Watch Out, YouTube! Facebook Wants Your Video Action

It was only a matter of time before Facebook figured out a way to make money from the videos that are played on their platform. As Fortune points out, before now, video creators didn’t have a way to make money on the Facebook platform. That all changes today, with Facebook’s new plan to monetize videos and share the revenue with creators. The revenue arrangement is the same as YouTube’s: 55 percent of the money earned from ads goes to the creator, and 45 percent goes to Facebook. So far, the program has a couple of dozen partners who have signed up, including the NBA, Fox Sports, Hearst, and Funny or Die.

Related: Facebook gaining ground on YouTube in video ads, report says

Prior to the new plan, Feed videos would only play mutely until the user clicked on them. Now, when users play a video on mobile, they will get a feed of “Suggested Videos.” It’s not until a few of these videos play, that the user will see an actual ad. And these ads, unlike Facebook’s autoplay videos, will play with the sound turned on.

In the past few weeks, the social media giant has tested the “Suggested Videos” product with a small number of iOS users. Today the test goes wider, and will eventually expand to include Android and desktop users.

Unlike YouTube, which gives content creators 55 percent of the revenue from the ads it plays before videos, Facebook will divvy up the 55 percent in revenue among multiple creators or partners. For example, if you watched a three-minute video from the NBA, and a two-minute video from Funny or Die, the 55 percent in ad revenue would be split proportionately between the NBA and Funny or Die.

Related: Will Facebook Kill the News Media or Save It?

Industry experts fully expect video—especially mobile video—to be a major source of revenue for Facebook in the future since users already deliver four billion videos views daily. The company made $3.3 billion in ad revenue in the first quarter of 2015, 73 percent of it from mobile ads alone. For now, Facebook says it is focused on shorter video formats, not long-form video formats like TV shows and movies.

To date, YouTube has been the only major player in user-posted video, but Facebook is stepping up its game. It just announced to advertisers the option to pay for video ads only after a video has played for 10 seconds. It’s a response to announcements that Snapchat and Twitter are rolling out video divisions too. In May, Spotify added video-streaming to its music-streaming app. And Hulu, Yahoo, and AOL are also pushing their video strategies.

For content providers, it’s a new way to play—and pay.

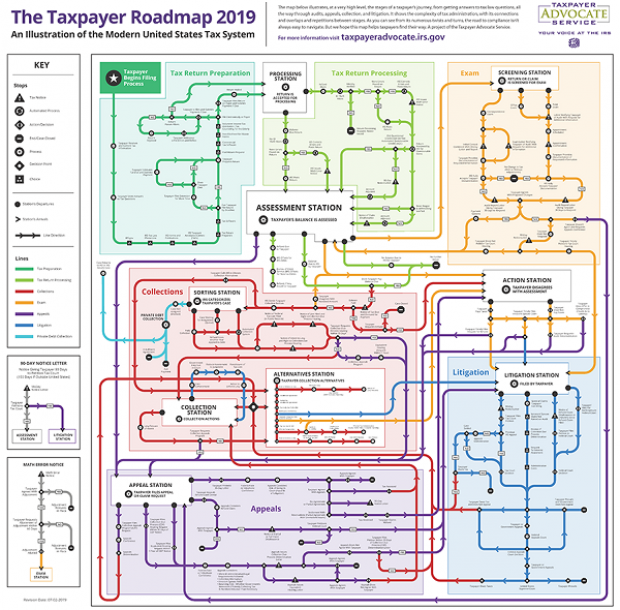

Map of the Day: Navigating the IRS

The Taxpayer Advocate Service – an independent organization within the IRS whose roughly 1,800 employees both assist taxpayers in resolving problems with the tax collection agency and recommend changes aimed at improving the system – released a “subway map” that shows the “the stages of a taxpayer’s journey.” The colorful diagram includes the steps a typical taxpayer takes to prepare and file their tax forms, as well as the many “stations” a tax return can pass through, including processing, audits, appeals and litigation. Not surprisingly, the map is quite complicated. Click here to review a larger version on the taxpayer advocate’s site.

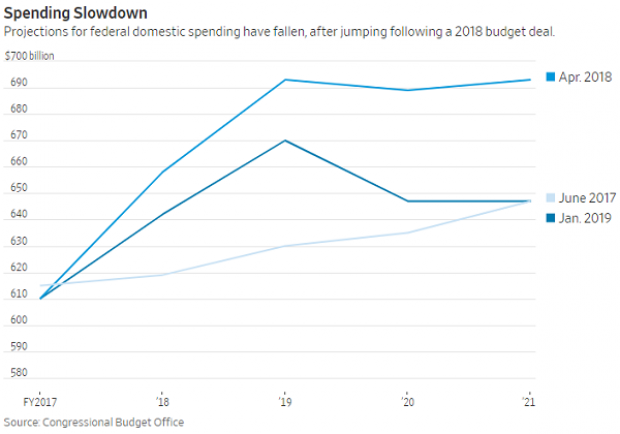

A Surprise Government Spending Slowdown

Economists expected federal spending to boost growth in 2019, but some of the fiscal stimulus provided by the 2018 budget deal has failed to show up this year, according to Kate Davidson of The Wall Street Journal.

Defense spending has come in as expected, but nondefense spending has lagged, and it’s unlikely to catch up to projections even if it accelerates in the coming months. Lower spending on disaster relief, the government shutdown earlier this year, and federal agencies spending less than they have been given by Congress all appear to be playing a role in the spending slowdown, Davidson said.

Number of the Day: $203,500

The Wall Street Journal’s Catherine Lucey reports that acting White House Chief of Staff Mick Mulvaney is making a bit more than his predecessors: “The latest annual report to Congress on White House personnel shows that President Trump’s third chief of staff is getting an annual salary of $203,500, compared with Reince Priebus and John Kelly, each of whom earned $179,700.” The difference is the result of Mulvaney still technically occupying the role of director of the White House Office of Management and Budget, where his salary level is set by law.

The White House told the Journal that if Mulvaney is made permanent chief of staff his salary would be adjusted to the current salary for an assistant to the president, $183,000.

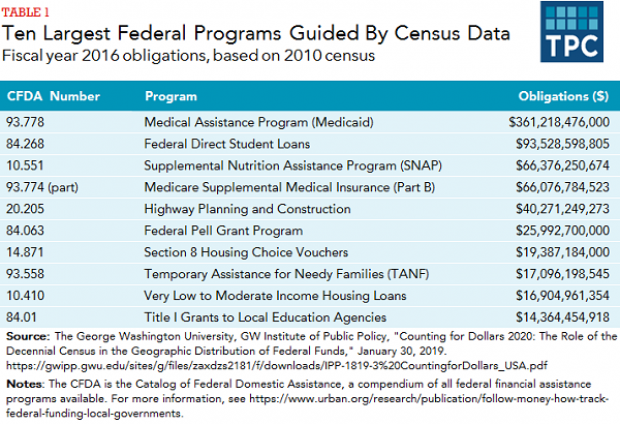

The Census Affects Nearly $1 Trillion in Spending

The 2020 census faces possible delay as the Supreme Court sorts out the legality of a controversial citizenship question added by the Trump administration. Tracy Gordon of the Tax Policy Center notes that in addition to the basic issue of political representation, the decennial population count affects roughly $900 billion in federal spending, ranging from Medicaid assistance funds to Section 8 housing vouchers. Here’s a look at the top 10 programs affected by the census:

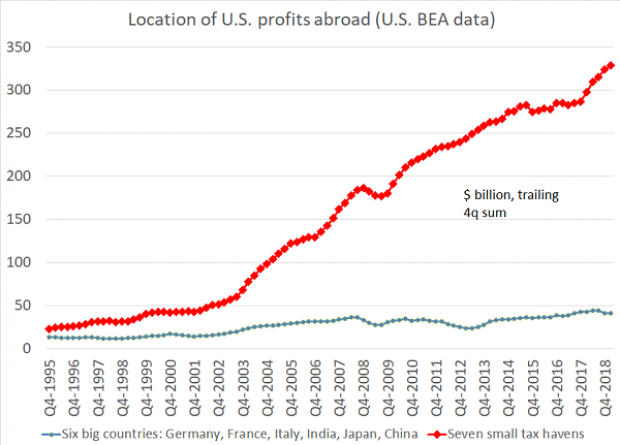

Chart of the Day: Offshore Profits Continue to Rise

Brad Setser, a former U.S. Treasury economist now with the Council on Foreign Relations, added another detail to his assessment of the foreign provisions of the Tax Cuts and Jobs Act: “A bit more evidence that Trump's tax reform didn't change incentives to offshore profits: the enormous profits that U.S. firms report in low tax jurisdictions continues to rise,” Setser wrote. “In fact, there was a bit of a jump up over the course of 2018.”