major source of revenue for Facebook in the future since users already deliver four billion videos views daily. The company made $3.3 billion in ad revenue in the first quarter of 2015, 73 percent of it from mobile ads alone. For now, Facebook says it is focused on shorter video formats, not long-form video formats like TV shows and movies.

To date, YouTube has been the only major player in user-posted video, but Facebook is stepping up its game. It just announced to advertisers the option to pay for video ads only after a video has played for 10 seconds. It’s a response to announcements that Snapchat and Twitter are rolling out video divisions too. In May, Spotify added video-streaming to its music-streaming app. And Hulu, Yahoo, and AOL are also pushing their video strategies.

For content providers, it’s a new way to play—and pay.

The IRS Gives Hurricane Harvey Victims a Break

The tax agency announced Monday that “victims in parts of Texas have until Jan. 31, 2018, to file certain individual and business tax returns and make certain tax payments.”

Fitch Sends a Warning on US Credit Rating

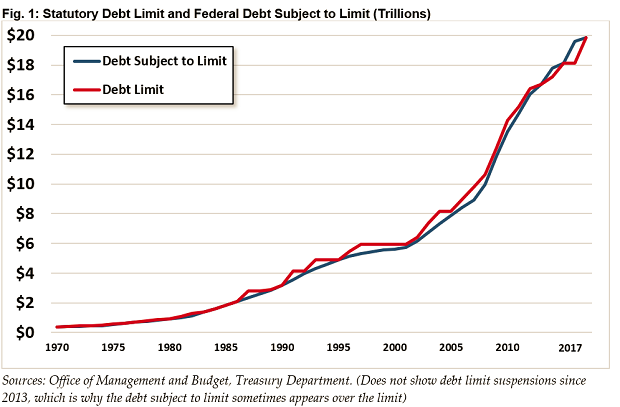

One of the three major credit ratings agencies warned Wednesday that a failure to raise the debt ceiling could result in a lower credit rating for the U.S.

Fitch Ratings currently assigns a AAA rating to U.S. debt, the highest level possible. However, a failure to raise the debt ceiling "may not be compatible with 'AAA' status," according to the agency.

If the U.S. cannot sell more debt after bumping up against the debt ceiling, it may not be able to make all of its interest payments on time and in full. The federal government could begin running out of cash as soon as October.

The debt ceiling is currently $19.9 trillion, and Treasury Secretary Steven Mnuchin has repeatedly urged Congress to raise the debt ceiling by September 29. A failure to do so could roil financial markets around the world, and ultimately increase the cost of servicing U.S. debt.

This is not the first time Congress has faced this problem. During an earlier debt ceiling showdown in 2011, Standard & Poor's reduced its rating on U.S. debt from its highest level to AA+. However, Fitch and Moody’s stuck with their top ratings.

Senators to Hold Hearings on a Bipartisan Fix for Health Care

Mark your calendars: Senate health committee Chairman Lamar Alexander (R-Tenn.) and Ranking Member Patty Murray (D-Wash.) announced today that they will hold bipartisan hearings on Sept. 6 and 7 focused on stabilizing premiums in the individual insurance market. The first hearing will be with state insurance commissioners; the second will be with governors.

In a statement, Alexander noted that 18 million Americans buy insurance on the individual market.

“My goal by the end of September is to give them peace of mind that they will be able to buy insurance at a reasonable price for the year 2018,” he said. “Unless Congress acts by September 27—when insurance companies must sign contracts with the federal government to sell insurance on the federal exchange in 2018— 9 million Americans in the individual market who receive no government help purchasing health insurance and whose premiums have already skyrocketed may see their premiums go up even more. Even those with subsidies in up to half our states may find themselves with zero options for buying health insurance on the Obamacare exchanges in 2018.”

McConnell: ‘Zero Chance’ the Debt Ceiling Will Be Breached

At an event in Kentucky to discuss tax reform, Senate Majority Leader Mitch McConnell and Treasury Secretary Steven Mnuchin insisted Monday that Congress will raise the debt ceiling by late next month, in time for the U.S. to avoid a default that could roil the global economy and markets.

Related: The Debt Ceiling — What It Is and Why We Should Care

The key quotes, per Roll Call:

McConnell: "There is zero chance — no chance — we won't raise the debt ceiling. No chance. America's not going to default. And we'll get the job done in conjunction with the secretary of the Treasury."

Mnuchin: “We’re going to get the debt ceiling passed. I think that everybody understands this is not a Republican issue, this is not a Democrat issue. We need to be able to pay our debts. This is about having a clean debt ceiling so that we can maintain the best credit, the reserve currency, and be focused on what we should be focusing on — so many other really important issues for the economy.”

Related: Here’s a Solution for the Annual Debt Ceiling Crisis — Get Rid of It

Mnuchin reiterated his “strong preference” for a “clean” increase to the debt limit — one without other policy proposals or spending cuts attached to it — but some House conservatives continue to press for such cuts.

Bonus McConnell quote on what tax breaks might be eliminated in tax reform: “I think there are only two things that the American people think are actually in the Constitution: The charitable deduction and the home mortgage interest deduction. So, if you’re worried about those two, you can breathe easy. For all the rest of you, there’s no point in doing tax reform unless we look at all of these preferences, and carried interest would be among them.”

Trump’s Travel and Family Size Squeeze Secret Service Budget

In an interview with USA Today, Secret Service Director Randolph "Tex" Alles said the agency is bumping up against federally mandated salary and overtime caps in executing its mission to protect the president and his family.

USA Today’s Kevin Johnson notes that 42 people in the Trump administration have Secret Service protection, including 18 of the president’s family members. Under President Obama, 31 people had such protection.

“The compensation crunch is so serious that the director has begun discussions with key lawmakers to raise the combined salary and overtime cap for agents, from $160,000 per year to $187,000 for at least the duration of Trump's first term,” Johnson reported.

Related: Which Former President Costs US the Most?

In a statement, Alles said the agency has the funding it needs for the rest of the fiscal year, which runs through Sept. 30, but estimated that 1,100 employees run into statutory pay caps as a result of overtime work during this calendar year.

“This issue is not one that can be attributed to the current Administration’s protection requirements alone, but rather has been an ongoing issue for nearly a decade due to an overall increase in operational tempo," Alles said in the statement.

Earlier: The Secret Service Won’t Get $60 Million More to Protect the Trumps